Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Feb, 2017 | 11:00

By Tim Zawacki

Highlights

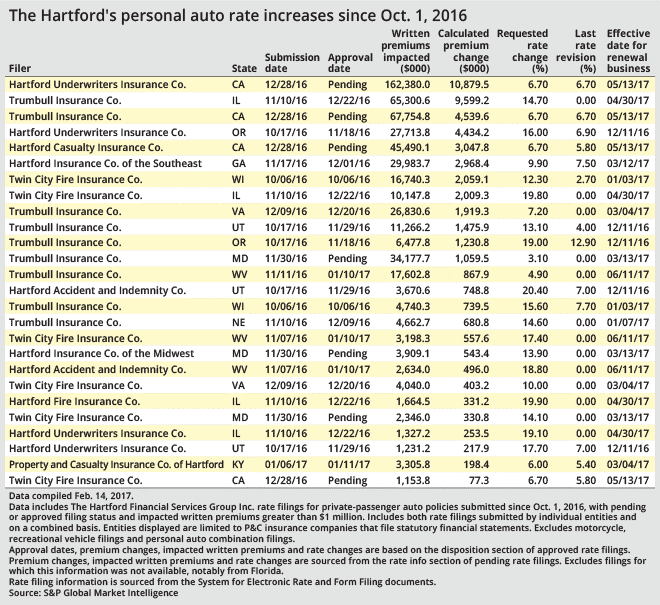

Rate filing data suggests an active response by The Hartford Financial Services Group Inc. to rising loss costs in the private-passenger auto business across a range of products and states.

Rate filing data suggests an active response by The Hartford Financial Services Group Inc. to rising loss costs in the private-passenger auto business across a range of products and states.

The Hartford reported a personal auto combined ratio of 118.1% and an underlying combined ratio of 113.6% during the fourth quarter of 2016, up from 103.5% and 102.9%, respectively, in the year-earlier period. It was the third consecutive quarter and the fourth quarter in the last five in which the underlying combined ratio, which excludes the impact of current accident-year catastrophes and prior-year reserve development, topped 100%.

"We need to get our rate adequacies back to a better state, [and] we feel like we're doing all that we can to make that happen," said Douglas Elliot, president of The Hartford, speaking February 15 during an investor conference.

S&P Global Market Intelligence received numerous filings by The Hartford's U.S. property and casualty subsidiaries that had been submitted to various state regulators between October 2016 and January 2017 for private-passenger auto rate increases. The list of filings includes at least 23 instances in which individual entities sought overall rate hikes of 10% or more on books of business ranging in size from less than $100,000 to as much as $65.3 million as measured by annualized written premiums in nine states. Several of the filings include requests by multiple subsidiaries of The Hartford for rate increases within the same filing.

In one such scenario, three individual entities — Hartford Fire Insurance Co., Hartford Underwriters Insurance Co. and Trumbull Insurance Co. — filed in Illinois for overall rate increases of between 14.7% and 19.9%, or 15% on a combined basis, for business written under The Hartford's Open Road Advantage Private Passenger Auto plan. The increases are scheduled to take effect for renewals effective April 30. A fourth subsidiary, Twin City Fire Insurance Co., separately filed for a 19.8% increase on its Illinois Open Road Advantage business. The combined filing appeared to pertain to business written directly, while the Twin City Fire filing referenced the agency channel.

The most impactful private-passenger auto rate increase filed by The Hartford as measured by the prospective change in annualized written premiums, involved a mid-single-digit increase on a larger book of business.

Hartford Underwriters and Trumbull submitted a combined filing in California for a 6.7% overall rate increase on an AARP program that had $230.1 million in annualized written premiums. The Hartford Underwriters portion of the book had $162.4 million in annualized written premiums. The companies had previously raised rates in California by 6.3% and 6.7% in filings disposed by the California Department of Insurance in December 2015 and August 2016. The latest filing would take effect for renewal business on May 13.

Twin City Fire and Hartford Casualty Insurance Co. submitted a separate combined filing for their own 6.7% overall rate increases on California books of business with annualized written premiums of $46.6 million.

The Hartford Chairman and CEO Christopher Swift said during the February 15 conference that "something snapped in a material way" during the second half of 2015 in the company's personal auto business, but it is only recently that the magnitude of changes in claims frequency and severity became apparent.

"All I can tell you is that each quarter ... we try to make our best calls [based on] the data we're seeing at that time, understanding the environment we were working in," Swift said. "But clearly we didn't get it quite right, and we've gone back and looked at a number of our processes and opportunities. ... We have areas where we could continue to get better."

Swift said the company brought in third parties to see how its internal processes might have contributed to the delayed realization of emerging trends. He identified the rollout of a new claims system on a nationwide basis in early 2015 as possibly having contributed to more "disruption in some of our data patterns" than The Hartford had initially realized.

Regarding the rate increases on in-force business, particularly the business produced through The Hartford's strategic relationship with AARP, Swift said the association is aware of the company's need to "get ... profitability right," and they have been "very supportive and constructive." The AARP policies generally have 12-month terms, and Swift said The Hartford is seeking to pursue rate actions "in a way that doesn't shock your existing in-force too much."

He pointed to the independent agency channel as the area in which The Hartford is pursuing the most remediation as it seeks to "aggressively" shrink the top line of the business and to raise rates.

"But we will fix this," he pledged. "You will see improvement in 2017."