Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 13 Dec, 2023

By Tony Lenoir

Long passed over in favor of states with ambitious renewable targets, the sunny US Southeast is emerging as one of the next grid-scale US photovoltaic El Dorados as highly remunerative, Inflation Reduction Act-boosted forecast solar financials compel renewable developers to the region in the next 10 years.

The latest S&P Global Market Intelligence Power Forecast calls for solar to expand substantially in the region, accounting for 11% of total generation output in 2033 across the seven states making up the US Southeast. Even at this rate of growth, cannibalization of the solar price curve will, for the most part, be avoided, pointing to attractive returns over the next 10 years, particularly in the first half of the outlook.

That said, combined with the region's solar-friendly attributes, such sunny financial prospects could prove much more enticing to developers than currently anticipated, markedly boosting prospects for utility-scale solar generation assets in the footprint — and eventually weighing on energy prices.

Part 2: Bright projected economics to help US Southeast fill solar gap amid green boom

Part 3: Solar profitability quickly diminishes in competitive NY landscape

Part 4: ERCOT (Jan. 2)

Part 5: MISO/PJM (Jan. 8)

The S&P Global Market Intelligence Power Forecast projects the US Southeast will triple its grid-scale solar capacity in the next 10 years, to 62.3 GW, making up 21% of the region's generation fleet while contributing 11% to generation output in 2033. North Carolina is to account for nearly half of the buildup; Florida, a relatively distant second, roughly a third. The forecast calls for North Carolina and Florida, respectively, to produce nearly 27% and 14% of their electricity from the sun in 2033.

Despite the forecast increase in utility-scale photovoltaic capacity by 2033, penetration levels are expected to remain relatively low, which will keep solar energy revenues in the region elevated through most of the forecast. From 2024 through 2033, the forecast energy revenue stream alone on average more than doubles estimated debt obligations. It also ensures a full 12% return to equity holders through most of the interval across the seven states that make up the region. Given these financial prospects, and considering recent renewable energy-supporting legislative developments, the latest projections for solar deployment in the region could be erring on the conservative side.

Currently trailing most of the US in renewable generation — solar accounted for only 3.7% of overall generation output across the seven states in this analysis in 2022 — the region offers a long runway for grid-scale solar growth. That said, the context of the energy transition adds a sense of urgency to speeding up photovoltaic deployment in the area if the US is to meet its various environmental and self-sufficiency objectives. That is where federal incentives, notably the Inflation Reduction Act (IRA) of 2022, come in.

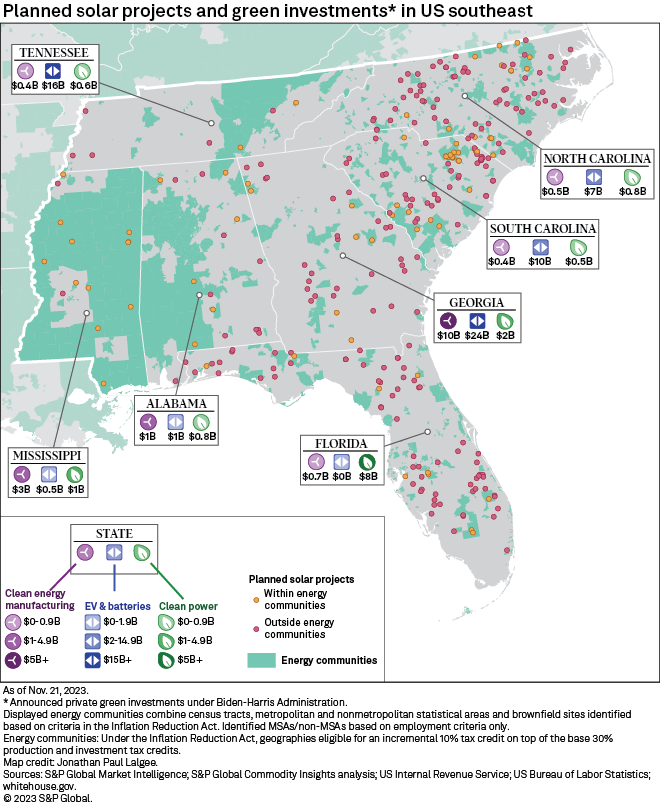

Clauses in the IRA have transformed the US Southeast into a magnet for green investments. This includes the energy community special rule, which aims to stimulate clean energy development in communities historically reliant on fossil fuels via incremental 10% breaks supplementing the IRA's base 30% production and investment tax credits. Commodity Insights identified large swaths of the US Southeast likely qualifying based on energy community criteria in the IRA, notably in Mississippi, Alabama and Tennessee.

|

Currently, the seven US southern states that make up the region under review have a combined 18.3 GW of additional large-scale solar capacity in the pipeline, of which 28.4% are in identified energy communities. The metric varies widely across the geography, however, with the proportion of planned solar projects identified as likely eligible for the tax-credit adders reaching nearly 84% in Mississippi but coming in slightly below 11% in Florida. In the rest of the footprint, the percentage ranges from 18.7% in Georgia to 40.6% in Alabama.

Aside from the energy community special rule, which in essence seeks to boost economic activity in less affluent communities, the IRA features the Empowering Rural America (New ERA) program — the "largest investment in rural electrification since President Franklin Delano Roosevelt signed the Rural Electrification Act into law in 1936" according to the US Department of Agriculture. Funding from the $9.7 billion program is available to member-owned rural electric cooperatives to, among other things, "purchase, build or deploy renewable energy."

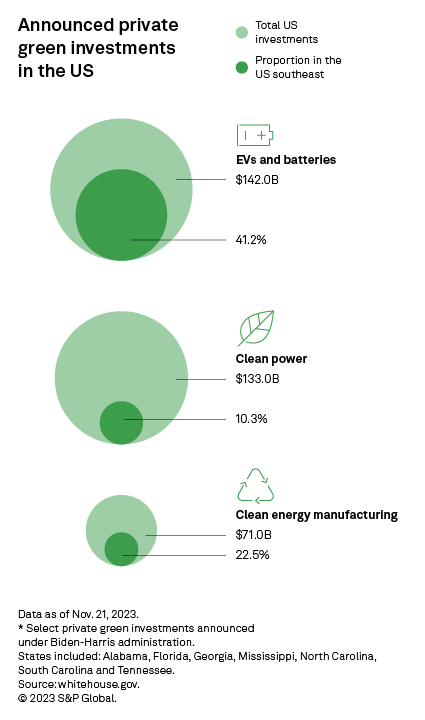

The IRA itself builds on subsidies from the Bipartisan Infrastructure Law of 2021 to develop clean energy in the US and lower carbon emissions. On Nov. 21, 2023, the White House on its website highlighted that $346 billion in private investments in clean energy manufacturing, clean power and EVs & batteries in the US had been announced under the current administration. Over a quarter of this amount, or more than $88 billion, is to be invested in the US Southeast, with $36 billion for Georgia alone.

Visualization by Allen Villanueva, Joseph Reyes and Rameez Ali.Cartography by Jonathan Paul Lalgee.For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast. Regulatory Research Associates is a group within S&P Global Commodity Insights.S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.