Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 08, 2022

Our banking risk experts provide insight into events impacting the financial sector in emerging markets in August. HIghlights:

State-owned Bangladesh banks likely to continue having provisioning shortfall.

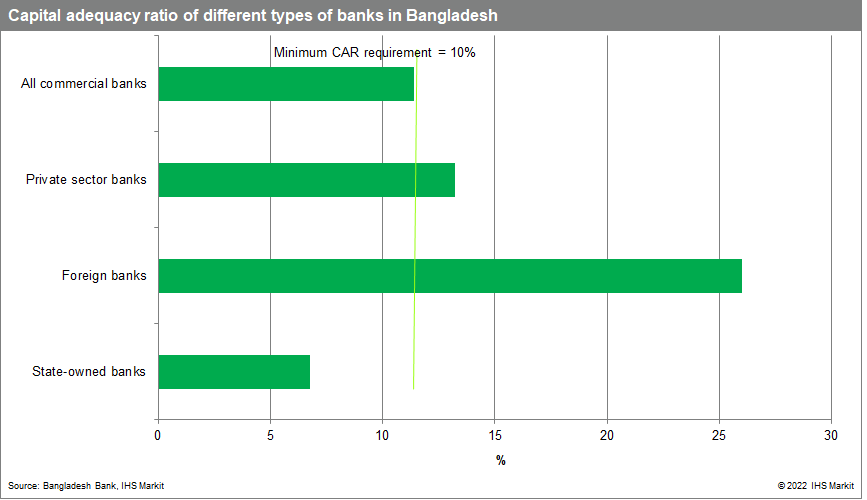

Bangladesh government has sought a USD4.5 billion loan from the IMF to support its budget and current account deficit. This will suggest that capital injection into state-owned banks will not be forthcoming in 2022 at the very least. State-owned banks in Bangladesh already have a lower-than-required level of capital adequacy ratio at 6.8% in March 2022, and an increasing shortfall in bad loan provisioning. Going forward, over the next several months, IHS Markit expects credit growth to slow down due to worsening asset quality in Bangladesh banks, especially state-owned ones due to particularly poor credit standards in the past.

High energy prices likely lead to worsening asset quality at Pakistan.

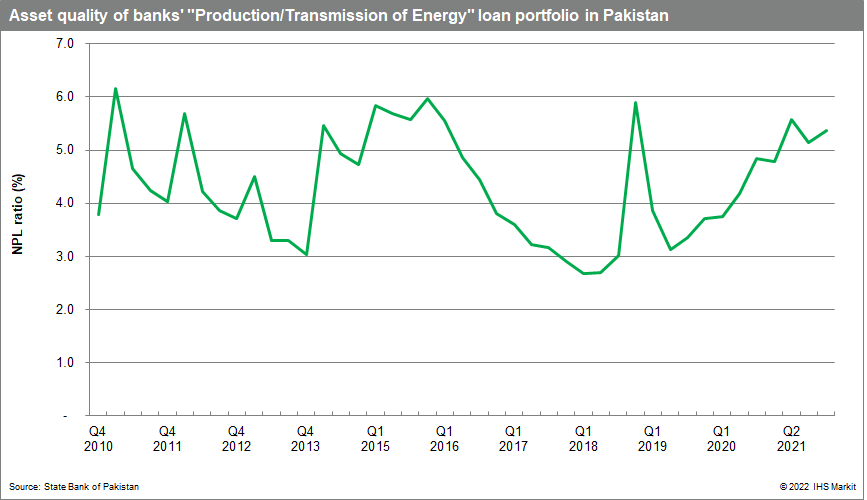

Pakistani energy production and transmission companies have historically required government subsidy to survive due to state-installed price cap on oil and gas prices. Although these maximum prices have been allowed to rise by between 20% and 45% in June and July, the government has continued to require IMF support (with the latest injection in July 2022). The rise in energy prices will likely impact on these energy companies' ability to repay bank loans, impacting on asset quality.

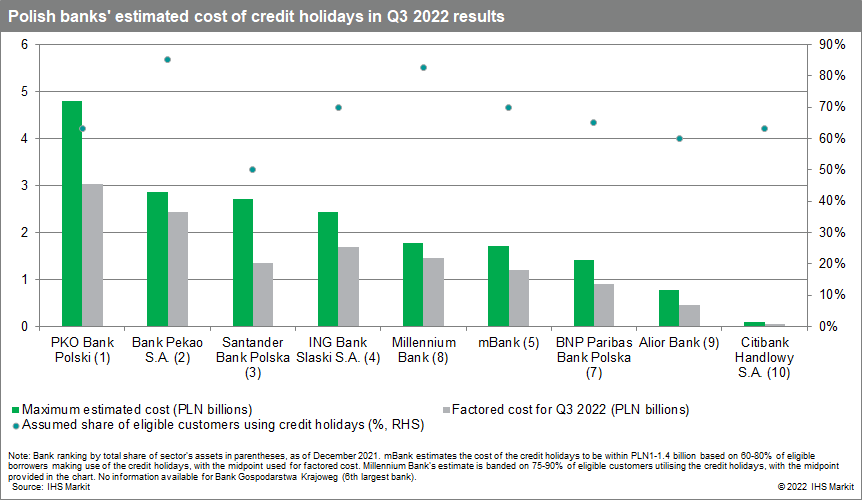

Polish banks foresee large one-off costs from credit holidays, dampening profitability into the third quarter of 2022 and raising risk to capital buffers.

The Polish parliament ratified the implementation of borrower support measures given rising cost pressures on households in mid-July. Subsequently, Polish banks announced the estimated costs from eligible mortgage loan borrowers opting to suspend mortgage repayments, which is possible for up to four months in the second half of 2022 and for a further four over the course of 2023. Large costs are anticipated to be a one-off given the un-nuanced approach to credit holidays that make all borrowers with domestic-currency mortgage loans eligible. Third quarter financial results are expected to hit negative territory, not seen for some banks since the Global Financial Crisis; with IHS Markit estimating that for the ten largest banks (excluding Bank Gospodarstwa Krajowego), costs are likely to range between 6.9% to 10.1% of shareholders' equity, based on June 2022 data. However, the Polish sector does exhibit sufficient buffers with a capital adequacy ratio of 18.5% and a regulatory Tier 1 capital ratio of 16.6% in March 2022, although some banks, such as Bank Millennium, are expected to fare worse and temporarily dip below minimum capital requirements.

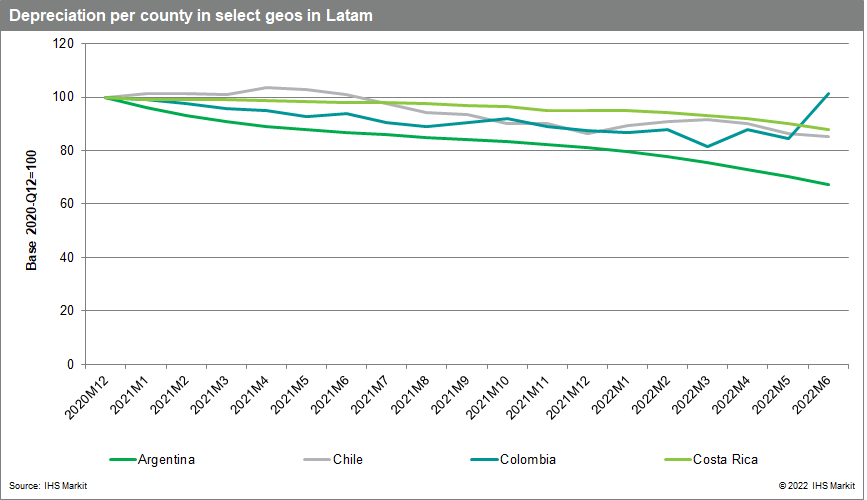

Exchange rate depreciations affecting direct and indirect foreign exchange risks in Argentina, Chile and Costa Rica.

Increased political uncertainty (and sovereign distress in the case of Argentina) led to a significant depreciation of the exchange rates of Argentina, Chile, Colombia and Costa Rica. In the case of Chile and Colombia, foreign exchange risks are limited given the low dollarization in these countries (and also, in Colombia there has been a recovery in the exchange rate over the last month). However, Costa Rican borrowers with dollarized debt were already significantly distressed; this depreciation increases the likelihood of higher impairment over the rest of the year in the country. Perhaps the most affected country is Argentina, where it is likely that the depreciation is even higher, given that the black-market rate is well below the official one. So far, foreign exchange risks are limited in this nation given low credit dollarization and the large holding of foreign exchange reserves for dollar deposits; however, a weakened central bank increases the likelihood of the use of banks' reserves as funds to stabilize the currency.

Gulf leaders in the fintech space could seek to tighten regulations as sector grows in importance.

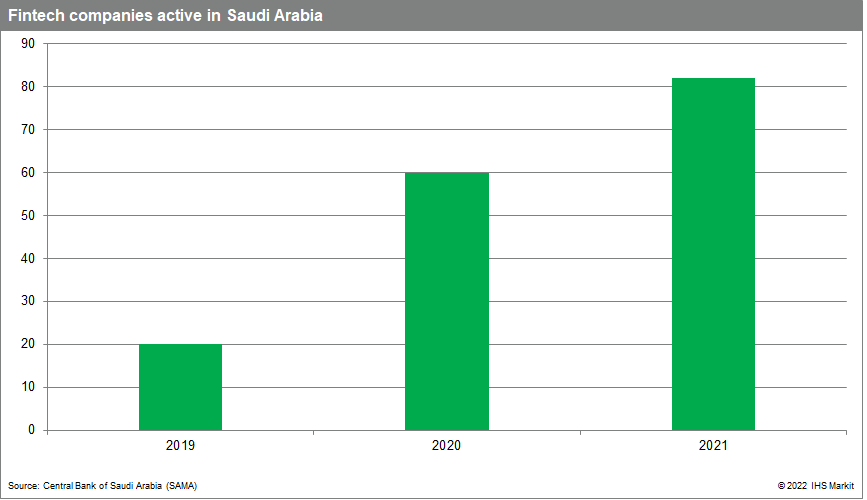

Saudi Arabia, the UAE, Bahrain, and Qatar - markets that have been most active regionally in attracting new companies operating in the fintech space - are expected to maintain a conservative approach to regulating the nascent sector even as they compete against one another to attract new capital and technology. Saudi Arabia, for example, which has seen very fast growth in the number of registered companies since launching FinTech Saudi in 2018, could seek to better define paid-up capital and other macroprudential requirements in order to provide more clarity to potential entrants while keeping regulatory burdens low enough to encourage growth. Unlike in the UAE, where digital banks are required to partner with existing commercial banks, facilitating their growth, Saudi Arabian banks have so far been slow to partner in the fintech space. We expect Saudi banks to wade into this space this year as they seek ways to boost funding to maintain credit growth.

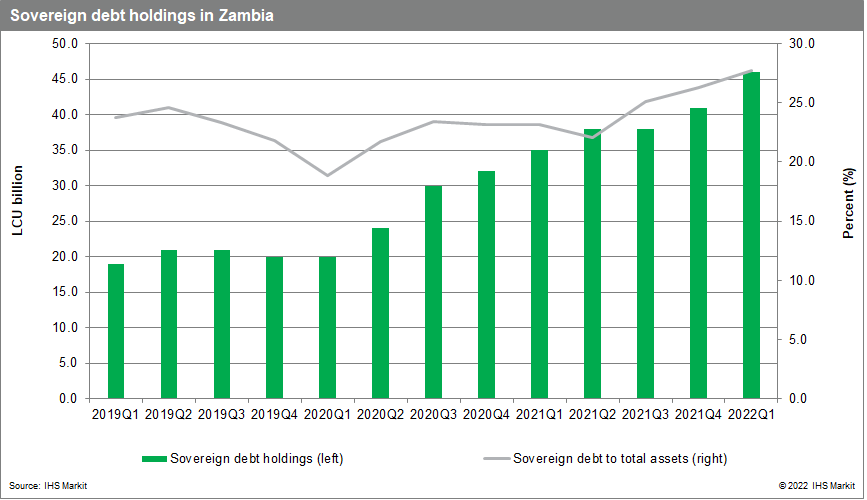

Zambia's creditors are expected to commit to debt relief required to secure funding from the IMF, likely to reduce reliance on commercial bank's funding.

Zambia's bilateral creditors are expected to release a statement advising the exact amount to be provided as debt relief, a necessary step to pave the way for Zambia to secure a USD1.4 billion credit facility with the International Monetary Fund (IMF). Access to the IMF credit facility will bridge some of the government's funding requirement for 2022, thus easing pressure on commercial banks to purchase additional government debt, which crowds out private-sector lending. In addition, the debt restructuring will improve Zambia's debt sustainability, which will in turn help bank's asset quality, given that part of the banking sector's NPLs are as a result of government arrears.

Posted 08 August 2022 by Natasha McSwiggan, Senior Economist, Banking Risk, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.