Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 23 Aug, 2023

By David Hayes

Bankers are paying up to keep deposits and expect to continue relying on deposit rate specials, according to S&P Global Market Intelligence's latest 2023 US Bank Outlook Survey.

* Less than half of respondents believe that deposits will increase at their organization over the next 12 months, the lowest percentage reported on S&P Global Market Intelligence's most recent US Bank Outlook Surveys.

* Seventy-two percent of respondents said their institution increased the use of deposit rate specials over the last 12 months.

* Almost 37% of respondents believe that over the next 12 months their organization will increase their usage of products that allow deposits to be structured for insurance across multiple banks.

Banks still hopeful on deposits, but sentiment slides

S&P Global Market Intelligence surveys conducted between June 7 and July 7 found that 47.3% of US banking executives project deposits to increase at their institution over the next 12 months, down from 53.1% in the first-quarter survey and 51.1% in the fourth-quarter 2022 survey. The most bullish responses, those executives expecting deposit growth of 5% or more, fell to 7.3% of respondents, down from 11.6% and 13.5% in the previous two surveys, respectively.

The proportion of respondents expecting deposits to remain the same at their institution increased to 20.7%, up from about 16% in the first quarter and 12% in the fourth quarter of 2022.

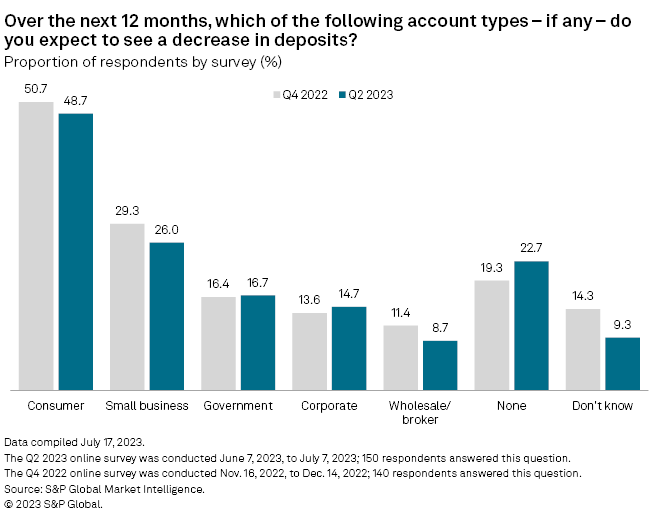

The sentiment among survey participants for which types of deposit accounts would see declines remained largely unchanged in the most recent survey compared to the 2022 fourth-quarter survey. Roughly half of respondents, 48.7%, expected to see consumer deposits drop at their organization over the next 12 months. Similarly, 26.0% of respondents expected small business deposits to decline at their institution, down from 29.3% in the fourth quarter, but within the margin of error for the survey.

Two-thirds of respondents project they will hold on to or even grow uninsured deposits

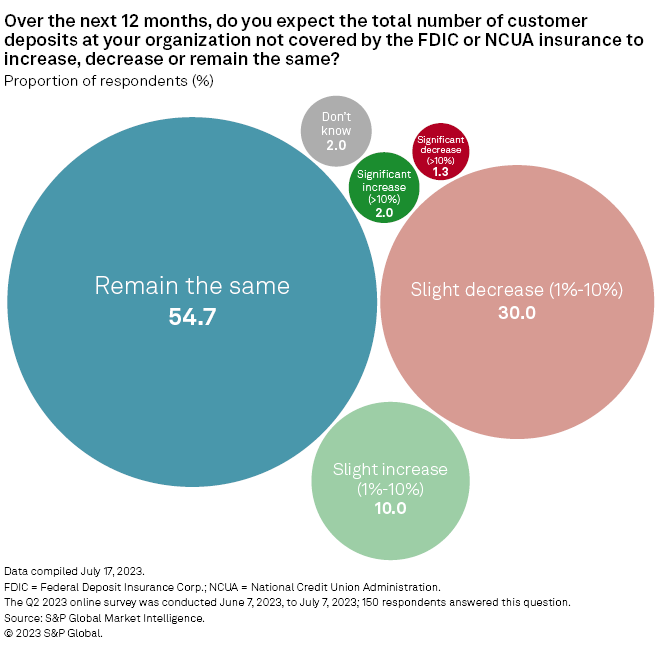

About 66.7% of respondents expect uninsured deposits at their institution to remain flat or even increase over the next 12 months, even as the industry as a whole has reported declines in uninsured deposits over the last several quarters.

Meanwhile, 30.0% of respondents expected that uninsured deposits at their institution would register relatively slight declines of less than 10% over the next 12 months. Just 1.3% of respondents believed their institution would see uninsured deposit outflows of 10% or more.

Yet, the exact amount of uninsured deposits held at banks is murky as several banks have restated the amount of uninsured deposits previously given in their call reports. In late July, the Federal Deposit Insurance Corporation issued a statement that called for call report amendments from banks that had "incorrectly reduced" reported uninsured deposits by omitting intercompany deposits or deposits collateralized by pledged assets.

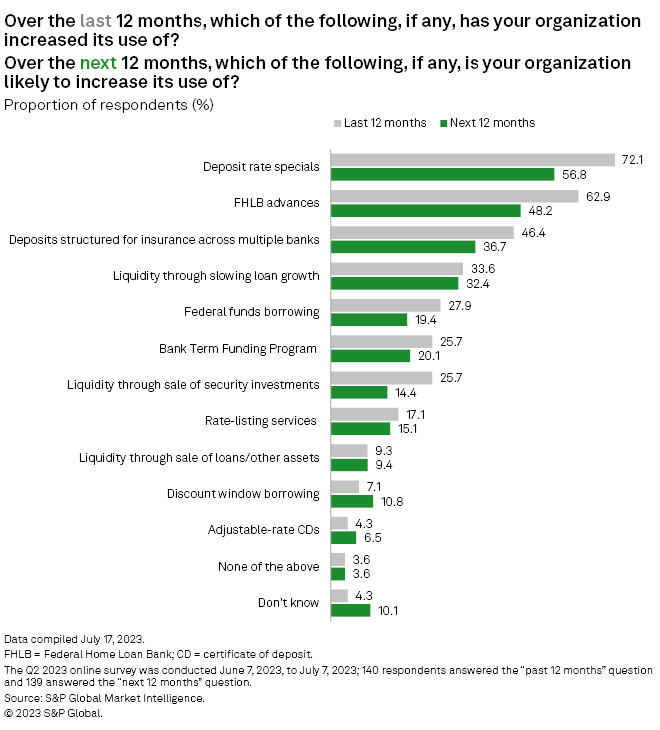

Banks to continue focus on maintaining liquidity

Almost three-quarters of respondents, 72.1%, said that their organization had increased its use of deposit rate specials over the last 12 months, the highest percentage of any of the 11 options given for the question on liquidity and deposit sources. Over half of respondents, 56.8%, also projected that their institution would increase its usage of deposit rate specials over the next 12 months, which was also the highest percentage among all options given.

Just shy of 63% of respondents stated that their institution had increased its usage of advances from the Federal Home Loan Bank system over the last 12 months and 48.2% of respondents expected their institution would expand usage of FHLB advances over the next 12 months.

"Deposits structured for insurance across multiple banks" was the third-most common choice for survey participants, with 46.4% of participants saying their institution had increased usage of this option over the last 12 months and 36.7% of participants expecting their institution will increase usage of this kind of product over the next 12 months.

Deposit stress testing

As the prospect of deposit runs became very real earlier this year, ensuring access to adequate liquidity took on greater prominence. On July 28, the FDIC, the Federal Reserve, the Office of the Comptroller of the Currency and the National Credit Union Administration urged banks to update their contingency funding plans more frequently as market conditions change, noting that "the events of the first half of 2023 have further underscored the importance of liquidity risk management and contingency funding planning."

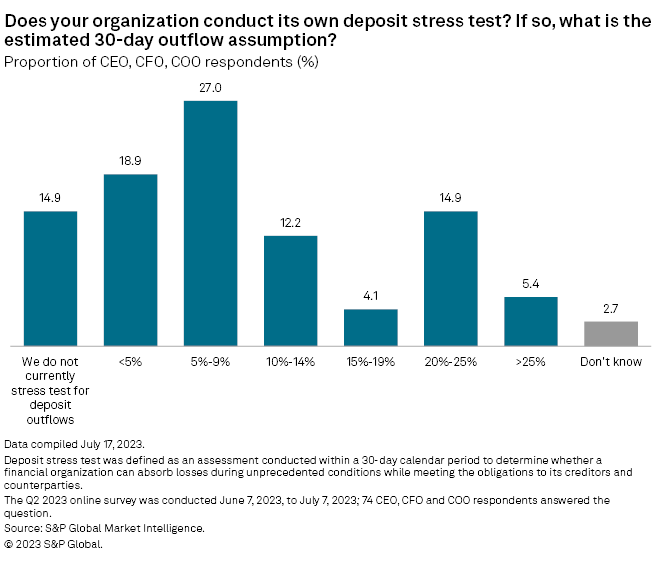

Stress testing for deposit outflows could be one way that banks preemptively plan for finding additional funding in light of unexpected withdrawals, but awareness of "deposit stress testing" was varied among survey respondents.

Among the 143 respondents that answered the question, almost one-fifth, 19.6%, did not know if their institution currently conducted deposit stress tests. After limiting the responses to just the 74 CEO, CFO or COO participants, only 2.7% of respondents did not know if their institution conducted a deposit stress test, but 14.9% of respondents said their institution did not conduct deposit stress tests. Among those companies that did conduct a stress test, the most common 30-day outflow assumption was 5% to 9% of deposits.

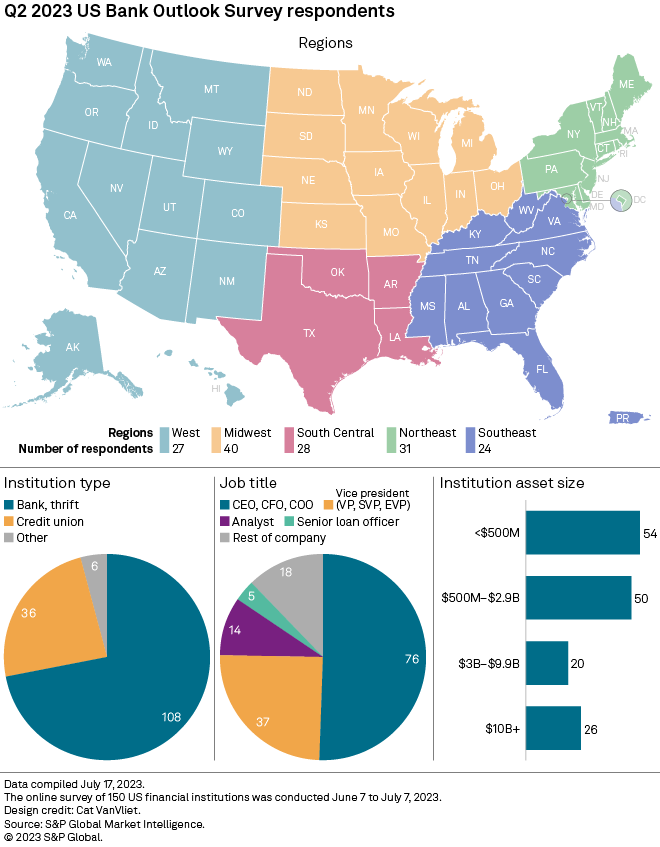

S&P Global Market Intelligence surveyed 150 US financial institution clients on various topics including expected loan and deposit growth, projected interest rates and liquidity trends. Of the 150 participants, 108 worked for commercial banks or thrifts, 36 for credit unions and six for other US institutions.

The online survey was conducted between June 7, 2023, and July 7, 2023.

The margin of error for topline statistics is +/- 8 points at the 95% confidence level.

If you would like to participate in future US banking surveys, please contact david.hayes@spglobal.com.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.