Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 May, 2016 | 21:30

Highlights

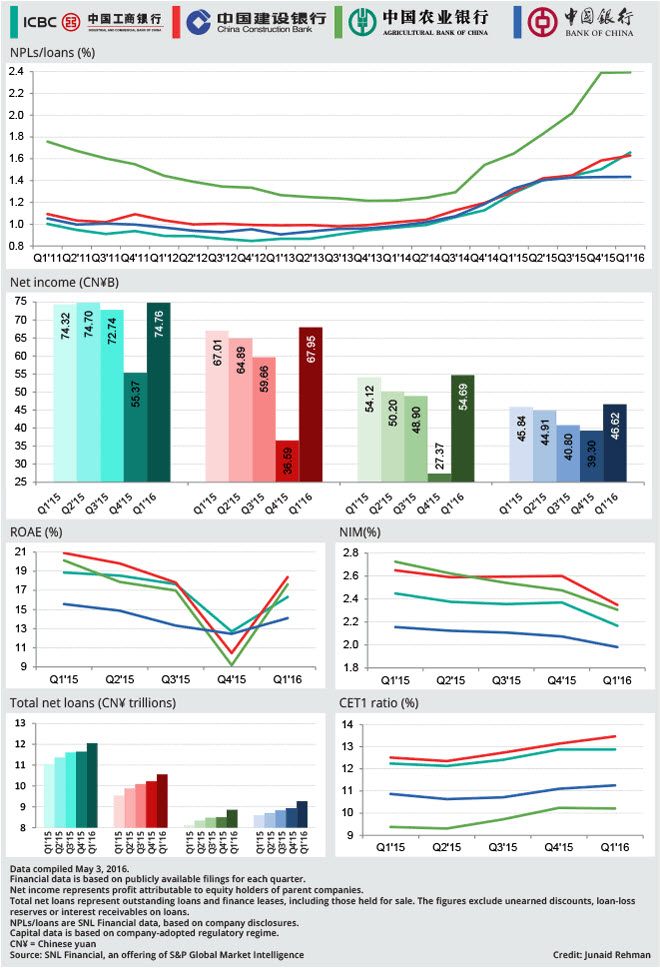

Non-performing loan ratios at Industrial & Commercial Bank of China Ltd., the largest Chinese bank by assets, and China Construction Bank Corp. rose at the end of March from three months earlier, when they were at multiyear highs, according to SNL Financial data. The gauge for Agricultural Bank of China Ltd. and Bank of China Ltd. held steady at levels not seen in years.

Net profit will likely fall at each of the four banks in 2016

First-quarter earnings at the four largest banks in China show an alarming trend of growing bad debt is probably here to stay, heightening the possibility that they are headed to their first annual profit decline in years in 2016.

Nonperforming loan ratios at Industrial & Commercial Bank of China Ltd., the largest Chinese bank by assets, and China Construction Bank Corp. rose at the end of March from three months earlier, when they were at multiyear highs, according to SNL Financial data. The gauge for Agricultural Bank of China Ltd. and Bank of China Ltd. held steady at levels not seen in years.

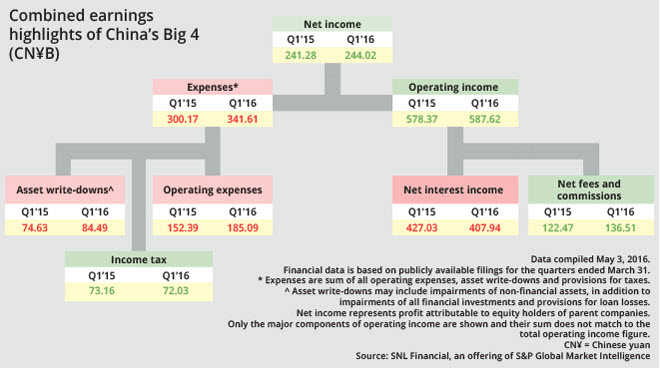

Combined asset write-downs at the four banks increased to 84.49 billion yuan in the quarter ended March 31 from a year earlier.

An acceleration of NPL formation has emerged as a key challenge for Chinese banks, as the country's economic growth slows. Asset quality at Chinese lenders will likely further weaken in 2016, S&P Global Ratings said in an April 8 report. The rating agency expects the industry-wide NPL ratio in China to hit 3.1% by the end of 2016, rising from 2.2% a year earlier and almost doubling from 1.6% at the end of 2014.

"The troubles for Chinese banks are unlikely to disappear in a hurry," S&P Global Ratings said.

Rising credit costs, combined with worsening interest margins, mean profit at big Chinese banks is on track for the first decline in 13 years in 2016, the rating agency said.

Aggregate net profit at the top four banks still edged up to 244.02 billion yuan in the first quarter from 241.28 billion yuan a year earlier, helped by growth in income from fees and commissions.

It remains to be seen how they will hold up for the rest of the year, though, as they face interest margin contraction following multiple central bank rate cuts, in addition to rising credit costs.

Net profit will likely fall at each of the four banks in 2016, according to analyst estimates compiled by S&P Capital IQ. Last time full-year profit fell at ICBC was 2004, while for China Construction Bank, an earnings decline in 2016 would be the first retreat since 2002 and for Bank of China, the first since 2003. Agricultural Bank of China last posted an annual profit fall in 2007.