Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 15 Sep, 2022

By Zoe Roth and Rich Karpinski

Highlights

Intelligent transportation technologies have enormous potential to improve driver and pedestrian experiences by reducing congestion, improving safety, and limiting associated emissions.

Introduction

Intelligent transportation systems (ITS) use technologies like IoT and AI/ML algorithms to make transportation and traffic systems work more efficiently through optimization and automation. On the hardware side, video and LiDAR cameras and a variety of sensor technologies can collect information on traffic flow, people counts and traffic light efficiency. When this data is normalized, contextualized, and connected to a backend analytics platform, intelligent transportation technologies have enormous potential to improve driver and pedestrian experiences by reducing congestion, improving safety, and limiting associated emissions.

The Take

ITS companies generally approach transportation with three main goals—innovating traditional approaches, improving rider safety, and decarbonizing transit networks. The first, updating legacy systems and optimizing rider experience, can be done by shortening wait times for busses, searching for parking spots, or waiting at red lights. As cities look to reach zero-traffic related deaths, often called vision-zero, connected vehicle data and ITS can identify areas of frequent crashes or speeding occurrences to optimize enforcement and mitigate future accidents. Decarbonization and reducing the transportation sectors associated emissions is the last goal and is a central tenet in many vendor approaches.

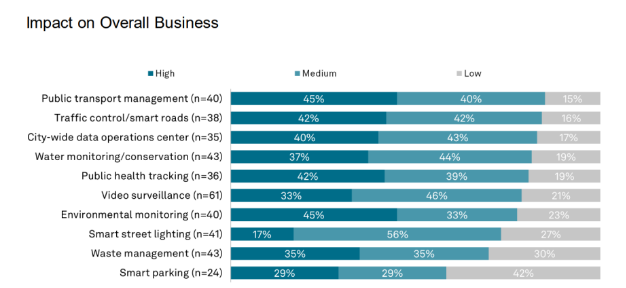

Truly intelligent transportation systems can integrate public transportation optimization, traffic management, and multimodal assets like scooters and bikes to multiply the impact of smart transportation efforts. As vendors look to break into the sector – both specialists delivering intelligent transportation applications and IT/cloud vendors providing supporting data infrastructure –factoring in citizen opinion and equity should be central in planning and deployments. Public sector respondents noted the transformative potential of transportation upgrades, noting the impact of ITS technology as having the highest impact on business of all smart city IoT applications. 84% of respondents who implemented smart roads/traffic control saw a medium to high impact on business, which rose to 85% for public transportation optimization, according to 451 Research’s VoCUL: Internet of Things, The OT Perspective, Use Cases & Outcomes.

Figure 1: IoT Initiatives Impact on Business Operations, Government Respondents

Source: 451 Research Voice of the Connected User Landscape: Internet of Things, The OT Perspective, Use Cases & Outcomes 2021

The edge imperative

Before understanding the different technologies than can enable a digital transformation of the roads, its important to understand the connectivity needed to support hardware and software platforms in the sector. Almost all ITS companies have a software component, most often an analytics dashboard than can act as a data visualization platform and identify trends, with the ultimate goal of providing predictive insight. This data collection often includes a hardware component, such as a camera or sensor. Sensors embedded in roadways or other infrastructure like traffic lights can also feed analytics systems with real-time information on conditions like traffic flows, weather events and pedestrian activity.

Where and when to analyze transportation data is a key consideration. Some insights – such as accident avoidance impacting real-time steering decisions – need to be delivered in milliseconds and thus are most likely collected via on-car sensors/cameras and analyzed leveraging on-vehicle compute. Other decisions require a timely but not instantaneous response – for instance, a navigation decision or traffic light timing change – and can be managed best via nearby edge infrastructure. Finally, workloads such as traffic forecasting or road capacity demand planning are best done via centralized infrastructure – data center or cloud – and likely involve pulling together multiple data sources and leveraging sophisticated AI/ML models. In addition to these operational considerations, related issues such as network availability; infrastructure cost; data sovereignty; and citizen privacy all have an impact on ITS workload execution venue decisions.

ITS: Greater than the sum of its parts

Many ITS companies frame their mission around decarbonization or emission reduction, which can also align with local or states safety goals. The following will address a non-exhaustive list of ITS use-cases.

Traffic management can provide improved travel times via connected infrastructure and analytics. Automation and connectivity can allow real-time control and adjustment of traffic lights, digital signage and speed limits based on current conditions. Companies in this segment usually focus on either hardware, ie, embedded sensors collecting car counts on road or in roadside cabinet units, or cameras providing real-time coverage of problem intersections. Vendors like LYT use connected vehicle to infrastructure (V2I) information to reduce congestion and increase uptime for emergency vehicles and public transportation vehicles. As more data is collected over time, traffic lights become smarter and can better predict scheduling. INRIX provides a similar offering, using connected vehicle data for roadway and signal analytics to visualize traffic conditions and population insight.

Public transportation optimization improves train, bus, subway and rail efficiency while cutting costs. As cities look to increase ridership on bus fleets, convincing riders to shift away from car usage will continue to be a roadblock. Companies like Via and Optibus optimize transit efficiency through dynamic routing, thereby reducing wait times and inefficient existing routes. This demand responsive transit (DRT) is more flexible and rider-oriented than traditional fixed route transit options. Public transportation optimization can not only see reductions in carbon emissions tied to city fleets, but updates fixed-route transit lines to better respond to current levels of rider demand. GeoAI, Trapeze and IVU Traffic Technologies also compete in this segment.

Micro-mobility/multi-modal transportation helps relieve over-crowding and provides equitable transit options in urban areas. e-scooters and e-Bikes in cities have primarily come to market to address first or last mile transit needs in densely populated urban areas. Companies like Bird, Lime, Citibike, and Superpedestrian are few players among a massive micro-mobility market looking to reduce emissions associated with car-dependent cities. Many vendors link payments through a mobile wallet, and charge through some combination of time spent and distance traveled. As micro-mobility proliferates, members of local governments have purported the need for data-sharing between providers, to identify movement trends and pain-points.

As curbs become valuable sites of transaction, smart curb management allows cities and business to manage and monetize access. Innovating at the curb, sectioning off smart loading and parking zones not only can reduce emissions in time spent circling for parking, but can also realize new revenue for busy cities with high demand for delivery. While curb management and smart parking represent distinct areas of focus, their colocation presents a need for collaboration between providers. Companies like Automotus, Vade and Coord (spun out of Sidewalk Labs Pebble) look to digitize and optimize driver experience at the curb through sensors and computer vision. Automotus reported working with both delivery companies like UPS and Amazon for smart loading zones for package delivery, and with cities and municipalities looking to incentivize EV parking zones.

Mobility data providers

Wireless operators and mobility data providers are notable behind-the-scenes actors providing connectivity and data, respectively, needed to run intelligent transportation systems. Operators, including Verizon and T-Mobile, position their role in transportation initiatives as a connectivity broker. In offering the wireless connectivity – including via emerging 5G networks – needed to support real-time monitoring and reporting, cellular networks can provide the low-latency response times needed for real-time asset tracking and predictive insight.

As data becomes increasingly the “oil” needed to run ITS, many vendors have stepped into the role of mobility data providers. Mobility data includes insight onto the flow and location of people and goods through the use of aggregated connected vehicle (CVD) and other supplemental data. Consumers of this data include customers in smart city planning, fleet management and insurance.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is part of S&P Global Market Intelligence. For more about 451 Research, please contact 451ClientServices@spglobal.com.

Podcast

Research