Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 18 Aug, 2021

Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn >

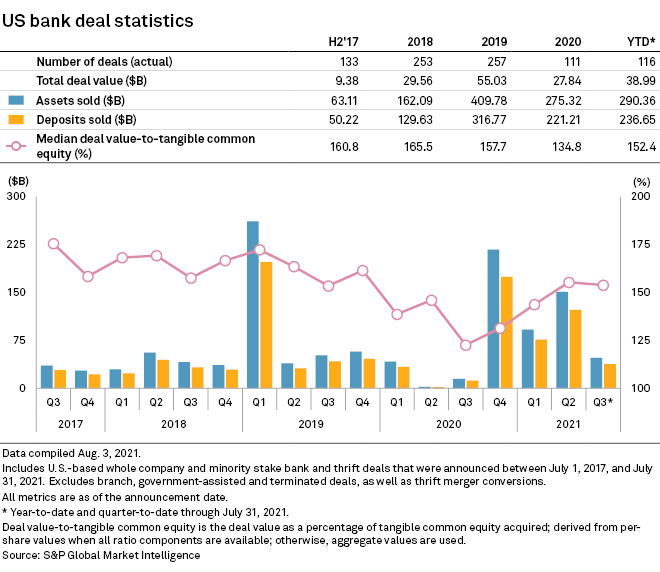

In this edition, we take a closer look at the rebound of bank M&A in the U.S. as deal activity continued to climb back to pre-pandemic levels. Over just the first seven months of this year, banks have announced 116 deals, compared with 111 over all of 2020. Credit unions also remain on the hunt for U.S. bank acquisitions as they use secondary capital to expand their deal capacity. However, the deal-making process for smaller banks could be delayed and blocked in certain circumstances as President Biden seeks to implement a plan for the revitalization of merger oversight, according to lawyers and experts.

The Federal Reserve is facing growing criticism as a substantial market disruptor after more than doubling its asset holdings over the last two years to above $8 trillion. Economists warned that the Fed's holdings and continued $120 billion per month in securities purchases are upsetting markets — sending stock valuations to new highs, pushing down yields and reducing credit discipline — and the central bank needs to look at cutting its stockpile.

Venture capital transaction activity was high in sectors such as e-commerce, automotive and internet software and services as investors deployed roughly $306.98 billion in the first half, up 150.5% from about $122.55 billion in the same period in 2020. Continuing the strong momentum recorded in the first half, startups globally racked up roughly $63.12 billion across 1,598 funding rounds in July.

Small banks may face M&A delays, other obstacles under new Biden order

The Biden administration's new executive order targeting M&A activity could slow the deal-making process for smaller banks and halt deals in some cases, according to M&A experts.

— Read the full article from S&P Global Market Intelligence

Armed with secondary capital, more credit unions aim to buy banks

Alabama CU, which plans to acquire Security Federal Savings Bank, recently funded $30 million in secondary capital to fund more potential deals.

— Read the full article from S&P Global Market Intelligence

Bank M&A 2021 Deal Tracker: 19 deals announced in July

U.S. banks announced 116 deals over the first seven months of 2021.

— Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

New anti-redlining rule effort must answer 2 key questions, stakeholders say

What matters more, the amount a bank lends or the quantity and quality of its loans? And is a bank's physical location more important than its digital footprint?

— Read the full article from S&P Global Market Intelligence

Citizens adds $29B NYC deposits in 3 months

Citizens Financial Group's pair of deals in the New York City metro area will give it a top 10 deposit market share with more than $30 billion in deposits and put it in direct competition with heavyweights like JPMorgan Chase.

— Read the full article from S&P Global Market Intelligence

Banks keep plowing into bonds as liquidity surge continues

Despite a sharp drop in long-term yields, a pileup of deposits that doesn't look likely to ease anytime soon is continuing to swell banks' securities portfolios.

— Read the full article from S&P Global Market Intelligence

European banks exit payment businesses as specialists show that big is best

European banks are increasingly selling off payments assets, ranging from merchant acquiring businesses to ATM networks. Rather than private equity firms, payments giants such as Worldline, Global Payments and Nexi have emerged as dominant buyers.

— Read the full article from S&P Global Market Intelligence

Insurance

Insurance Insight: Texas private auto rate filing tussle pits consumer advocate against insurers

The Office of Public Insurance Counsel's objections to pandemic-era requests for rate increases by private auto insurers hit a crescendo with its accusation that Progressive is seeking to raise rates by an "excessive" amount.

— Read the full article from S&P Global Market Intelligence

Credit and Markets

Economists warn of market disruption as Fed balance sheet surpasses $8 trillion

The Fed needs to normalize its bond holdings as its massive balance sheet upends yields and increases asset prices, S&P Global Ratings' top economist warns.

— Read the full article from S&P Global Market Intelligence

US jobs growth lacking; inflation pressure may last into 2022 – SF Fed official

The pandemic set U.S. employment trends back roughly two decades, said Sylvain Leduc, executive vice president and director of research of the Federal Reserve Bank of San Francisco, during the latest episode of Market Intelligence Live.

— Read the full article from S&P Global Market Intelligence

Energy and Utilities

Building gas ban debate reaches Capitol Hill amid infrastructure, spending push

Democrats signaled they would more explicitly support building electrification after the bipartisan Senate infrastructure bill took a relatively fuel-neutral approach to building decarbonization and energy efficiency.

— Read the full article from S&P Global Market Intelligence

How Snam's CEO wants to turn a major pipeline company into a hydrogen powerhouse

Marco Alverà won broad recognition for his advocacy of hydrogen and efforts to turn Snam, Europe's largest natural gas transmission company, into a model for the energy transition.

— Read the full article from S&P Global Market Intelligence

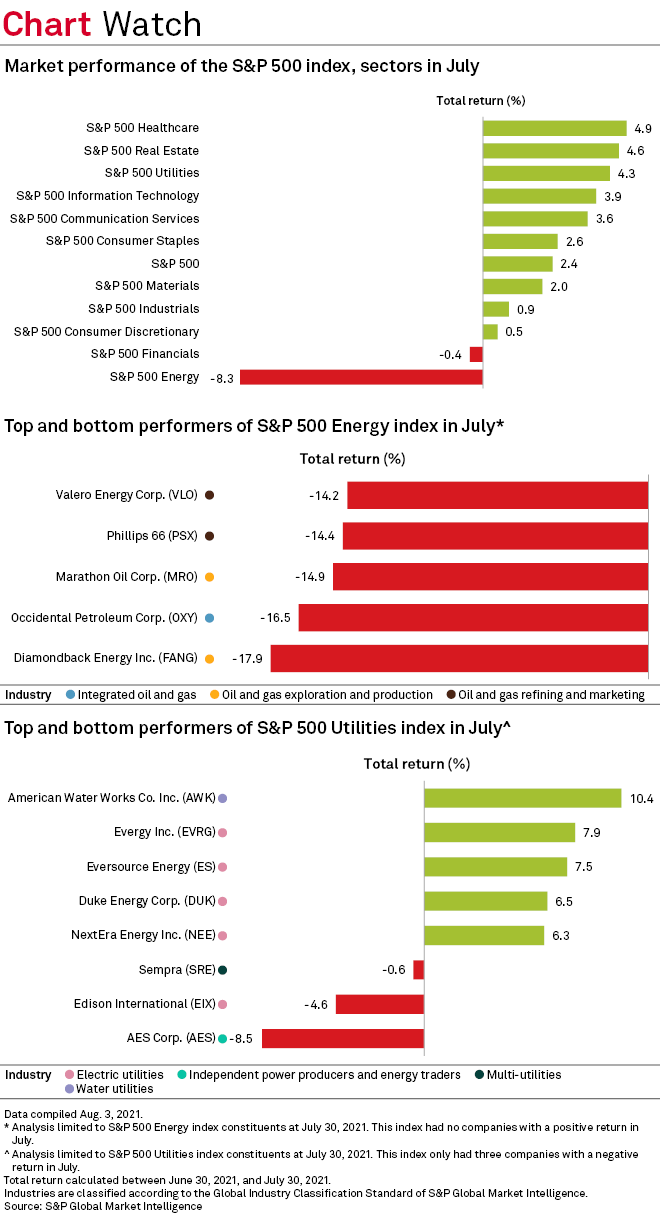

Energy stocks nosedive in July amid OPEC agreement, COVID-19 resurgence

The S&P 500 Energy slumped 8.3%, the worst performer of the S&P 500 key sectors in July. Meanwhile, S&P 500 Utilities saw an increase of 4.3%, outpacing the broader S&P 500 index which gained 2.4%.

— Read the full article from S&P Global Market Intelligence

Fintech

Power-guzzling crypto miners racing to find cheaper energy sources

The U.S. has become the world's second-largest market for miners of bitcoin and other digital currencies as states roll out financial incentives and energy companies discover a new revenue source.

— Read the full article from S&P Global Market Intelligence

Square pays up for Afterpay but price is justified, analysts say

The deal values Afterpay at 29.3x next-12-months revenue, an elevated price that is a sign Square sees a huge market opportunity for buy now, pay later going forward.

— Read the full article from S&P Global Market Intelligence

Healthcare

Healthcare IPOs accelerate in Q2'21, raising almost $2B more than Q1'21

The $15.64 billion raised in the second quarter brought total valuation for the first half of the year to $28.8 billion, surpassing the level seen at the midpoint of 2020.

— Read the full article from S&P Global Market Intelligence

Healthcare's SPAC craze has cooled but blank-check model is 'here to stay'

After their meteoric rise in 2020, special purpose acquisition companies continue to be a popular exit vehicle for healthcare companies halfway through 2021.

— Read the full article from S&P Global Market Intelligence

Private Equity

Walmart-owned Flipkart takes crown in July global VC funding rounds

Venture capital deployed globally soared 129.3% year over year to roughly $63.12 billion in July, building on the strong momentum recorded in the first half of 2021, according to S&P Global Market Intelligence data.

— Read the full article from S&P Global Market Intelligence

Technology, Media and Telecommunications

T-Mobile's Sievert ranks as 2020's highest-paid US telecom CEO after Sprint deal

T-Mobile CEO Mike Sievert ranked as the highest-paid telecommunications CEO among U.S.-listed companies in 2020, buoyed by a large stock award as Sievert took the reins of the U.S. wireless carrier following its merger with Sprint.

— Read the full article from S&P Global Market Intelligence

Metals and Mining

Tesla looks upstream in hunt for EV battery-grade nickel

The manufacturer has been an outspoken proponent of increasing the availability of sustainably produced nickel for its electric vehicle batteries and recently decided to go directly to the source for the metal.

— Read the full article from S&P Global Market Intelligence

The Week in M&A

Midstream approach to renewables takes shape as more firms announce investments

Read full article

Fresh out of bankruptcy, Chesapeake pursues $2.2B Haynesville acquisition

Read full article

Bayer seeks to unlock potential of precision medicines with $1.5B acquisition

Read full article

Prudential PLC CEO sees opportunities for 'hybrid inorganic' deals

Read full article

The Big Number

Trending

Read more on the S&P Global Market Intelligence and follow @zackhale on Twitter

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets.