Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Apr, 2018

Capital Markets

U.S. merger and acquisition activity hit the ground running in 2018, with announced deal value accelerating to its fastest start since 2000. Middle-market manufacturing M&A activity is also off to a much better start than last year.

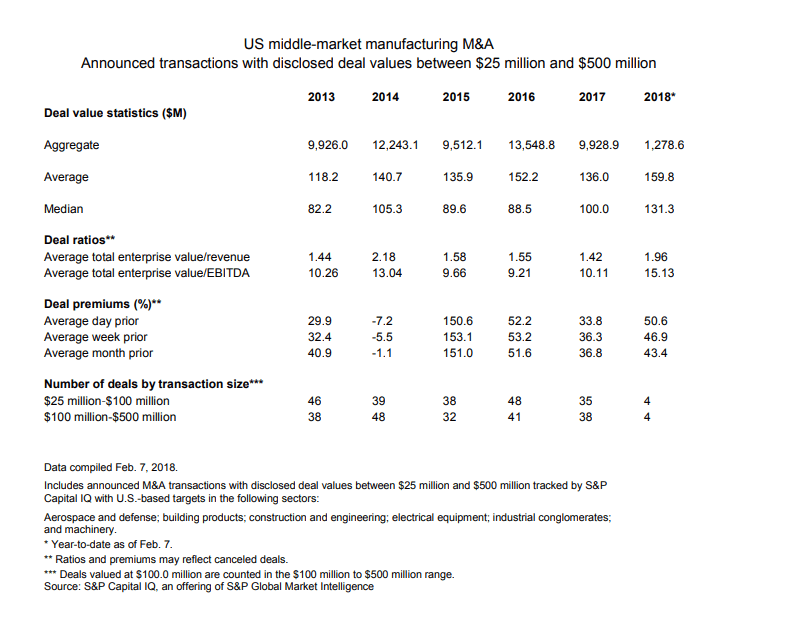

Year-to-date as of February 7, 2018, there have been about $1.28 billion of middle-market manufacturing M&A transactions announced, compared to $622.1 million as of the same date in 2017. The rebound in activity is welcome after middle-market M&A activity in the manufacturing space plunged last year, falling more than 25% from $13.55 billion in 2016. If 2018 continues as it has begun, announced middle-market manufacturing deal value could once again top $12 billion.

For the purposes of this analysis, S&P Global Market Intelligence defined middle-market M&A activity as deals valued at $25 million to $500 million. We included transactions for which deal value information is available through S&P Capital IQ, an offering of S&P Global Market Intelligence. The analysis captures transactions within the following sectors, as defined on S&P Capital IQ: aerospace and defense; building products; construction and engineering; electrical equipment; industrial conglomerates; and machinery.

Within this M&A category, the largest deal of 2017 was private equity firm Lindsay Goldberg's $500 million investment in Lexington, Ky.-based fan manufacturer Delta T Corp. Another top middle-market manufacturing deal came when European aerospace firm Sonaca SA agreed to acquire St. Charles, Mo.-based LMI Aerospace Inc. (NasdaqGS:LMIA) from an investor group for approximately $432 million, including assumed debt. This transaction was one of several private equity exits from manufacturing company investments in 2017.

The third-largest middle-market manufacturing deal of 2017 also involved a European buyer and private equity seller. U.K.-based Spirax-Sarco Engineering plc (LSE:SPX) purchased Pittsburgh-based thermal technology company Chromalox Inc. from Irving Place Capital for $415 million in July. Irving Place Capital

and Chromalox management had acquired a controlling stake in the company in December 2012.

Another foreign buyer made the fourth-largest U.S. middle-market manufacturing M&A deal of last year, although this transaction did not involve a private equity firm. In August 2017, Japanese industrial machinery firm Tsubaki Nakashima Co. Ltd. (TSE:6464) acquired the global precision bearing components business of Tennessee-based diversified industry company NN Inc. (NasdaqGS:NNBR).

Like what you see? There’s more. Stay informed with more market data from S&P Global Market Intelligence — your single source for essential manufacturing insight.