Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 17 Dec, 2021

Paytm had a disappointing stock market debut, but we think public investors are discounting the Indian mobile payments company's future growth potential. As the more successful listing story of South Korean financial technology company Kakao Pay shows, an accelerated diversification into financial services could be the key for Paytm.

Paytm's bleak debut reflects investor concerns around monetization opportunities for fintechs in India's fast-growing, albeit interchange-starved, mobile payments market. But as Kakao Pay's successful listing shows, the path to profitability for payment fintechs entails building higher-margin revenues by upselling financial services to consumers and merchants.

At first glance, Paytm's IPO seemed overpriced relative to public valuations of global payment companies. But the Indian fintech shares the same characteristics as other fast-growing fintechs, especially Kakao Pay. Having assembled a wide spectrum of financial services, largely through pursuit of regulatory licenses, Paytm is set to accelerate fee income from lending, insurance and wealth management businesses. With a growing share of financial services revenues, Paytm's current valuation gap with Kakao Pay will likely diminish.

Shares of One97 Communications Ltd., which operates as Paytm and is backed by Berkshire Hathaway Inc. and Alibaba Group Holding Ltd., among others, slid in its first two trading days post listing, closing at 1,360 Indian rupees on Nov. 22, which represented a 37% decline from the IPO price. The stock has since recovered but is hovering well below the IPO price. Paytm's rocky debut came against the background of the IPO valuation appearing overvalued compared to global public peers.

Paytm's expensive IPO valuation

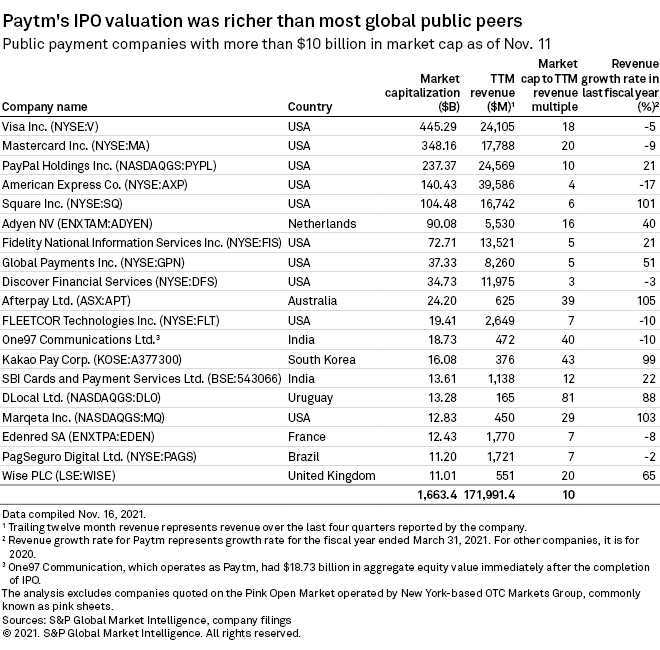

Paytm's IPO pricing made it one of the most expensive payment companies in the world, according to our review of 18 publicly traded payments companies with more than $10 billion in market capitalization as of Nov. 11. Only three stocks either nearly matched or surpassed Paytm's valuation multiple of 40x trailing 12 months revenue at the time: Australia's Afterpay Ltd., South Korea's Kakao Pay Corp. and Uruguay's DLocal Ltd.

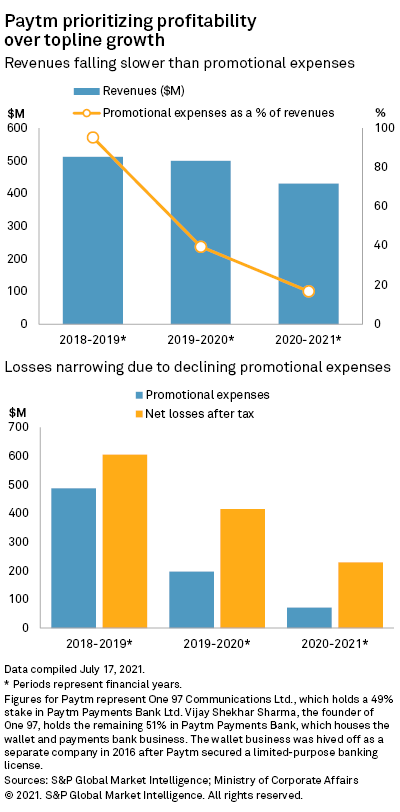

The three global peers had record revenue growth rates in their last fiscal year, ranging from 88% to 105%. At the outset, Paytm's revenue decline of 10% in its most recent fiscal year and flat revenues in the previous fiscal year might make it an unlikely candidate to attract comparisons with the three global peers.

Still, we believe Paytm should be treated as a high-growth technology company. Its tepid top-line growth in recent years was a result of the impact of the pandemic on its travel and entertainment booking segments and a rejig in focus toward revenue-generating businesses. The company has laid the groundwork for generating revenue growth through diversified sources.

Therefore, Paytm's negative performance upon listing makes it look undervalued compared to the other fast-growing companies with similar characteristics. A comparison with Kakao Pay could point to positives for Paytm. We believe the South Korean company is Paytm's closest peer among large publicly traded payment fintechs. Both are expanding beyond mobile payments and are building diversified financial platforms in their respective markets.

Financial services driving Kakao Pay's premium valuation

The South Korean company has had a stellar run since listing on Nov. 3, with its closing share price as of Nov. 26 about 147% higher than its IPO price. Kakao Pay's market cap was 1.6x greater than Paytm as of Nov. 26.

The relatively lower valuation for Paytm may seem unwarranted since it is already bigger than Kakao Pay based on several metrics. For example, Paytm had higher revenues than Kakao Pay for the 12 months ended June 30, 2021. The Indian fintech has, arguably, greater growth potential because it operates in a market with significantly lower levels of credit card penetration, whereas South Korea offers fewer cash transactions to chase for Kakao Pay.

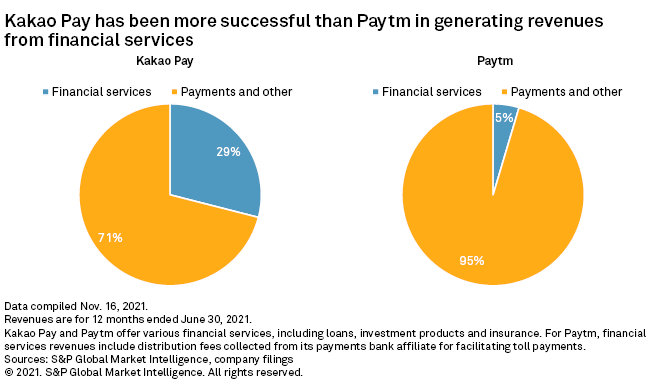

But a more bullish investor sentiment about Kakao Pay largely stems from its growing share of financial services revenues. Kakao Pay's revenues from financial services accounted for 29% of its total revenues for 12 months ended June 30, 2021, whereas that share was less than 5% for Paytm.

Unlike their U.S counterparts like PayPal Holdings Inc., Asian payment fintechs cannot generate profits through payments alone and need additional revenue streams such as financial services to become profitable.

As we discussed in our previous research, transaction take rate defined as revenues as a percentage of transaction payment value is a useful metric to evaluate payment fintechs. In Asia, transaction take rates tend to be relatively lower than in the U.S. as caps on interchange and high competition inhibit fintechs' ability to raise merchant fees. After adjusting for payment processing charges paid to banks, the net take rate is either close to zero or negative for Paytm and Kakao Pay.

Asian fintechs need to make up for low payment take rates by upselling higher-margin products like financial services. For instance, unsecured lending that funds consumer purchases not only fuels the transaction value but also optimizes the revenue take rate as fintechs earn sourcing fees from banking partners or higher transaction fees from merchants for boosting turnover.

Ant Group, the largest diversified fintech platform in the region, best illustrated this model before its IPO was scrapped in late 2020 due to regulatory changes. About 7% of transaction value comprising loans disbursed and sales of wealth management and insurance products facilitated through the payment platform contributed more than half of Ant's revenues in 2019, according to our estimates.

Kakao Pay has made greater progress than Paytm in building revenues from financial services. The South Korean fintech's overall revenue take rate grew from 37 basis points in the first quarter of 2020 to 45 basis points in the second quarter of 2021, as quarterly digital finance revenues grew 5x to $25 million during this period. The company is narrowing losses every year with the growing share of financial services.

If Kakao Pay is any guide, Paytm could see a bump in valuation as financial services revenues are set to grow faster than payments revenues.

Paytm's financial services business ready to fly

The Indian company's financial services strategy mirrors that of Kakao Pay, in that it is gaining a distribution footprint across all segments and opportunistically embracing risk-bearing models in some.

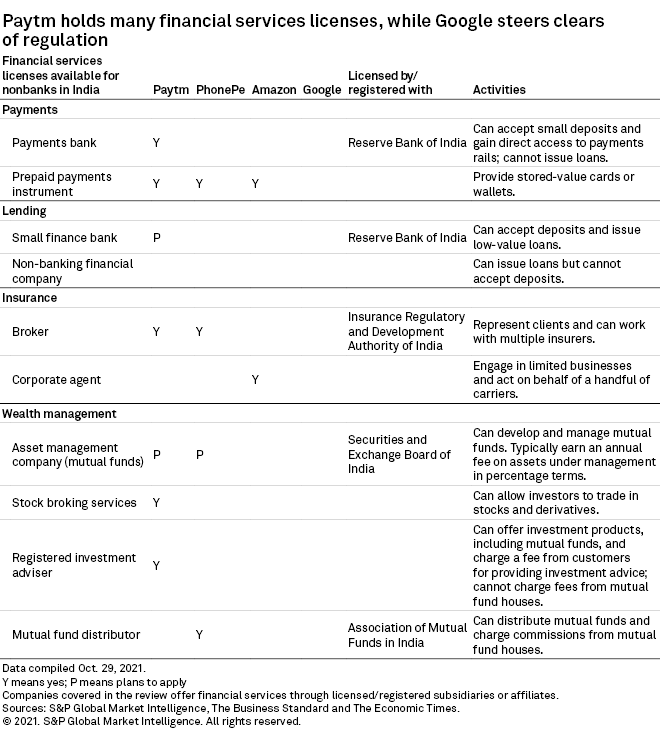

Paytm has secured at least five intermediary licenses available for non-financial institutions in payments, insurance and wealth management. It leans on banks and nonbanking lenders for its deferred payment and unsecured lending options. Kakao Pay holds intermediary licenses in securities brokerage and insurance, among others. It had partnerships with 133 financial institutions, including banks, credit-card companies, investment securities and insurance companies, as of September.

In insurance, the two companies are pivoting away from profit sharing with incumbents. Kakao Pay plans to set up a digital nonlife insurance company, whereas Paytm is waiting for regulatory approval for the acquisition of an insurer. Further, Paytm plans to seek a small finance banking license in 2022 to facilitate balance-sheet lending.

Many of Paytm's financial services started only in 2020, and so digital finance revenues were less than 5% of total revenues for 12 months ended June 30, 2021. But some of the financial services already appear to be gaining traction.

For instance, in October, loan disbursals facilitated by Paytm totaled $84 million, 5x higher than the amount disbursed in October 2020. The company earns fees from lending partners for facilitating loans as well as for providing collection services. Commissions from carriers for insurance policies sold through the platform and fees from consumers for equity broking services are among other potential revenue drivers.

Low market share in mobile payments not a hurdle

Investor concerns around Paytm's insignificant market share in popular mobile payments may be overblown. Paytm's focus on merchants and other revenue-generating payment products has served it well.

Paytm held only 13% of account-to-account transfers processed through the Unified Payments Interface system for the first six months of 2021, according to S&P Global Market Intelligence's 2021 India Mobile Payments Market Report. In 2018, Paytm was closely competing with PhonePe and Google Pay in UPI payments and had a dominant share in stored-value wallet transactions. Wallets have since become inconsequential, and Paytm has conceded the UPI market share to Alphabet Inc.'s Google and PhonePe Private Limited.

But a comparison of Paytm with other leading players on UPI payments alone seems flawed. Dominance in UPI payments does not necessarily offer a better path to revenues for payment fintechs. The government's decision to waive off merchant fees on UPI transactions has significantly limited the revenue pool for payment fintechs.

Paytm's revenues are substantially higher than the more popular UPI peers. For instance, Paytm had $429 million in revenues in fiscal year 2021 compared to PhonePe's $93 million. During this period, the Walmart unit handled $339 billion in UPI transaction value, more than 5.6x the UPI value handled by Paytm.

Relatively low market share in UPI payments was largely driven by Paytm's decision to scale back marketing and promotional expenses. Its shift away from aggressively acquiring consumer market share in UPI payments has helped narrow losses.

Top-line growth in payment revenues largely comes from merchant relationships by enabling recurring transactions, one-click payments, instant refunds and reconciliations. The company's payments banking license allows it to offer a broad suite of products to businesses, without the need for sponsor banks, including a single real-time current account for all fund flows.

Value-added services like IoT-based point-of-sale devices that provide instant audio payment confirmation make Paytm an attractive partner for small businesses in offline payments. Payment gateway relationships with digital merchants supporting multiple payment methods is another source of revenue growth.

Thanks to its focus on non-UPI payments, Paytm is even earning a small positive spread between payments revenues and processing expenses. The company’s payments business generated a gross profit of $9 million in fiscal 2021, compared to a loss of $69 million in 12 months ended March 31, 2020. After accounting for marketing expenses, however, the payments business stays in the red.

Paytm is unlikely to generate profitable growth in its payments business, but its vast scale and breadth allow that business to break even. Deriving financial services revenues from consumers and merchants at little or no additional cost of acquisition will boost profitability for the company.

| Strengths | Weaknesses |

|---|---|

|

Having been an early mover, Paytm has a large customer base and enjoys a strong brand. The company's pursuit of several regulatory licenses allows it to handle a broad suite of payments services "in-house" without the need for a sponsor bank. Its innovative point-of-sale devices create stickier experiences for merchants. |

Paytm's diversification into various financial services and e-commerce businesses means that it is expanding in too many directions. The company must avoid the pitfalls of allocating capital inefficiently across businesses. |

| Opportunities | Threats |

|

Paytm's financial services such as small-ticket unsecured loans target a market segment where banks have traditionally lagged: thin-file individuals and small businesses. |

The company's plans to make a significant penetration in lending and insurance need regulatory approvals for its affiliates. Without the ability to underwrite financial risks and develop bespoke products, the company cannot unlock full potential. |

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.