Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Jul, 2016 | 10:00

Highlights

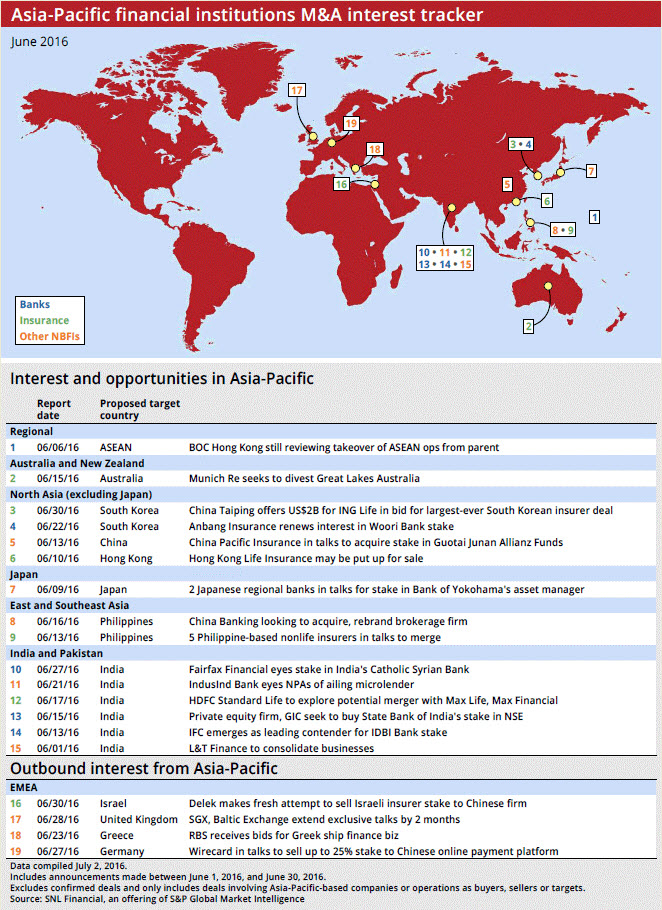

Chinese firms drove deal talks in June as they continued to actively look for overseas acquisitions, with Anbang Insurance Group Co. leading the charge as it targeted more deals in South Korea.

Editor's note: This tracker covers possible deals reported by media across the Asia-Pacific region over a certain period. The information is gathered from various news sources, excludes confirmed deals and is limited to potential acquisitions or sales involving companies or operations in the region. Click here to read the previous month's article.

Chinese firms drove deal talks in June as they continued to actively look for overseas acquisitions, with Anbang Insurance Group Co. leading the charge as it targeted more deals in South Korea.

Anbang is reportedly participating in the first round of bidding for Seoul-based ING Life Insurance Korea Ltd. and is said to be interested in a stake in Woori Bank. Other Chinese firms ventured further afield with potential deals for an Israeli insurer and a German payment processing firm.

Click here to download the above infographic as a PDF. At the end of this blog post is a list of June reports about possible deals compiled by S&P Global Market Intelligence.

Anbang, which has been on an acquisition spree in recent years, is joining other Chinese insurers in bidding for ING Life in what could potentially be the largest-ever deal for a South Korean insurer. MBK Partners Ltd., a South Korean private equity firm that acquired ING Life in 2013, values the business at around 5 trillion won, a person with direct knowledge of the matter told S&P Global Market Intelligence in a July 1 report.

China Taiping Insurance Group Ltd. has offered about 2.5 trillion won for the whole of ING Life. Other Chinese firms said to have submitted first-round bids are China Life Insurance (Group) Co., JD Capital Co. Ltd. and Ping An Insurance (Group) Co. of China Ltd.

Chinese insurers are looking at overseas acquisitions as domestic challenges are forcing them to seek higher-return assets. Local stock prices have been sliding and yields on debt holdings have also been in decline.

Anbang has certainly been one of the most active Chinese firms in recent years in overseas acquisitions. It has been involved in several high-profile real estate deals, most recently in its failed bid to acquire U.S.-based Starwood Hotels & Resorts Worldwide Inc. But Anbang has also increasingly focused on South Korea, with an agreement in place to acquire Allianz Group's life insurance operations in the country and an acquisition of a majority stake in TONGYANG Life Insurance Co. Ltd. in 2015.

The insurance group is not limiting its acquisitive eye to South Korean insurers. It is also interested in buying a stake in Woori Bank from the government, Reuters reported June 22.

Anbang had previously failed to buy a controlling stake in the bank in 2014 due to local regulations. At the time, Anbang was the only potential buyer to submit a preliminary bid for the lender, but at least two competing bids were required for the sale process to proceed.

South Korean regulators are examining details of a sale plan but nothing has been finalized, an official from the Financial Services Commission told Reuters. Anbang is interested in a 10% stake in Woori Bank, while other possible buyers have expressed interest in smaller stakes.

Other Chinese firms sought deals further overseas in a variety of industries. China Merchants Bank Co. Ltd. is one of the possible buyers vying for Royal Bank of Scotland Group Plc's Greek ship finance business, Reuters reported June 22.

The business being sold includes a banking license and about 40 employees, and is worth an estimated US$3 billion. RBS has held preliminary talks with several interested parties.

Another Chinese investment group is looking to buy a stake in Delek Group Ltd.insurance unit Phoenix Holdings Ltd., Globes reported June 30. The potential deal could be held up at the regulatory level as Israeli regulators are likely to continue to oppose Chinese investment. Delek had previously made attempts to sell its estimated 53% stake in Phoenix, including to China's Fosun International Ltd.

German payment processing firm Wirecard AG is in talks with AliPay Internet Technology Co. Ltd. for a possible stake sale, Reuters reported June 26. Wirecard is reportedly seeking to sell a stake of up to 25%, and possibly more at a future date, to the Chinese online payment platform. AliPay is a unit of Alibaba Group Holding Ltd. Back at home, China Pacific Insurance (Group) Co. Ltd. is in discussions to acquire an interest in Guotai Junan Allianz Funds. The company said June 13 that it is in preliminary talks with Guotai Junan Securities Co. Ltd. about the stake acquisition but no definitive agreement has been reached.

June also saw news emerge about a number of other potential deals in the insurance space, with the owners of Hong Kong Life Insurance Ltd. considering putting the company up for sale. Hong Kong Life Insurance is jointly owned by five Hong Kong financial institutions and a sale could amount to US$600 million, Reuters reported June 10. Singapore's Great Eastern Holdings Ltd. is reportedly considering a bid for the Hong Kong insurer.

Meanwhile, five nonlife insurers in the Philippines are looking to merge in 2016, amid pressure from tougher capital requirements. Stronghold Insurance Co. Inc. has started a merger deal with Milestone Guaranty and Assurance Corp. and BF General Insurance Co., The Philippine Star reported June 13.

Stronghold has also initiated talks with Premiere Insurance and Surety Corp. and Country Bankers Insurance Corp. for a similar deal. If the deals push through, the surviving entity could hold a total premium portfolio of more than 400 million pesos.

In another potential insurance merger, India's HDFC Standard Life Insurance Co. Ltd. is exploring a merger with Max Life Insurance Co. Ltd. and Max Financial Services Ltd.

HDFC Standard Life said June 17 that the boards of the three companies have agreed to evaluate plans to potentially merge Max Life and Max Financial into HDFC Standard Life. The proposed merger is still subject to due diligence.

To read articles about the other deal possibilities, click on the following headlines:

BOC Hong Kong still reviewing takeover of ASEAN ops from parent

Munich Re seeks to divest Great Lakes Australia

Report: 2 Japanese regional banks in talks for stake in Bank of Yokohama's asset manager

Report: Fairfax Financial eyes stake in India's Catholic Syrian Bank

Report: IndusInd Bank eyes NPAs of ailing microlender

Report: Private equity firm, GIC seek to buy State Bank of India's stake in NSE

Report: IFC emerges as leading contender for IDBI Bank stake

L&T Finance to consolidate businesses

SGX, Baltic Exchange extend exclusive talks by 2 months

As of July 6, US$1 was equivalent to 1,163.40 South Korean won and 47.11 Philippine pesos.