Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jul 05, 2022

Our banking risk experts provide insight into events impacting the financial sector in emerging markets in July.

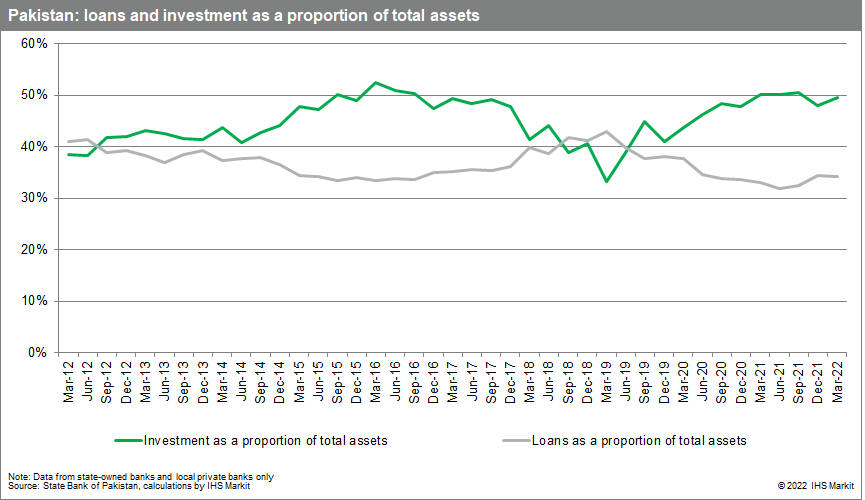

Pakistani banks are likely to further support government finances by purchasing more sovereign debt, affecting their ability to disburse more loans.

Pakistan's government has already received loans from China to replenish its foreign currency reserves despite already hiking its interest rate to nearly 14%. Local banks are likely to be asked to continue to purchase sovereign debt instruments - such as Pakistan Investment Bonds - to support government finances and are also likely to face higher foreign currency reserve requirements to help with the fiscal situation and the government's foreign currency position, both of which are likely to affect banks' ability to disburse more loans due to the crowding-out effect.

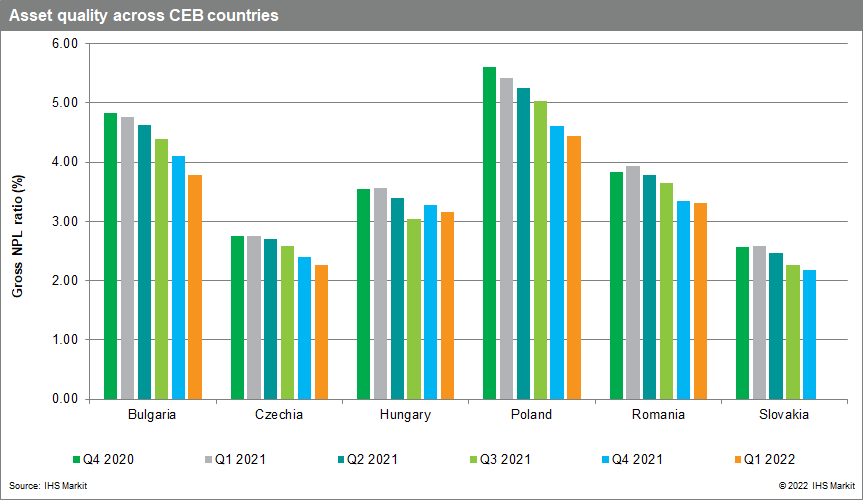

The re-emergence of borrower support measures across Central Europe and the Balkans (CEB).

With some Central European states announcing new measures - such as Poland in April, Hungary in June, and Romania (with a loan moratorium effective from 1 July) - and the increasing costs of living in the region following the Russian invasion of Ukraine, we expect further banking-sector support measures to help borrowers and/or encouraging new lending to be introduced by additional Emerging European authorities, including Bulgaria and Croatia, in the near term. Widespread action could also trigger a European Central Bank (ECB) initiative to harmonise moratorium guidelines.

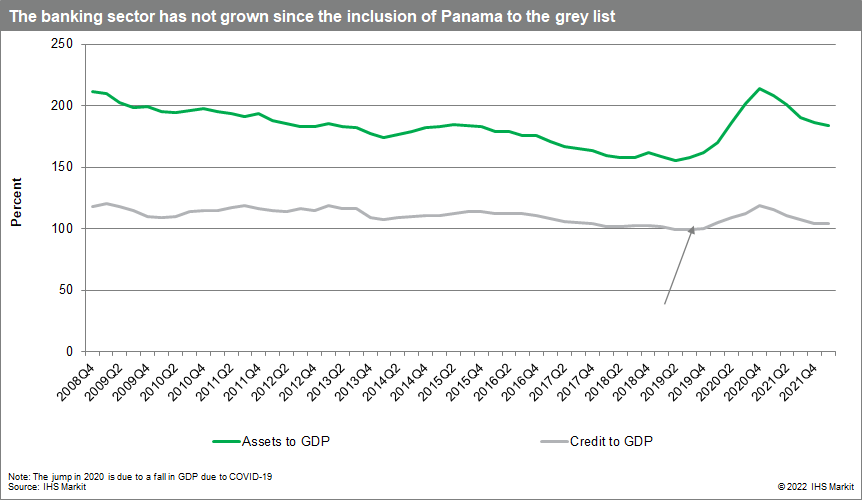

Panama's action plan for departing the grey list of the Financial Action Task Force (FATF).

After June 2019 - when Panama was included into the list of countries under increased monitoring (informally labelled the "grey list") of the FATF - some correspondent banks have decided to sever their ties with the country. The Panamanian authorities have implemented some measures to move away from the list, aligning with 11 out of the FATF's 15 recommendations. However, the organisation has deemed Panama's measures insufficient, and has urged it to comply with all recommendations by October 2022 - or it could be included in the high-risk jurisdiction list (the "black list"). We expect the country's regulators and legislators to establish a plan to comply with the FATF's demands.

Strong household borrowing is likely to give way to more corporate demand across the Gulf.

Since 2020, household lending has been outpacing corporate lending in over half of Middle East and North Africa (MENA) countries. This differential was strongest in Saudi Arabia, where household loans grew three times faster than corporate loans. Household loans have grown 27% year on year (y/y) on average since the start of 2020 compared with just 8% y/y growth in corporate lending. Some of this was due to borrower-friendly interest rates and support programmes for homebuyers, but was also due to sluggish demand from corporates as they held back on new investments and paid down existing debt. We expect corporate lending to grow relatively more strongly this year throughout the region as external borrowing costs and investor sentiment deteriorate, leading banks to turn back to domestic bank borrowing. This is particularly likely in the Gulf, where investment spending is expected to increase.

Release of end-2021 data to reveal the status of asset quality in Mozambique, following the expiration of forbearance measures.

Mozambique is expected to release its December 2021 Financial Stability Review, which is likely to reveal the first impact on asset quality following the end of forbearance measures in June 2021. Thus far, asset quality risks have been contained through forbearance measures, reflected by the sector's NPL ratio, which stood at 9.9% - lower than the 11.9% at the onset of the pandemic. IHS Markit projects the NPL ratio to start increasing gradually in 2022, as some of the restructured loans materialise into NPLs amid rising inflation because of the Russia-Ukraine conflict. In April, Banco de Moçambique increased its policy rate by 200 basis points, signalling tighter monetary policy to contain inflation, which is likely to further affect borrower's debt-service capacity and keep loan growth below potential. IHS Markit projects y/y loan growth of 2.4% in 2022 for Mozambique, versus loan growth of 16.3% y/y and 0.7% y/y in 2020 and 2021, respectively. The increase in loan growth will be mostly because of the startup of the floating liquefied natural gas Coral-South project during the second half of 2022.

Posted 05 July 2022 by Natasha McSwiggan, Senior Economist, Banking Risk, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.