Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Sep, 2016 | 16:30

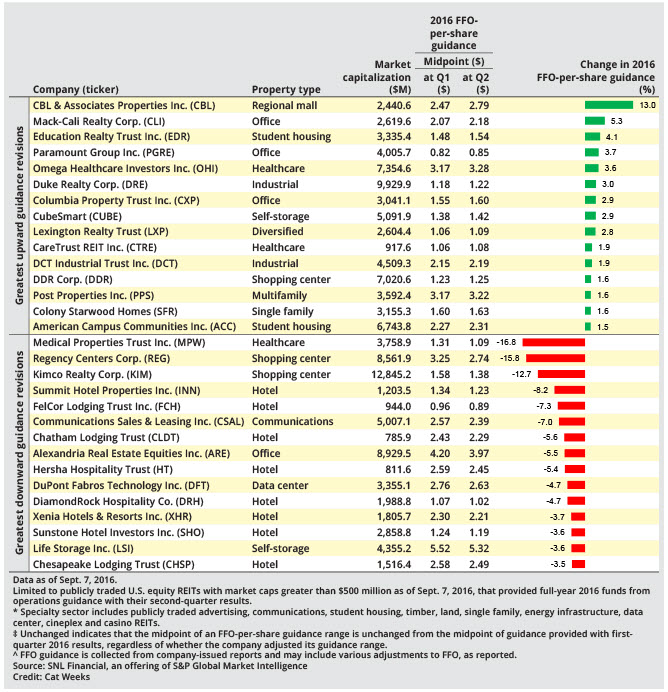

Methodology note: Midpoint guidance is calculated by taking an average of low and high company-issued FFO-per-share guidance ranges for the given period.

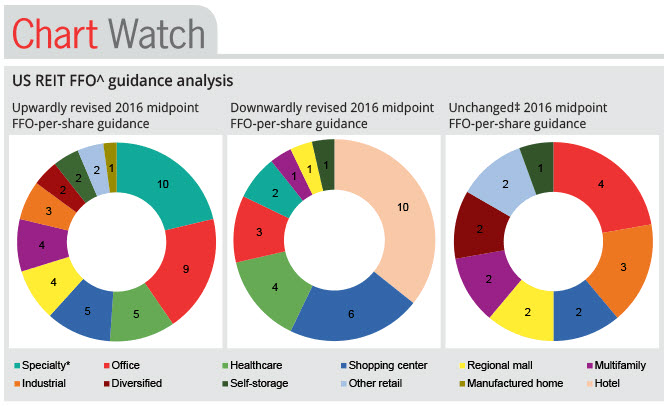

More than half of the U.S. REITs in a new SNL Real Estate analysis increased the midpoint of their 2016 per-share Funds From Operations (FFO) guidance when releasing their second-quarter earnings results. Specialty and office REITs led the way by number of increases, while hotel REITs made the most decreases.

The analysis includes publicly traded U.S. REITs with market caps greater than $500 million that provided full-year FFO-per-share guidance in both their first-quarter and second-quarter results — 93 companies in all. Among those companies, 47 REITs increased the midpoint of their guidance, while 28 companies lowered their guidance midpoint and 18 left the midpoint of their guidance unchanged.

Regional mall REIT CBL & Associates Properties Inc. raised the midpoint of its FFO-per-share range 13.0% to $2.79, the largest increase of the group.

Mack-Cali Realty Corp. made the second-largest boost to its guidance, raising the midpoint 5.3% to $2.18 per share.

Medical Properties Trust Inc., a healthcare-focused REIT, revised its FFO guidance to $1.09 from $1.31 per share, representing a 16.8% drop, the largest decrease of the group.

Regency Centers Corp., Kimco Realty Corp. and Summit Hotel Properties Inc. lowered their guidance midpoints by 15.8%, 12.7% and 8.2%, respectively.