Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 09, 2021

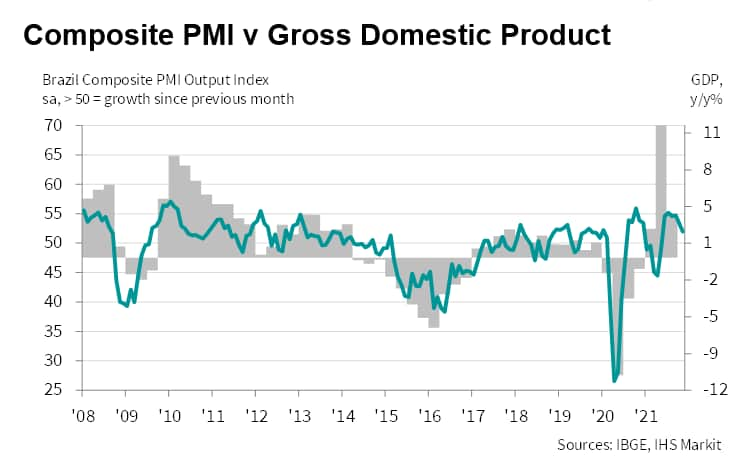

Brazil dipped back into recession in the third quarter of 2021 as a severe drought hugely impacted farmers. PMI data for the fourth quarter so far showed a resilient service sector, but factory production contracted to a greater extent as demand was stymied by rising interest rates and price pressures. With inflation mounting, the central bank hiked the policy rate for the seventh time running, a factor that could hurt consumption and investment in coming months.

Official statistics data for the third quarter of 2021 highlighted another quarterly contraction in GDP as the agriculture and livestock sector posted its worst performance (-8.0%) in nine-and-a-half years due to a severe drought. Industrial production stabilised (0.0%), with companies in this segment negatively impacted by supply-side issues and mounting inflationary pressures. Services activity expanded (+1.1%) in what appears to be a shift in demand from goods to services as COVID-19 restrictions recede. Encouragingly, domestic consumption rose (+0.9%), but exports decreased sharply (-9.8%).

Industrial production figures from IBGE showed another monthly reduction in output during October, the fifth in successive months. Timely PMI data indicated that the manufacturing sector remained stuck in contraction, with the downturn gathering pace during November. Companies indicated that order book volumes were down markedly, owing to higher interest rates and inflationary pressures. Elevated prices for inputs also restricted input buying and job creation as companies focused on cost-reduction measures.

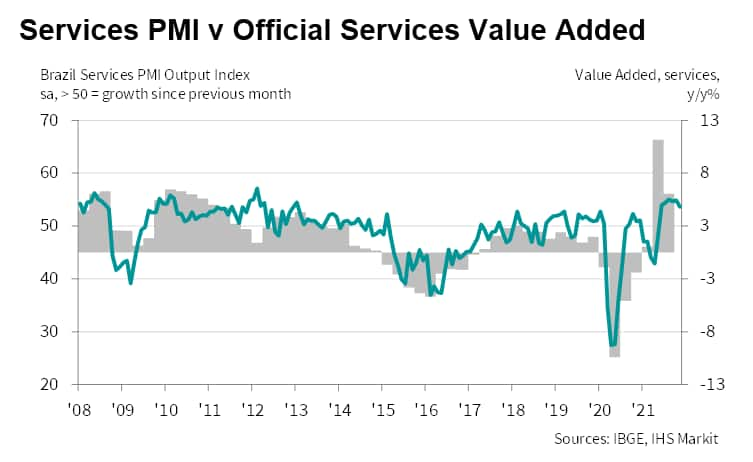

Conversely, demand for Brazilian services remained resilient in spite of the intensification of inflationary pressures and recent rises in borrowing costs.

PMI survey participants registered the fastest upturn in new business since March 2019 and a solid, albeit slower, expansion in output during November.

Price pressures in Brazil remained elevated, as global shortages of inputs and supply-chain disruptions were exacerbated by an unprecedented drought and associated increases in energy prices. Official inflation climbed to 10.7% in October, the highest since January 2016 and more than double the central bank's upper-limit goal (5.25%) for 2021.

While PMI data showed that input costs continued to rise at a stronger rate in manufacturing than in services midway through the final quarter of 2021, the latter registered a survey record increase (data collection started in March 2007). Subsequently, the aggregate rate of input cost inflation climbed to a series peak.

Additional cost burdens continued to be passed on to consumers in November, with prices charged for goods and services increasing further. At the private sector level, the PMI results highlighted the third-sharpest rise in output prices since comparable data became available in early-2007.

The official interest rate (SELIC) that was at a near 24-year low of 2% in February has been raised for seven consecutive times as the central bank attempts to meet its primary goal of price stability. For 2021, the inflation target is 3.75%, with a ceiling of 5.25%. The policy rate was lifted to 9.25% in November, the highest in over four years.

Survey participants of the manufacturing PMI panel continued to indicate that rising interest rates had a negative impact on the performance of the sector during November, and companies became increasingly concerned that future consumption and investment would be restricted by rising borrowing costs and inflationary pressures.

Indeed, a large proportion of purchases in Brazil are attained on credit and indebtedness is on the rise. Preliminary data from the central bank showed an increase in household debt to 59.9% of national income. Excluding mortgages, household debt amounted to 37.0% of GDP.

This is particularly concerning as the cost of borrowing is rising. In August, the annual interest rate on a credit card for households averaged 63.8% and that for overdrafts stood at 125.1%.

Throughout the COVID-19 crisis, access to credit helped households to maintain their purchasing standards and support living costs amid a reduction in real income due to the pandemic and rising inflation.

However, looking ahead, ongoing rises in banking rates could curtail consumption, investment, gross domestic product, employment and real wages. Brazil's economy could face many other headwinds, such as sustained periods of elevated inflation, new waves of COVID-19, political gridlock, currency volatility, lingering issues in supply chains and deteriorating market confidence.

Upcoming releases of PMI data will prove useful in highlighting how recent developments affected the private sector economy in the final month of the year.

To hear about this story and much more, tune into our latest podcast here.

Pollyanna De Lima, Economics Associate Director, IHS Markit

Tel: +44-1491-461-075

pollyanna.delima@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Posted 09 December 2021 by Pollyanna De Lima, Economics Associate Director, Economic Indices, S&P Global Market Intelligence

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location