Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Feb 5, 2025

Jasper Ivan Madlangbayan Tamara Thorne

Since OpenAI LLC's release of the GPT-3 large language model, AI has emerged as one of the most exciting and debated topics within the investor community. The rapid pace of its development — promising significant productivity gains — has captured the attention of financial markets.

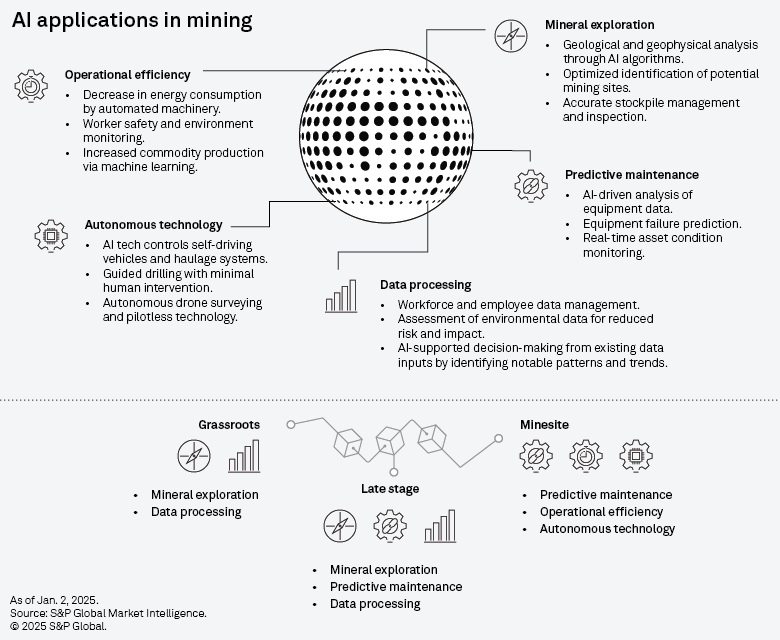

AI is transforming the mining industry and becoming an increasingly important component at various stages of the production process. The technology promises cost savings, enhanced safety, improved efficiency and a reduction in carbon footprint. However, it also presents risks such as high integration costs, data security concerns, overreliance on empirical and modeled data, and ethical dilemmas. While the mining sector grapples with complexities, it also demonstrates a willingness to shape the future of mining using AI, albeit at a slow pace.

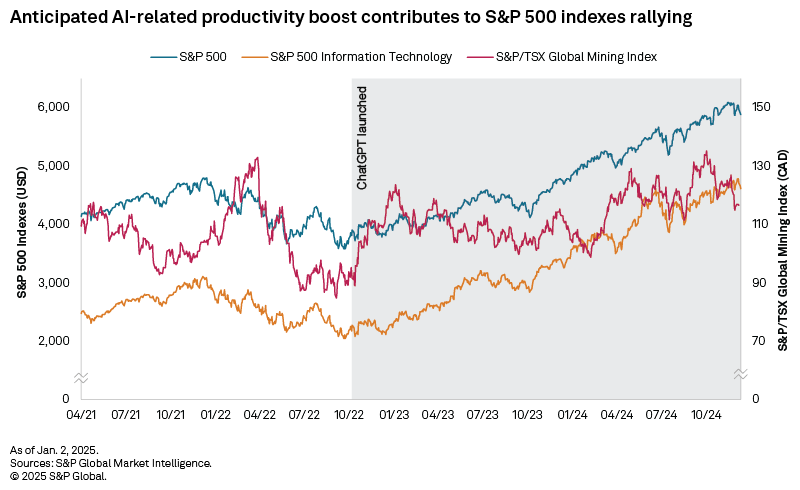

Virtually no industry has remained untouched by this transformative technology, and considerable progress has been made in AI adoption rates across sectors such as finance, technology and healthcare. The hype around generative AI grew following the release of ChatGPT, rallying AI stocks and contributing to gains in the S&P 500 Information Technology (Sector) index, which surged 30% from November 2022 — when OpenAI launched the chatbot app — to November 2023.

While the breakthrough with LLMs has opened new horizons for data processing, the integration of AI and robotics has been in place at major mining sites long before generative AI became a prominent force in our lives. With the rapid acceleration of AI adoption and continued use of automation across various mining activities, it is now nearly impossible to envision a significant-scale mining operation that does not incorporate technology at some stage of the mining value chain.

Ongoing advancements in the AI sector are creating new opportunities and avenues for integration, promising tangible benefits of business continuity and operational efficiency for the mining industry. In this article, we examine the progress made thus far in applying AI within mining, identify the primary drivers propelling the next technological revolution and explore the potential achievements and risks.

Smart mining at the forefront

One of the earliest and most transformative AI initiatives in mining was the implementation of autonomous haulage systems (AHS), pioneered and first deployed by Rio Tinto PLC as part of its Mine of the Future program. AHS utilizes a combination of sensors, GPS technology, machine learning and control algorithms for route optimization and accident prevention. At its Gudai-Darri site in Pilbara, Western Australia, Rio Tinto partnered with original equipment manufacturer Caterpillar Inc. to advance automation efforts. As a result, AI has been integrated into mine automation and simulation systems, autonomous trucks, drills, trains, water carts, long-distance heavy-haul trains and a fully automated laboratory. In addition, about 80% of the haul truck fleet at Pilbara operations is now automated, with Rio Tinto operating about 200 trains through its proprietary AutoHaul technology. According to the company, these automation efforts improve efficiency and safer operations by eliminating driver error. At BHP Group Ltd.'s iron ore operations in Western Australia, more than 30% of trucks were automated as of 2022, and the mining giant has utilized AI to aid decision-making to allow for safer and more efficient operations. Outside of automation, Rio Tinto's smart mining system has become a focal point in its daily operations, utilizing virtual reality, 3D modeling and visualization. At its Tiwai Point smelter in New Zealand, the company employs a simulated 3D model of the smelter to re-create scenarios and prevent safety incidents.

Exploration represents another area of mining where AI has already been in use. As miners globally contend with reduced exploration budgets, AI is adept at analyzing vast amounts of geological data to identify mineral deposits, thus optimizing drilling rates and excavation efforts. In May 2023, BHP partnered with Microsoft Corp. to integrate AI into its systems to improve copper recovery at its Escondida mine in Chile. Through a combination of AI-driven recommendations from Microsoft's Azure platform and data directly coming from the plant, concentrator operators can adjust operational variables to optimize ore processing and grade recovery. BHP has successfully employed this technology to discover new copper deposits in Australia and the US. In May 2024, BHP also announced its partnership with Ivanhoe Electric Inc., utilizing the latter's geophysical transmitter and machine learning software to detect the presence of minerals such as copper, nickel, gold and silver to help reduce costs and time and minimize ecosystem disturbance. In 2018, before its acquisition by Newmont Mining Corp., Goldcorp Inc. developed an AI model in conjunction with IBM Canada Ltd. to enhance predictability for gold exploration at the Red Lake project in Ontario and accelerate target identification through machine learning and spatial analytics.

It appears that the adoption of AI has also helped improve predictive maintenance. By leveraging advanced algorithms and machine learning, companies can analyze equipment performance data to anticipate potential failures before they occur. This proactive approach aims to not only reduce downtime but also extend the lifespan of critical machinery. As the mining industry continues to embrace AI-driven predictive maintenance solutions, the potential for improved asset management and resource allocation will become increasingly evident. On the administrative side, technological advancements in AI coupled with remote sensing can enable governments to quickly identify sites subject to illegal mining and deforestation through notable topographical features and visual landscape changes.

Larger producers enjoy a competitive advantage as they can better manage costs. However, as larger producers lead the way and scale up, capital investment costs may reduce over time, and smaller players could also achieve a degree of value creation. A recent example is the US-based mining startup KoBold Metals Co., which recently raised $537 million in funding to develop existing projects into mines — including the Mingomba copper mine in Zambia — through its proprietary TerraShed system and Machine Prospector software. A significant portion of their funding success was attributed to the company's AI-driven approach to exploration.

Tech and mining alliance: Pioneering a new era of progress

Tech companies have found significant opportunities as mining companies seek to integrate AI into their operations for various applications. In 2022, breakthroughs in virtual and augmented reality enabled Skycatch Inc., in partnership with Teck Resources Ltd. and NVIDIA Corp., to develop a visual digital twin platform that allows for an immersive and real-time simulation of Teck's mining operations, enabling operators to visualize different operational variables dynamically. Fleet Space Technologies Pty Ltd., an Australia-based tech firm, recently partnered with Barrick Gold Corp. to implement AI-driven exploration at its Reko Diq copper mine in Pakistan. Utilizing Fleet Space Technologies's ExoSphere system, copper exploration is enhanced through 3D subsurface maps that help identify features such as groundwater systems and copper ore bodies. The system aims to accelerate exploration at the site while minimizing the environmental impact associated with traditional exploration methods. At the Fontenoy project in Australia, predictive explorer Earth AI Inc. and Australian Securities Exchange-listed Legacy Minerals Holdings Ltd. have continued implementing the former's AI deposit targeting system to drive drilling efforts. In November 2024, they announced their first AI-driven greenfield palladium discovery at the property.

US-based software provider Aspen Technology Inc. has continued to venture into digital mining solutions. At the Mungari gold mine in Western Australia, Evolution Mining Ltd. has implemented prescriptive maintenance programs using AspenTech's Aspen Mtell technology, mitigating safety risks and predicting asset failures.

In the critical minerals space, the energy transition continues to drive demand as the industry faces challenges such as declining ore grades, extended lead times for developing greenfield projects, and rising costs. Therefore, scientific advancements are intensifying efforts to reduce commodity intensity — a crucial factor in battery production. Generative AI models are being used to support research aimed at discovering new, more sustainable battery materials, which could help governments achieve greater critical mineral security.

Risk assessment

Advancements in AI have led investors to believe that adopting AI technologies will yield high returns in the future, not just in the mining industry but across all sectors of the economy. The question remains: Will these high expectations be met or will the much-discussed AI bubble burst?

While there are significant advantages to AI adoption — and the full potential of AI in mining has yet to be realized, with many opportunities still to explore — there are also notable challenges and risks associated with the technology. Integrating and maintaining AI systems can be costly. Whether these expenses are factored into total minesite costs or development and expansion capital expenditures, mining companies will need to grapple with additional costs for purchasing hardware and software, training the workforce and providing ongoing technical support and maintenance.

Former Senior Director of Solutions Consulting at AspenTech Keith Flynn said, "The main challenge to AI adoption in the mining industry is trust. In this high-stakes environment, miners are hesitant to fully depend on AI-generated empirical models. A hybrid approach, an 'open loop control,' which incorporates necessary human intervention, is seen as the path forward. Capital investment is the second biggest obstacle, especially at remote sites where latency, connectivity, and power grids can be unreliable."

Data security risks naturally arise as AI processes vast amounts of information, some of which may be sensitive, heightening cybersecurity concerns. Governments worldwide are working to establish regulatory frameworks for AI. These frameworks, in themselves, are a compliance risk, requiring mining companies to allocate more resources for monitoring. Furthermore, recommendations from AI systems may yield discriminatory results if there is inherent bias from data sources and existing algorithms.

While AI applications in mining could help fulfill societal needs such as improving industry safety and reducing carbon footprints, ethical concerns regarding job displacement may also exist.

Conclusion

In December 2024, OpenAI LLC co-founder, CEO and director Sam Altman indicated that the development of generative AI is expected to accelerate in 2025. He emphasized that while delays may occur, the emergence of superintelligence is anticipated within the next decade. Notably, three of the top 10 emerging technologies for 2024, as outlined in the latest World Economic Forum report, are based on AI systems.

The writing is on the wall: Regardless of whether any particular mining company has embraced the AI revolution, this disruptive innovation, which promises to outperform human capabilities, is accelerating and bringing new opportunities to the industry and profits for its financial investors. As the new phase of AI progresses from one frontier model to the next, the mining industry, which has been historically slow to implement change, faces the challenge of balancing potential gains with the associated risks.

A combination of pressures such as profit maximization, decarbonization goals, falling grades and growing demand for critical minerals driven by the clean energy transition — alongside environmental, social and governance pressures to improve worker safety and emissions reduction — will only intensify in the future, compelling the industry to adopt and adapt integrating AI models at mining operations. Overall, the mining sector stands to become more profitable and efficient with proper AI governance as it becomes safer and cleaner..

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is a technology research group within S&P Global Market Intelligence. For more about the group, please refer to the 451 Research overview and contact page.