Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 06, 2021

This analytics article utilizes trade data published by IHS Markit Global Trade Analytics Suite (GTAS)

Key observations:

The COVID-19 pandemic is for sure the largest black swan since the end of WWII. It's a global health crisis which affected Europe in particular and simultaneous demand and supply shock with adverse effects dependent on the initial and subsequent mid-run reaction of states and, in the case of the EU, partially coordinated actions were taken at the supranational level (lockdowns, forced production stoppages, restrictions on international and intranational mobility, border controls, coordinated vaccination campaigns). The longer the duration of the pandemic, the better we are at fighting or mitigating its adverse effects (the learning curve effect is clear).

The pandemic in Europe is ongoing. The number of new cases has risen significantly in recent weeks (the fourth wave), with deaths rates rising but not at the same rates due to the vaccination campaign, leading some of the EU27 Member States to reintroduce some restrictions on mobility or sectoral restrictions.

Source: IHS Markit Global Trade Atlas (© 2021 IHS Markit)

The pandemic affected different sectors of economic activity to various extents and directions (actually, it proved positive, for instance, for IT services). Nonetheless, it led to a sharp global recession, lower global demand, and consumer confidence lowering demand for air travel or tourism. In turn, it affected the demand and prices of crude oil and other refined petroleum products (such as jet fuel) and aircraft production.

The pandemic's beginning led to an initial drop in prices for petroleum-based products, and then, just as abruptly, prices rose sharply as producers limited production and demand steadily increased.

Global jet fuel (kerosine) prices are affected by global demand for air transport (passenger & freight), overall economic conditions, the prices of crude (also dependent on the extraction capabilities and limits), as well as the evolution of exchange rates of major currencies (e.g., USD - EUR rates).

Jet fuel prices are, in turn, a key cost parameter for air carriers, with aviation turbine fuel (ATF) accounting for 33-50 percent of the cost of running an airline.

Thus, jet fuel constitutes a compelling business case showing the possibilities of the IHS Markit Global Trade Analytics Suite (GTAS) database.

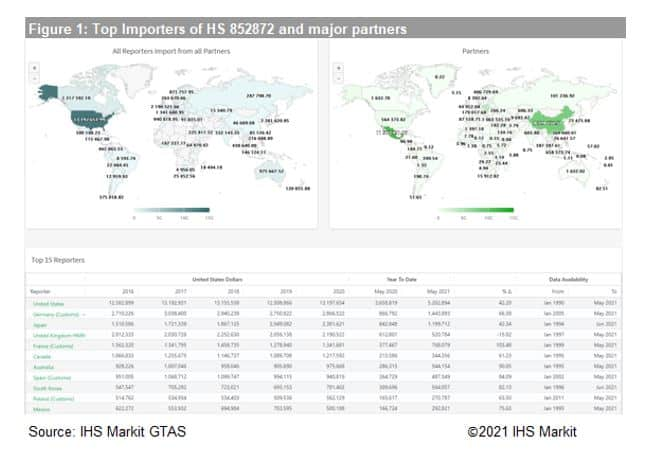

You can find kerosine in HS 271019 (petroleum oils, oils from bituminous minerals (other than crude) & products containing by weight gt=70% or more of these oils, not biodiesel or waste).

At the globally harmonized 6-digit code level, the HS code is an aggregate of more refined petroleum products; thus, unfortunately, we have to search for HS 8-digit codes that differ between reporters (GTAS allows for it). Therefore, kerosine is HS 271019 21 for EU27 and HS 271019 15 for US (the same code is a different product in EU27).

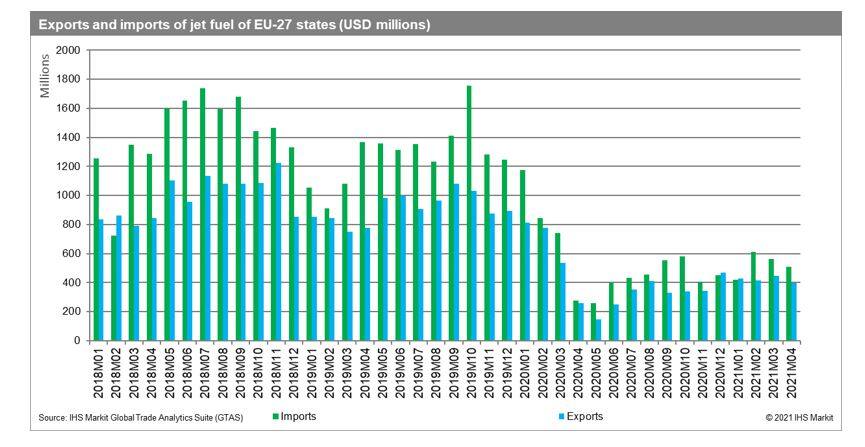

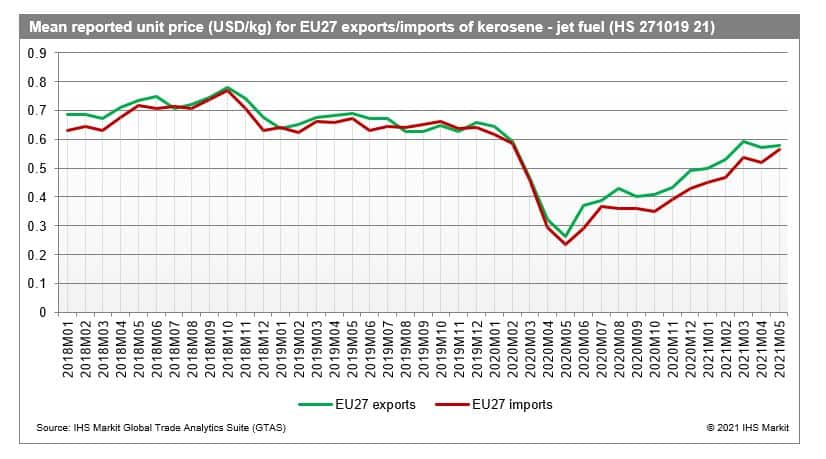

Let's focus on EU 27. To see the impact of COVID-19 on EU27's trade-in jet fuel, let extract the monthly data for kerosine exports and imports taken into account the pre-pandemic period (January 2018 - ) as a point of reference. The impact both on EU27's exports and imports become immediately visible.

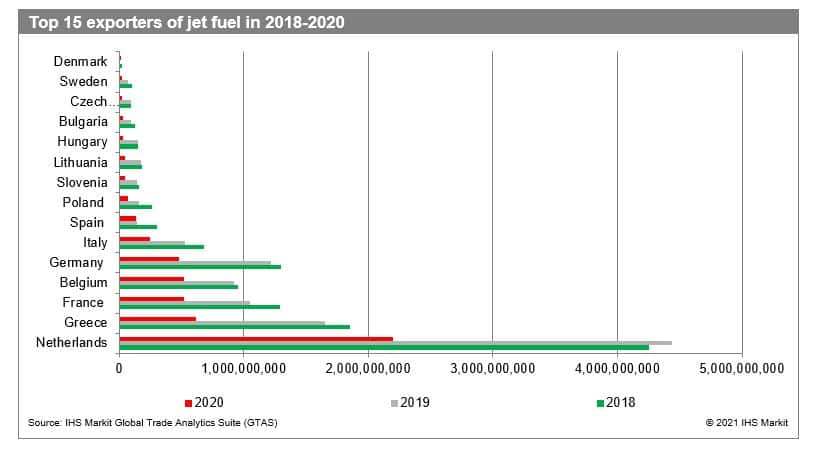

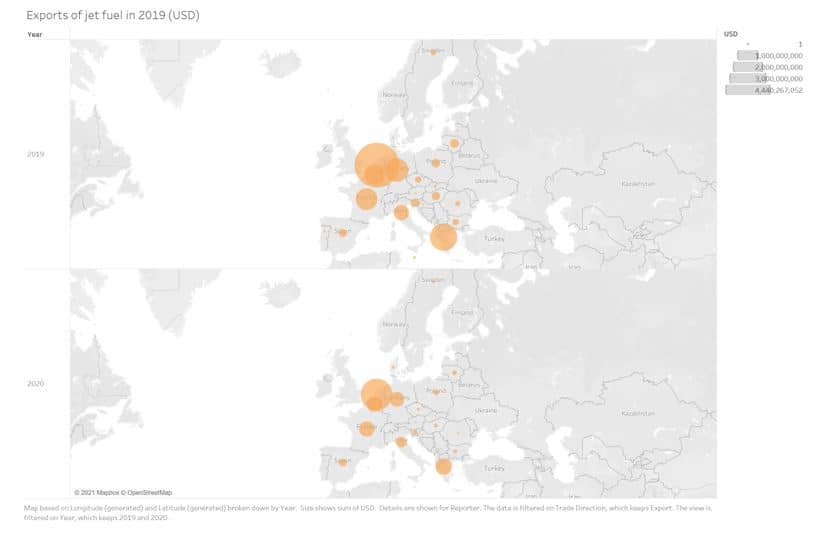

Production capabilities for jet fuel (and refined petroleum products in general) differ a lot between the EU Member States. This also impacts export capabilities. Aggregating monthly data to years, we can quickly identify the top exporters in EU27. The drop in exports was significant for all the top EU exporters in 2020 (we can also see it on the map).

Furthermore, using the value and quantity data available in the IHS Markit Global Trade Analytics Suite (GTAS), we can estimate the mean export and import unit prices (USD/kg) for EU-27. The result is consistent with our expectations. The mean export and import unit prices fell at the outset of the pandemic, reached the bottom in May 2020, and started rising again, driven by reduced production volumes and slowly rising demand. By May 2021, the unit prices more or less reached the pre-pandemic levels.

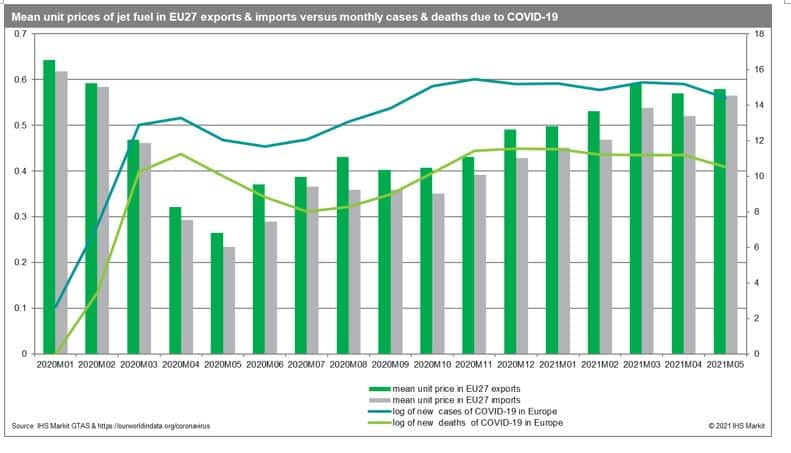

Overlaying the mean EU27's unit prices evolution with data on COVID-19 pandemic evolution in Europe (new cases & new COVID-19 related deaths), we can see the correlation (statistically significant and negative), meaning that escalation in the pandemic exerts a negative impact on unit prices of jet fuel in Europe; however, the effect seems to weaken over time, as we learn to deal with the ongoing pandemic. The correlation appears to be more robust for unit prices in imports and with series on new deaths (which seems to better explain the severity of the pandemic over time than the data on cases themselves).

This column is based on data from IHS Markit Maritime & Trade Global Trade Atlas (GTA) & GTA Forecasting.

For more details about Global Trade Atlas Forecasting please visit the product page

https://ihsmarkit.com/products/gta-forecasting.html

For more details about Global Trade Atlas (GTA) please visit the product page

https://ihsmarkit.com/products/maritime-global-trade-atlas.html

The full version of this article is available on the Connect platform for IHS Markit clients with a subscription to GTA/GTA Forecasting or GTAS Suite

*Please note that China (mainland) reported an aggregated value of trade for January-February 2020 and 2021 - for the year 2020 the data in the GTA database were equally split between the two months, while for 2021 the data were split unequally.

Please note that Brazil has revised data for 2020 affecting the reported growth rates (please be careful not to compare the current GTM Report with prior editions due to significant changes)

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

How can our products help you?