Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Oct, 2016 | 10:30

Highlights

The following post comes from Kagan, a research group within S&P Global Market Intelligence.

To learn more about our TMT (Technology, Media & Telecommunications) products and/or research, please request a demo.

The death of Supreme Court Justice Antonin Scalia places even greater importance on these elections, as his replacement will require 60 votes in the Senate for confirmation.

We expect TV broadcasters to pull in about $3.30 billion in political advertising revenue by the end of 2016, a 15.0% increase from the 2012 election cycle. In prior years, local TV has garnered on average two-thirds of all political ad dollars; however, rising competition from digital, cable TV and radio is cutting into TV's share.

TV markets in North Carolina, Iowa, Ohio and Pennsylvania will likely see a surge in political ad dollars as politicians and PACs use audience targeting to sway voters. Florida, Illinois, New Hampshire, Nevada and Wisconsin will be among the largest beneficiaries due to close Senate races.

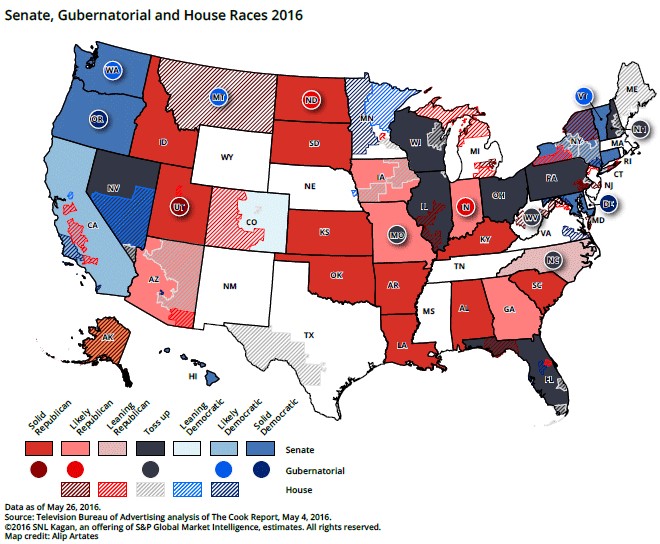

Tightly contested races and the potential for more battleground states than prior election years have led to an increase in political advertising Through the first quarter 2016. Along with the presidential election come some important Senate races as the Democrats try to regain control of the chamber.

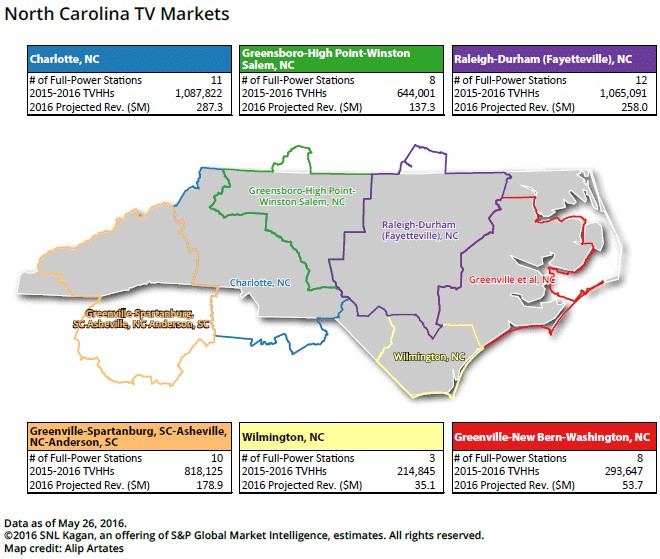

We project the six TV markets in North Carolina will generate $950.4 million in 2016, up 13.2% from $839.6 million in 2015. With its nearly 1.1 million TV households, the Charlotte market edges out the Raleigh-Durham (Fayetteville) TV market for the most households. Revenue in Charlotte is expected to grow 14.0% year over year to $287.3 million. The Raleigh-Durham market is expected to grow 12.9% to $258.0 million.

North Carolina's 15 electoral votes will make it a hotly contested state for presidential candidates, and the Senate seat held by Republican incumbent Richard Burr is viewed as one of the most vulnerable as he slips in the polls. However, Democratic candidate Deborah Ross still trails Burr in most polls in the traditionally Republican voting state.

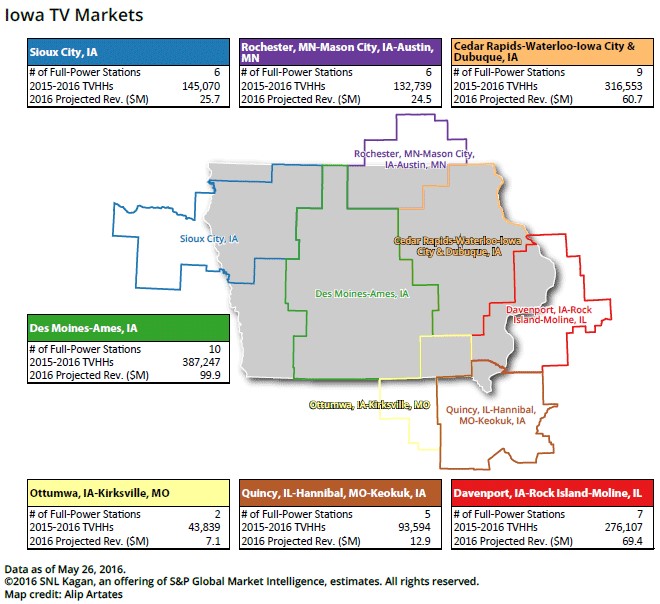

Iowa's six electoral votes and early caucuses often set the tone for the candidates that win there. However, the winners of the state's caucus go on to win their party's nomination only about half the time. Winners of the state are often surprises, making it an even more important spot for political advertising.

We anticipate it will likely be another highly competitive market for TV broadcasters in 2016. Sen. Charles Grassley faces a competitive race from Democratic challengers, such as Rob Hogg. In 2012, President Barack Obama defeated Mitt Romney by 5.81 percentage points in Iowa, and in 2008, Obama defeated John McCain by 9.54 percentage points.

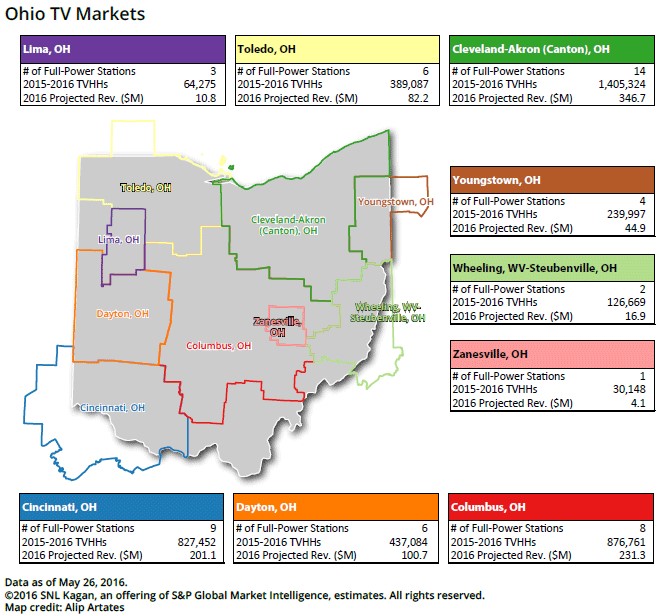

The 2016 Republican National Convention will be held in Cleveland in July, making Ohio's TV markets extremely valuable to political advertisers. Ohio is a diverse state and has been a good microcosm of the country. Of the Republican presidents, none has been elected without carrying Ohio, and the state has been a battleground for around the last 30 years.

The Ohio Senate race will garner national attention in 2016. Republican incumbent Rob Portman is facing Democrat Ted Strickland, Green Party candidate Joseph DeMare and independent candidates Thomas William Connors and Scott Rupert. Obama has publicly endorsed Strickland despite his criticism of new gun regulations. Portman and Strickland are neck-and-neck in the polls and will likely have to spend heavily on political advertising to sway voters.

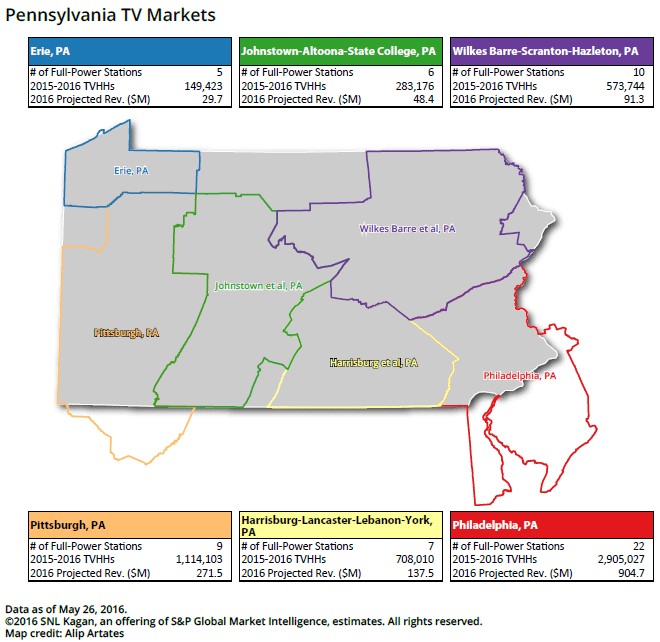

Although Pennsylvania gave Obama a comfortable victory margin in 2008 and 2012, the state has seen more Republican voters due to the rural part of the state's attachment to fossil fuels and conservative cultural tendencies. The contrast of views between the rural parts of the state and those in Philadelphia and Pittsburgh will bring political ads from both major parties in hopes of taking the state's 20 electoral votes.

Pennsylvania will also hold one of the most competitive Senate elections. Republican incumbent Pat Toomey is running against Democrat Katie McGinty, and the two have been close in the polls. Toomey's seat is said to be at the heart of the national Democratic effort to retake the Senate majority. Pennsylvania has aired the most political ads of all Senate races at 22,309 ads costing $32.3 million, according to Kantar Media/CMAG estimates.

David Wasserman, editor for "The Cook Political Report," believes the presidential election could come down to Pennsylvania as "the tipping point state." Philadelphia's educated white-collar suburbs have trended republican in the past, while western Pennsylvania's more blue-collar workers have trended democrat. According to the Television Bureau of Advertising, the state leans Democrat, but that could change as the election progresses and the ads pour in.

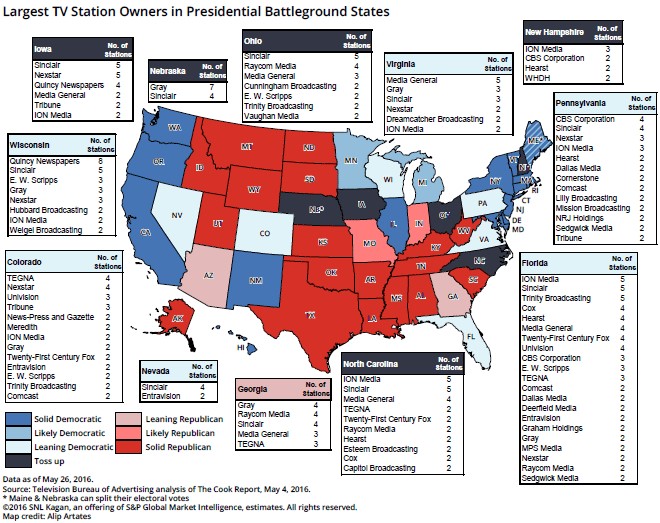

Sinclair has the greatest opportunity to benefit from the 2016 election cycle with its 42 full-power stations in 12 battleground states (Iowa, Nebraska, New Hampshire, North Carolina, Ohio, Georgia, Colorado, Florida, Nevada, Pennsylvania, Virginia and Wisconsin), covering an estimated 15.3 million TV households in 31 TV markets. ION Media is a distant second, with 25 stations.

Looking at the battleground markets on the basis of TV households reached shows ION leading the pack, covering an estimated 23.4 million TV homes in 21 markets, ten of which are in Florida and North Carolina. Univision Communications Inc. ranks second in terms of TV household coverage with nearly 16.6 million TV homes, while Sinclair comes in third.

The uncertainty in the presidential races will have a trickle-down effect to the Senate and gubernatorial races. The Senate races are estimated to bring in a hefty percentage of the total political ad revenue spent on TV, and those stations in the hotly contested states, such as Ohio, Florida, New Hampshire and Colorado will see a larger percentage of the political ad revenue spent.

Dark-money groups — 501(c) tax-exempt organizations — have been behind a majority of the political ads in the Senate. According to the Center for Responsive Politics, using data from the Federal Election Commission, these groups have spent 10 times the political ad dollars through the first quarter versus what was spent at this point during the 2012 election cycle. For the entire 2012 election cycle, dark-money spending on political ads topped $308.0 million, an amount that will likely be far exceeded in 2016.