Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 17, 2023

By Rajiv Biswas

Despite global economic headwinds from slowdowns in the US and EU economies, economic growth in the Asia-Pacific (APAC) region is forecast to strengthen in 2023. The key driver for the improvement in APAC regional growth will be from the rebound in growth momentum in mainland China due to the easing of COVID-19 restrictions.

Latest evidence from S&P Global Purchasing Managers' Index (PMI) surveys signals rebounding economic activity in mainland China, as well as continued expansionary conditions in India and a number of ASEAN industrial economies. The recovery of international tourism in the APAC region is also resulting in improving service sector exports for economies such as Thailand, Malaysia and Singapore. Commodity exporting nations, notably Australia, Malaysia and Indonesia, have also continued to benefit from high global commodity prices, notably for their exports of energy products.

The easing of COVID-19 restrictions in mainland China is forecast to boost its GDP growth rate from 3.0% in 2022 to 5.3% in 2023. This will be the key driver for APAC's GDP growth rate rising from 3.2% in 2022 to 4.2% in 2023, despite headwinds from moderating global growth momentum due to economic slowdowns in the US and EU.

The APAC macroeconomic outlook for 2023 is expected to remain resilient to the recent financial shockwaves caused to the US banking system, provided that US financial stability risks remain contained by the US financial regulatory authorities. Despite the failures of two US banks, Silicon Valley Bank (SVB) as well as Signature Bank, in rapid succession in recent days, US financial regulators have acted swiftly to limit contagion risks. The FDIC, Federal Reserve, and US Treasury have implemented a "rescue" plan that extended deposit insurance to all deposits at the two banks and pledged that the funds would be accessible on Monday, 13 March.

This is risk-positive for technology and other startup firms that in many cases had concentrated their deposits with SVB and avoids the likelihood of widespread imminent corporate failures. As part of the rescue plan, the Bank Term Funding Program (BTFP) has also been established, allowing all depository institutions to borrow at the Fed at a low rate.

The announcement that Credit Suisse will borrow CHF 50 billion from the Swiss National Bank in a fully collateralized Covered Loan Facility and short-term liquidity facility is also expected to mitigate potential contagion risks in the Western European banking sector, reducing any potential transmission risks to the APAC region.

Latest economic indicators for mainland China have meanwhile signalled a rebound in economic momentum. Economic data for the first two months of 2023 showed that industrial production rose by 2.4% year-on-year, while retail sales rose by 3.5% y/y.

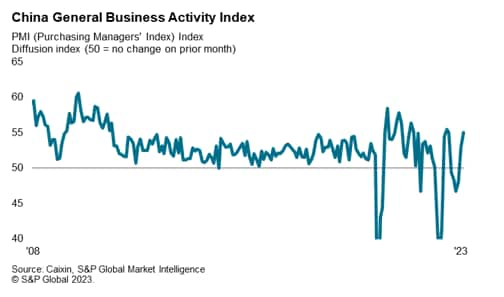

The latest Caixin China headline PMI, compiled by S&P global, increased from 49.2 in January to 51.6 in February to thereby signal an improvement in overall business conditions across China's manufacturing sector. Though modest, it marked the first expansion for seven months, with the reading being the second-highest recorded by the survey since May 2021.

At the same time, the headline Caixin General Services PMI picked up from 52.9 in January 2023 to 55.0 in February, to signal a back-to-back monthly increase in business activity across China's service sector. Notably, the rate of expansion was the quickest recorded since August 2022.

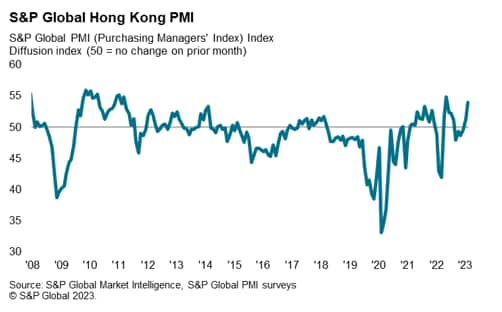

The rebound in mainland China's economy is expected to have significant positive effects on the rest of the APAC region. The economies of Hong Kong SAR and Taiwan have already shown early signs of a turnaround in economic activity given the close economic and trade ties with mainland China's economy.

The S&P Global Hong Kong SAR PMI posted 53.9 in February, up from 51.2 in January. This marked a second consecutive month of private sector expansion and the most rapid pace of growth since last May. The relaxation of COVID-19 measures across mainland China and Hong Kong SAR around the turn of the year, coupled with declining COVID-19 disruptions, supported another rapid expansion in new orders for goods and services from Hong Kong SAR. The rate at which new orders increased was the fastest since January 2011, buoyed by record expansion in international demand. The volume of new orders from mainland China also climbed at one of the quickest rates in the survey history.

The S&P Global Taiwan Manufacturing PMI rose significantly, from 44.3 in January to 49.0 in February, to signal only a marginal deterioration in the manufacturing sector. The rate of decline was the slowest since June 2022.

In the ASEAN region, strong domestic demand has continued to support economic expansion in a number of large economies. The headline S&P Global ASEAN Manufacturing PMI posted expansion for the seventeenth month running in February. Moreover, the pace of growth across the sector improved further, with the index rising from 51.0 in January to 51.5.

The ASEAN Manufacturing PMI showed expansion across all monitored ASEAN nations bar two, with Thailand leading the expansion for the second month running in February. Operating conditions faced by Thai manufacturers improved at the second-fastest pace on record, with the PMI at 54.8. The Filipino manufacturing sector also recorded expansionary conditions, with the PMI at 52.7. The Indonesian and Vietnamese manufacturing sectors both recorded modest rates of growth, with PMI readings of 51.2 in February.

In Japan, the au Jibun Bank Japan Services PMI, compiled by S&P Global, rose sharply from 52.3 in January to 54.0 in February to signal a solid expansion in activity. The index reading was the highest since last June. However, Japan's manufacturing sector continued to record contractionary conditions, with the headline au Jibun Bank Japan Manufacturing PMI dipping from 48.9 in January to 47.7 in February, as new orders continued to show weakness.

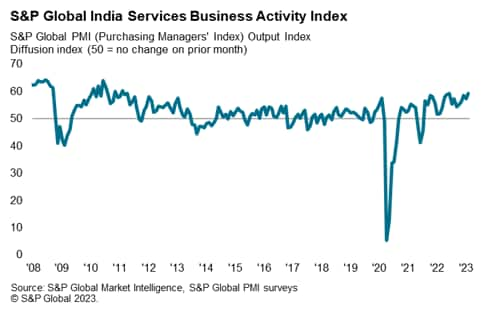

The Indian economy has also continued to show expansionary economic conditions in early 2023. The S&P Global India Services PMI rose from 57.2 in January to 59.4 in February, reaching its highest level in 12 years and indicated a sharp expansion in service sector output.

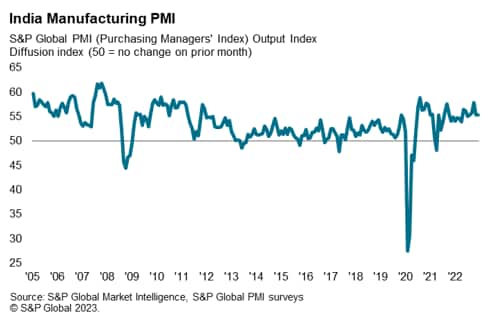

The S&P Global India Manufacturing PMI was, at 55.3 in February, little-changed from 55.4 in January and signalled continued expansion in the manufacturing sector. In the first ten months of the 2022-2023 fiscal year, India's manufacturing output has risen by 4.8% year-on-year. Manufactures of motor vehicles showed particularly strong growth, up 22% on a year ago.

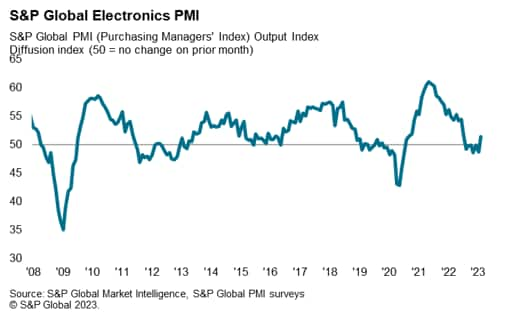

Improving conditions in the global electronics sector also have positive implications for the APAC electronics manufacturing sector. The S&P Global Electronics PMI posted 51.4 in February, up from 48.7 in January, to signal a return to expansion territory for the global electronics sector. The rate of growth was also the fastest since last July and was supported by improvements in new orders and output.

The upturn in global electronics demand is important for the APAC manufacturing outlook, as electronics manufacturing is a significant part of the manufacturing export sector for many Asian economies, including South Korea, mainland China, Japan, Malaysia, Singapore, Philippines, Taiwan, Thailand and Vietnam. Furthermore, the electronics supply chain is highly integrated across different economies in East Asia.

The APAC near-term economic outlook is therefore one of improving growth momentum in 2023 and 2024, driven by the rebound in mainland China. Real GDP growth for the APAC region is expected to increase from 3.2% in 2022 to 4.2% in 2023, rising further to 4.7% in 2024.

However, there are still a number of downside risks to the APAC economic outlook, notably from the growth slowdowns in the US and EU, which have impacted on APAC exports. Further monetary policy tightening in the US and EU could also result in protracted weak demand in these key markets during 2023. There are also continuing uncertainties and downside risks relating to potential contagion effects from recent banking sector shocks in the US and Western Europe.

Despite these risks and uncertainties, the base case scenario is for real GDP growth in the APAC region to strengthen in 2023. The APAC region is also forecast to be the fastest growing region of the world economy in 2023, boosted by strong economic expansion in mainland China, India and ASEAN.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.