Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct 14, 2024

By Zoe Roth

For nearly a decade, IT vendors, especially in networking, have worked to enable indoor location services. These vendors, however, are not the only players in the game — indoor positioning, navigation, wayfinding and asset visibility are key revenue-driving, location-based services that vendors can provide through the precise locating or mapping of people and assets.

Technologies that enable these services include indoor positioning systems, mapping engines, Bluetooth beacons, Wi-Fi access points, RFID infrastructure and ultra-wideband technologies for enhanced accuracy in industrial/manufacturing environments via real-time location services. Wi-Fi, Bluetooth Low Energy, RFID and UWB deliver varying degrees of precision attached to deployments, supporting use cases across industries like retail, healthcare and commercial real estate.

The indoor location market is highly fragmented in both the data collection and user-facing tools/visualization components. Vendors are often attached to one side of the equation — either using their own infrastructure (Bluetooth beacons, Wi-Fi access points, RFID tags and antennas) to locate and map assets, or delivering the map on which users visualize assets. Data integration happens in both directions to offer end users high-quality maps with real-time data on occupancy, routing to high-value assets, or indoor wayfinding through complex environments. As the smart spaces segment matures, user demand for indoor location services, often through the extension of existing hardware contracts, should continue to grow. Success in the market will be determined by articulating vertical expertise and attachment to high-value outcomes like navigation, wayfinding and asset tracking/management.

Context and challenges

Indoor location-based services (LBS) are not a new concept or technology — networking vendors have tackled the indoor location problem for over a decade. Early LBS products relied on a higher-than-normal concentration of 802.11 wireless access points that could locate a Wi-Fi client in a large but searchable range, like a hospital room or classroom. Staff would have a starting point to visually search for a large item.

Later, triangulation attempted to increase location accuracy, but in real-work scenarios the improvements were minimal. Using Wi-Fi to monitor people's movement around a store or entertainment venue gained interest, but again, the inherent inaccuracies defeated the purpose. One area where wireless positioning proved useful was determining whether a Wi-Fi client was inside or outside a perimeter like a building or outdoor area. Using RF monitoring across numerous wireless APs, "inside" or "outside" was discernable with a high degree of accuracy, and enterprises with security requirements found it useful for detecting rogue clients and APs.

Enterprise networking vendors like Aruba Networks Inc. (acquired by Hewlett Packard Enterprise Co.), Cisco Systems Inc. and Motorola Solutions Inc. (acquired by Zebra Technologies Corp. and then Extreme Networks Inc.) had early products to market and a handful of publicly referenceable customers. However, they never went mainstream in environments like retail or public venues, where video surveillance was more accurate.

Bluetooth was expected to improve the accuracy of indoor location from tens of square feet to a single-digit range, and could be applied to Bluetooth tags and mobile phones. Bluetooth's lower range made it inherently better for indoor location and could place a person or device within a few square feet — close enough to present in-store advertisement or offer Blue Dot navigation or turn-by-turn walking directions. The idea was sound, but consumers worried about hackers disabling Bluetooth, and device makers added features like address randomization to beacons, making it difficult to track devices as they moved through locations.

Indoor usage was initially characterized by inaccuracies horizontally and vertically. Network vendors started adding Bluetooth radios to wireless access points to increase the density and accuracy of 802.11 and Bluetooth wireless detection. In addition, Bluetooth beacons — small, low-powered Bluetooth radios — could fill in gaps, but this meant higher acquisition costs and recurring maintenance in replacing batteries. In addition, ensuring correct store maps and beacon locations was an ongoing task.

The common challenges among vendors include precision and accuracy (X, Y and Z), connectivity fragmentation, integration with existing systems, and user experience woes.

Enhancing precision accuracy indoors. Achieving accurate X, Y and Z positioning in complex environments like multistory buildings is difficult due to signal interference and obstructions. Multi-AP triangulation, sensor fusion and advanced algorithms can collate disaggregated data to enhance precision, but it is error-prone, particularly vertically, and applies to environments where multipath signals are a recurring issue.

Connectivity fragmentation. Different devices and networks use a variety of protocols (Wi-Fi, BLE, RFID), leading to inconsistent performance and integration issues. Adopting standardized protocols — like selecting Wi-Fi or RFID as a core protocol — can mitigate multivendor and multi-technology fragmentation.

Integration with existing systems. Merging new location technologies with legacy infrastructure is complex and can disrupt operations. Modular solutions may have an advantage in integrating with existing systems, especially those that can deliver relevant insights, like the location of an asset. Some vendors responded by creating low-cost, low-power beacons that would be placed more densely in an area to improve accuracy and reduce gaps in coverage.

User experience woes. Ensuring ease of use and reliable performance in diverse environments can be a challenge for end users. User behavior such as turning off wireless like Bluetooth and address randomization also reduces location information. In many cases, thoughtful signage placement is more effective and less costly than wireless technologies to guide consumers through a space. The degree of emphasis and investment each organization places on mapping user experience will vary, although emerging technologies like reality engines and LiDAR scans can deliver realistic renderings of indoor spaces.

Technology overview

At a very high level, indoor location services require some form of base map to layer real-time, location-aware data on. The LBS/IPS (indoor positioning system) vendor often creates this base map by rendering BIM (building information model), CAD or PDF/PNG files into proprietary mapping engines to visualize a space. Vendors place varying degrees of emphasis on the visualization of the space, with some supplementing initial renderings with LiDAR point cloud modeling to create a digital twin-like user interface for indoor navigation, while others simply leverage a base map as a layer to place sensors on.

These "sensors" that collect data are most often Wi-Fi access points that may house multiple radios like Wi-Fi, Bluetooth, or other wireless technologies. However, stand-alone Bluetooth beacons, and internet of things sensors and asset tags are other data-collecting components that are also available.

Data-collecting components

Wi-Fi access points

Depending on the vendor and the generation of technology, APs either have BLE beacons built in to pick up device signals, or require the installation of additional beacons to enhance coverage of an area. Once a map is rendered, APs either auto-locate themselves on the map, or are manually placed on the map by an IT or facilities manager. For Wi-Fi based positioning, vendors align with the IEEE 802.11 protocol for fine time measurement (FTM).

FTM measures the time of flight of Wi-Fi signals by calculating the time and inferring distance between devices and APs. While FTM is Wi-Fi specific, Bluetooth positioning relies on angle of arrival and angle of departure based on RSSI (relative signal strength) to determine location more accurately than Wi-Fi. From broad to precision location, Wi-Fi, Bluetooth and UWB provide a spectrum of positioning capabilities.

Bluetooth Low Energy

BLE offers more accurate location data compared to Wi-Fi, making it a critical technology for applications where precision is necessary. BLE often works alongside Wi-Fi and RFID, filling gaps where Wi-Fi might be too broad or RFID too specific. For BLE-based positioning, vendors leverage technologies such as angle of arrival and angle of departure to determine a device's location.

Many modern Wi-Fi APs come with integrated BLE beacons, making BLE a natural extension of existing infrastructure. The emergence of virtual BLE (vBLE) relies on software-defined zones, where the Wi-Fi APs emit BLE signals that mimic traditional BLE beacons. These virtual beacons can be managed and adjusted through software, reducing hardware capex and integrating emerging artificial intelligence optimizations.

RFID

RFID is an additional radio frequency-based technology used to enable indoor location services. An RFID deployment is made up of antennas, readers and tags. RFID tags contain a microchip and antenna, and are one of three types: passive (no battery, activated by reader signal), semi-active (battery, only transmits signals when activated by reader signal) and active (battery, continuously transmitting signals).

These tags are affixed to assets, personnel and other inventory items, and can relay location as needed to readers. RFID readers or scanners are either fixed at entry/exit points for continuous tracking, or mobile readers that support inventory and asset tracking as needed. RFID antennas support data transmission on both the tag and reader side. Tag antennas transmit and receive identification information via RF signals and can share data omnidirectionally.

Reader antennas emit RF signals to communicate with tags and are usually larger than those of tags. They can share data that is omnidirectionally or directionally focused on a specific area with longer read range. Software and middleware streamline RFID system operations, improve data accuracy, and integrate RFID data into broader business processes.

Verticals and use cases

Location services are of interest to a wide variety of verticals, although some may benefit from the technology more than others. Vendors in the space find success in targeting asset-heavy or dynamic personnel environments, such as healthcare and retail, as core markets. Commercial real estate, event venues, airports and hospitality are among the secondary verticals making investments in location-based platforms and applications.

When it comes to the specifics that use-case location services can enable, vendors deliver both vertical-agnostic use cases and those that target specific industries. Vertical-agnostic outcomes include asset tracking, indoor navigation/wayfinding, indoor positioning, occupancy analytics, emergency response refinement, and geofencing for marketing. Retail users rely on proximity marketing and foot traffic analysis to present customers with hyper-targeted ads and enhance customer visibility. Healthcare markets tend to rely on real-time location services (RTLS) for lower latency data collection and decision-making.

Outlook and differentiators

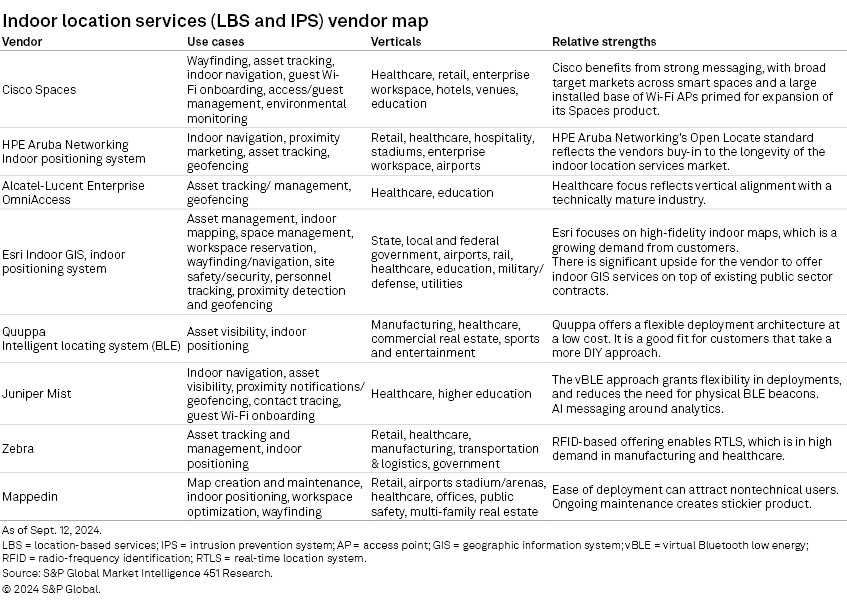

451 Research has preliminarily sized the LBS platform and applications market growing at an 18.9% CAGR from 2023-2028. While many of the core players (see figure below) have been in the market for a decade or more, new entrants and customer priorities will guide vendor success.

As mapping vendors build partner ecosystems to integrate IoT and sensor data across verticals, they are gaining advantage in a market that prioritizes user-friendly interfaces. No one vendor can serve every use case in every vertical, so many choose to focus their efforts on one to two use cases in a handful of verticals. Others position themselves as "data infrastructure," or plumbing for data collection that delivers use cases.

Mapping visualization as a differentiator. Technologies such as LiDAR, point clouds and iPhone scans are enhancing mapping precision, setting new benchmarks for accuracy and usability in the market.

UWB preparation. To align with industry standards, hardware that is compatible with UWB technology may be an advantage for players, especially in manufacturing settings.

Integration with workplace management. Reaching into the back office to integrate location data associated with people or assets with integrated workplace management or enterprise resource planning software suites connects physical infrastructure with real-world outcomes. Desk reservations, occupancy analytics and spatial intelligence are among the offerings vendors may lean on to become stickier and more valuable in deployments.

The following chart reflects key players in indoor location, focused on their vertical industry and use-case exposure. Many of the following vendors have some type of partnerships, mainly between networking and mapping specialists.

451 Research is a technology research group within S&P Global Market Intelligence. For more about the group, please refer to the 451 Research overview and contact page.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings

Segment