Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 6 Apr, 2022

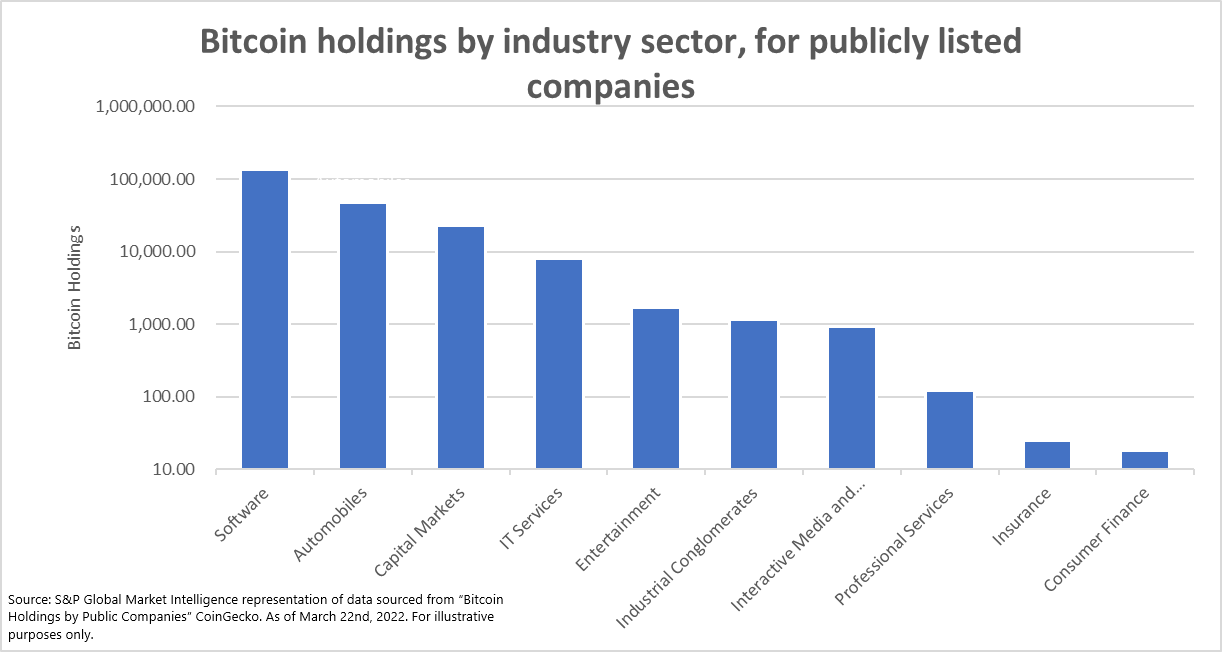

Whilst many financial policy- and government law-makers across the world are working on establishing a solid framework to regulate the growing cryptocurrency industry, some companies have already taken practical steps in diversifying their corporate balance sheet, by adding Bitcoin as part of their investment strategy. KPMG (in Canada) is one of the latest joining this growing and diverse pack,[1] which includes non-financial heavy-weight firms like Tesla, brokerage firms, crypto exchanges, venture capital firms as well as other institutional holders. As of March 22, 2022, the current exposure of publicly listed companies to Bitcoin alone is more than 200,000 Bitcoins (i.e. $9.7 Billion at current prices), and keeps growing.[2]

Figure 1: Bitcoin holdings by industry sector, for publicly listed companies

There is currently a vibrant debate on the actual energy consumption and carbon dioxide footprint of the Bitcoin blockchain. In fact, there is an argument that Bitcoin mining uses excess power that would be otherwise wasted, thus making miners not directly responsible for the greenhouse gas emissions linked to their energy consumption.

But how much are these emissions anyway? Obtaining an accurate estimate is quite difficult. Firstly, there is very little information on mining hardware efficiency or the breakdown of energy sources, and the correct attribution of emissions due to various stakeholders. Secondly, any estimate needs to be updated regularly, to take into account the redeployment of Bitcoin mining facilities to other countries (e.g. due to the Chinese mining ban) or the evolving carbon-emission profile of the plants used to power Bitcoin blockchain’s operations (e.g. in 2021, a coal-based plant was revived in southern Montana, contributing to a massive increase in greenhouse gas emissions).[3]

Despite all these technical challenges, it is estimated that holding a single Bitcoin in a digital wallet for a whole year is linked to a similar amount of carbon emissions as those produced by a person traveling on a London-Dubai-London flight in economy class.[4]

In recent years, there has been mounting global pressure within the investment industry to reorient capital allocation towards more sustainable business models. Concurrently, several countries (New Zealand, Switzerland, China, United Kingdom) have decided to make or (G7)[5] are moving towards making the Taskforce on Climate-related Financial Disclosures (TCFD) mandatory for largest-revenue companies in coming years.[6]

Depending on the evolution of current carbon tax policies and individual governments’ legislation, large-revenue companies might end up in the future having to pay carbon tax or choosing to pay carbon offsets, when investing in carbon-intensive activities and businesses. Taking into account the existing number of Bitcoins, estimated to be approximately 19 million,[7] this would translate into aggregate costs of between $4Bn-$40Bn a year, just for holding all of them in digital wallets, over a $100-$1000 per ton of carbon dioxide tax scenario. This could also have implications on the credit risk of companies holding Bitcoins, as these additional costs would reduce their earnings, and ultimately affect their financial strength and thus ability to repay debt.

Let us take as an example, MicroStrategy Incorporated, a publicly listed company providing enterprise analytics and services worldwide. This firm currently holds around 121,000 Bitcoins. In the extreme scenario of a $1000/tCO2 carbon tax applied to its Bitcoin investments, using S&P Global Market Intelligence’s Climate RiskGauge, we estimate a deterioration of its probability of default by 188 basis points, all else being equal.[8]

Our analysis does not factor in the additional negative effect due to Bitcoin’s price volatility but provides an initial view of the importance of estimating carbon emissions correctly and the potential credit risk implications of a carbon tax applied to investments connected to carbon-intensive crypto-assets.

Find out more about how to estimate the credit risk implications of carbon tax here >

[1] KPMG in Canada completes its first direct investment in cryptoassets”, February 7, 2022. https://home.kpmg/ca/en/home/media/press-releases/2022/02/kpmg-in-canada-invests-in-cryptoassets.html

[2] Public Companies with Bitcoin Holdings - CoinGecko (accessed March 1st, 2022). https://www.coingecko.com/en/public-companies-bitcoin

[3] Bitcoin miners revived a dying coal plant – then CO2 emissions soared | Cryptocurrencies | The Guardian (as of February 18th, 2022).

[4] “The Carbon Emissions of Bitcoin from an investor perspective”, Frankfurt School Blockchain Centre (As of November 16th, 2021).

[5] Canada, France, Italy, Germany, Japan, United Kingdom and United States.

[6] “G7 Finance Ministers and Central Bank Governors Communiqué” (June 5th, 2021), https://www.gov.uk/government/publications/g7-finance-ministers-meeting-june-2021-communique/g7-finance-ministers-and-central-bank-governors-communique

[7] “Total Circulating Bitcoin” https://www.blockchain.com/charts/total-bitcoins

[8] RiskGauge Score, S&P Capital IQ Platform, March 1st, 2022.