Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Dec 12, 2022

Our banking risk experts provide insight into events impacting the financial sector in emerging markets in December

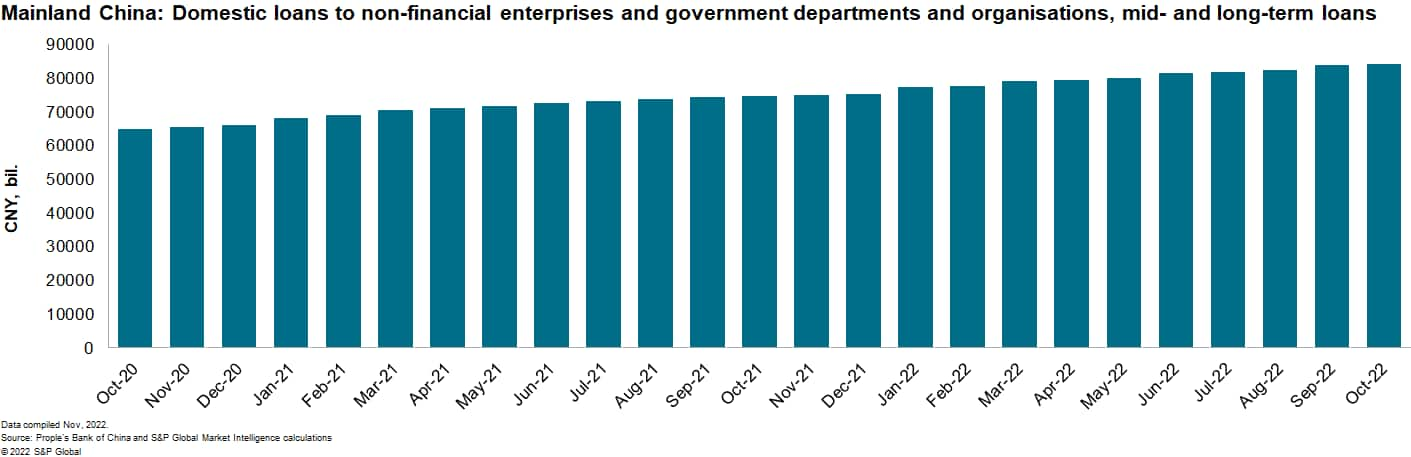

Only stronger banks are likely to extend lending to real estate companies.

In response to various plans to boost lending to real estate companies and the construction sector, larger banks have already immediately announced support. It is expected that at least the five largest banks, especially the largest four state-owned ones, will participate. Alternatively, these banks will likely be responsible for the bad loans should these real estate companies fail. However, weaker banks are unlikely to participate to the same extent due to their smaller sizes, and more importantly their tighter liquidity and also poorer asset quality.

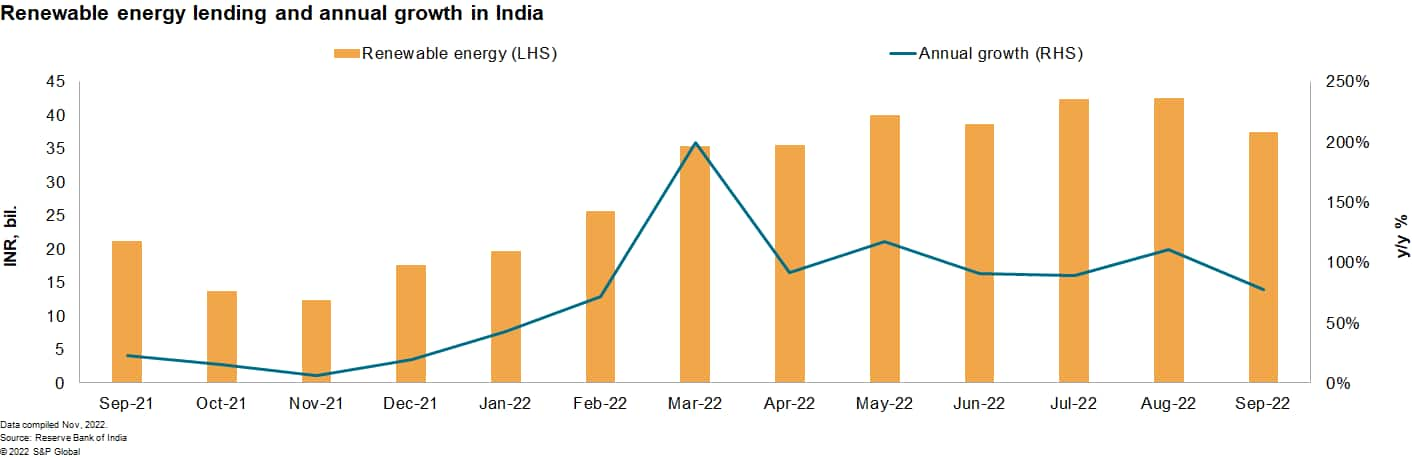

India's lending for renewable energy projects is likely to speed up because of efforts to push for domestic adoptions.

In India, banks have been required to lend 40% of their new loans to priority sectors for decades, and in 2019, the policy was revised to allow a doubling of lending limits to individual renewable-sector borrowers. This had led to renewable energy loans growing extremely quickly. Although oil prices have stabilized, the geopolitical situation regarding mainland China and the latter's continued strict COVID-19 policy will likely increase India's need to continue development of its renewable energy sector, which will continue to drive lending to the sector from a relatively low base. However, a fall in energy prices and the immaturity of the technology has the potential to increase loan non-payment in the sector.

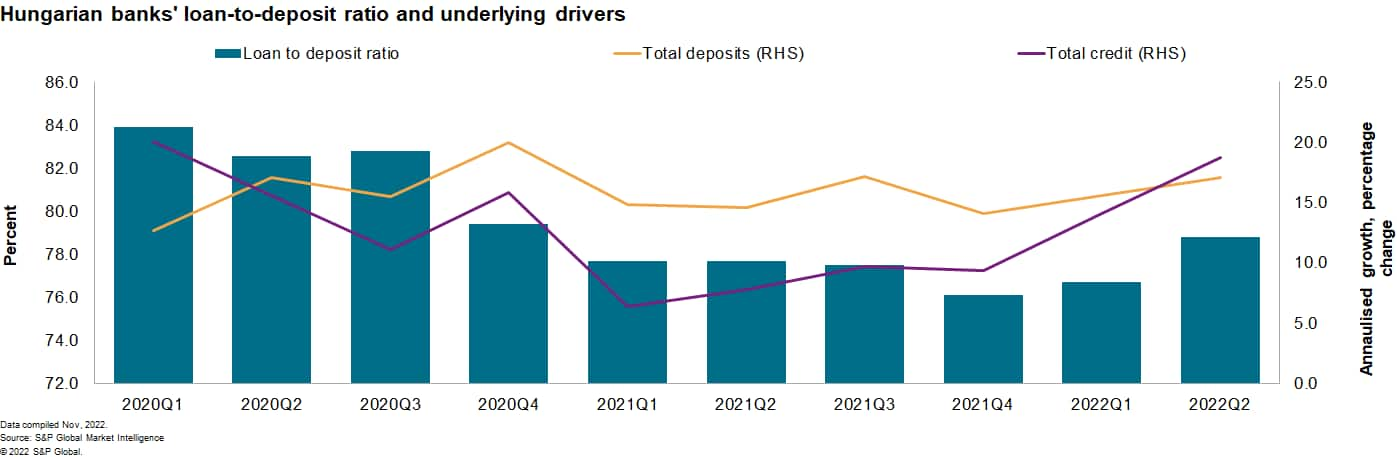

Vulnerabilities in the liquidity profile of Hungarian banks are likely to emerge as the government seeks to limit the rate of payable interest rates on large deposits until March 2023.

The December announcement by the Hungarian economic development minister is likely to generate vulnerabilities in banks' funding profiles. The average year-on-year growth rate in deposits has matched credit growth through the first half of 2022, with the latest move likely to subdue deposit mobilization, from which more than half of the sector's liabilities are derived. This in turn makes it likely that the sector's loan-to-deposit ratio will increase in the first quarter of 2023. Nonetheless, the sector's liquidity profile has benefited from term deposits, which make up more than half of total deposits. The latest move is likely to also weaken the expected compositional shift of deposits towards longer-maturity products to take advantage of the rate tightening cycle begun in 2021 by the Hungarian central bank.

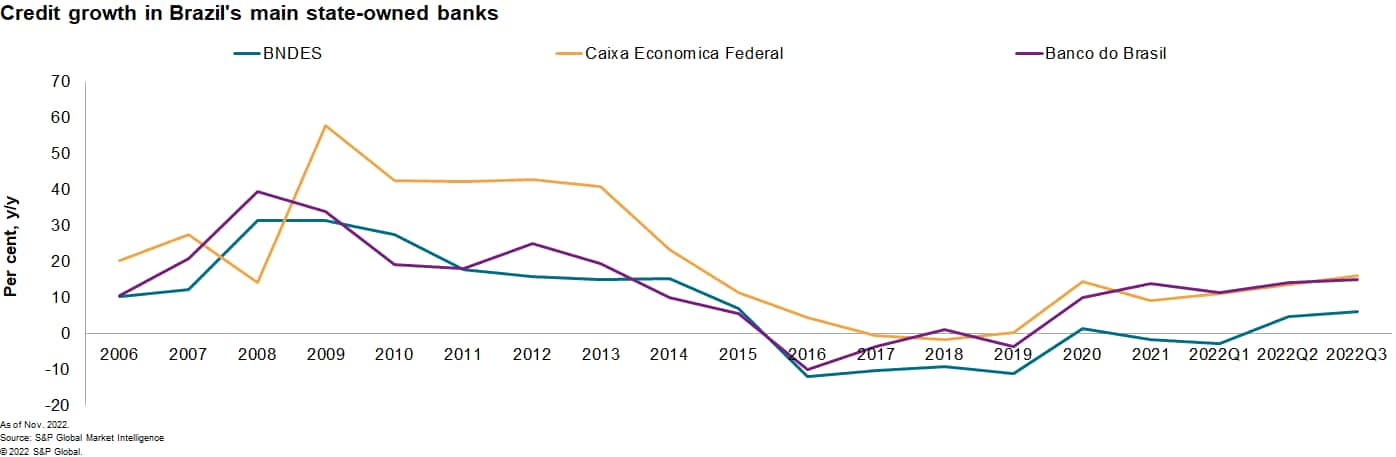

State-owned banks in Brazil are to slightly relax their risk controls but are unlikely to return to the looseness of the 2000s.

Luiz Inácio Lula de Silva, the president-elect of Brazil, will continue to announce his agenda for his presidency. During his previous mandate, he enabled the government to interfere in lending decisions through the sector's largest state-owned banks, such as Banco do Brasil, Caixa Economica Federal, and BNDES, leading to heightened levels of credit risk and banks increasing their reliance on state funding. Given that the country is in a much tighter fiscal condition than in the past, and that there is more Congressional opposition to Lula's party, it is unlikely that the entirety of past practices -especially the use of government borrowing as a financing method for state-owned banks - will be reintroduced. However, given that the president will retain the capacity to choose the CEOs of state-owned banks, it is likely that there will be some moderate changes in Brazilian regulations for banks, with more refinanced credits and higher levels of subsidized loans.

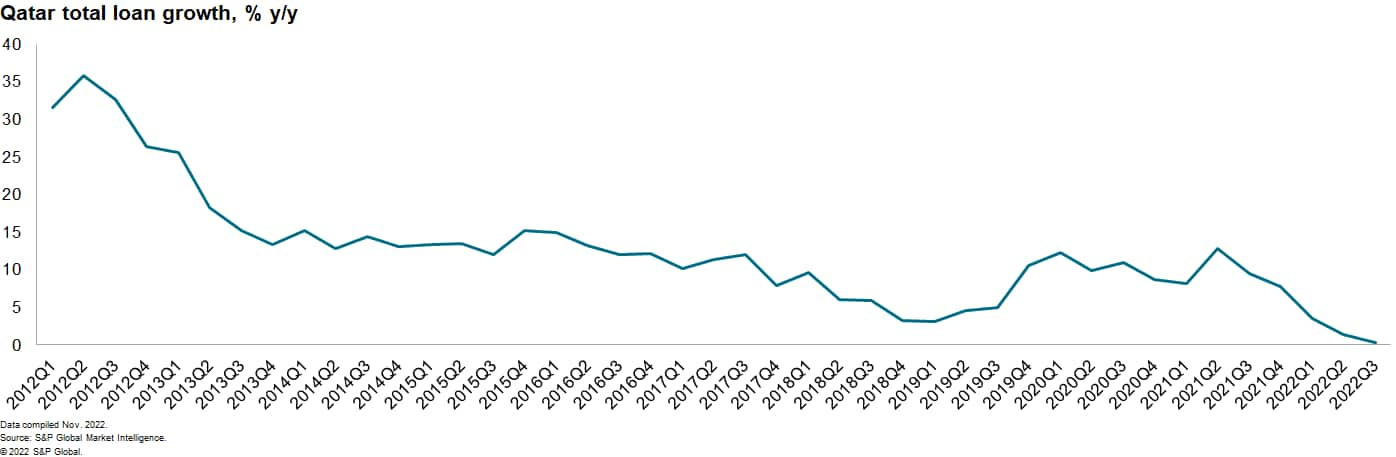

Post-World Cup credit growth is likely to slow initially as the construction sector cools in Qatar.

Several construction projects on pause during the FIFA World Cup will resume following its conclusion on 18 December, providing a boost to construction sector activity, but overall we expect infrastructure spending to decelerate markedly relative to the pre-World Cup period. This will translate into much slower credit growth in Qatar's banking sector over the next few months as public sector corporations in particular pay down debt and an outflow of non-resident deposits reduces liquidity. Full-year figures for 2022 are expected to yield the slowest rate of expansion in the banking sector in more than a decade, with deleveraging possible this year should deposit outflows continue. We expect this slowdown to be temporary, however, as an expected massive expansion of gas production capacity in the North Field should boost economic activity and demand for credit through 2026.

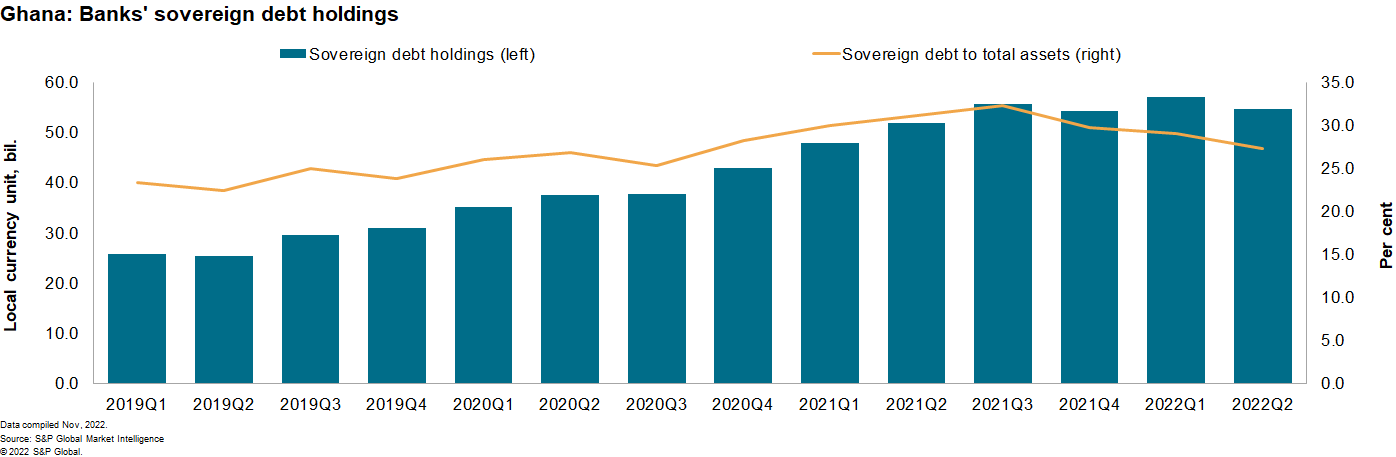

Developments related to Ghana's debt restructuring are likely to negatively affect stability in the banking sector.

Local media have reported that the Ghanaian government has agreed on a debt management strategy with the IMF. On 24 December, Deputy Minister of Finance John Kumah indicated through a radio interview that international debt bondholders would be asked to accept a 30% capital haircut and a three-year interest grace period. Domestic bondholders will also be subjected to a haircut, albeit less severe, with a one-year interest holiday and a reduced coupon of 5% in the second year, increasing to 10% in the third year. The reports are contradictory to the president's pledge in October 2022 that no haircuts would be sought domestically. Ghanaian banks hold about one-third of total assets as sovereign debt holdings, and thus a domestic debt restructuring could potentially trigger significant financial instability, potentially causing banks to require government support.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.