Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 Jun, 2025

By Maricor Zapata and Hussain Shah

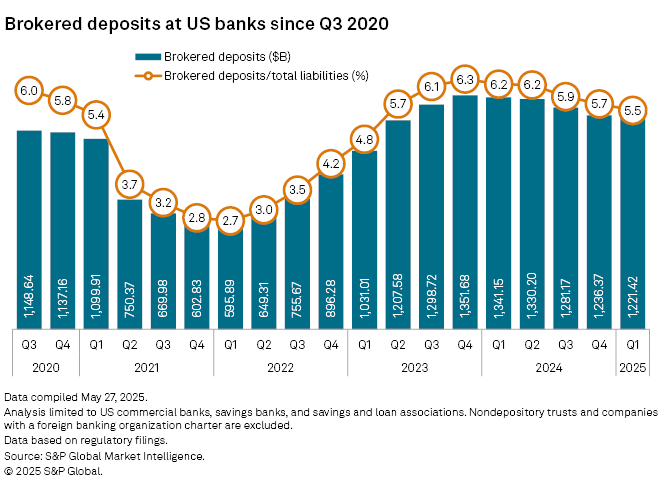

Brokered deposits at US banks declined for the fifth quarter in a row as many banks reduce reliance on expensive sources of funding amid the growth of low-cost deposits.

The sector finished the first quarter with $1.221 trillion in brokered deposits, down from $1.236 trillion at the end of 2024 and $1.341 trillion a year ago, according to S&P Global Market Intelligence data. As a percentage of total liabilities, brokered deposits dropped to 5.5%, from 5.7% in the previous quarter and 6.2% in the year-ago quarter.

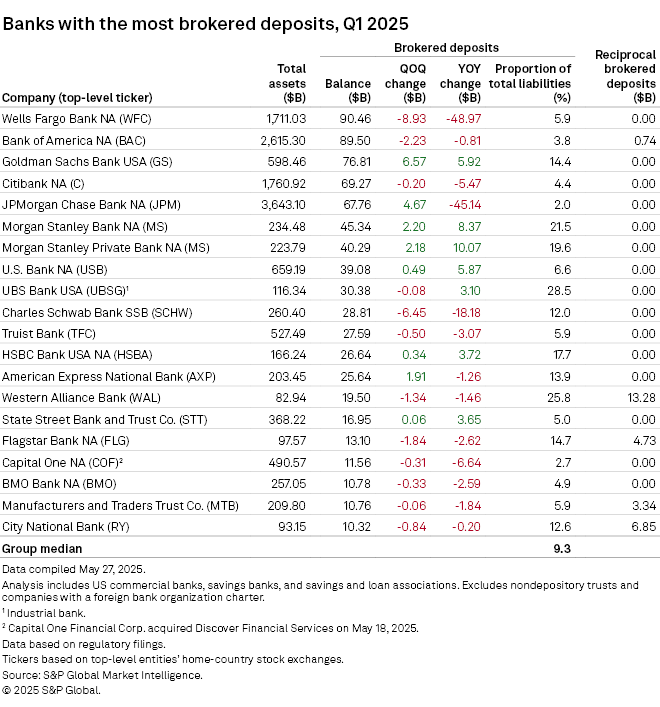

Many big players post lower brokered deposits

Of the 20 US banks with the most brokered deposits in the first quarter, 12 booked sequentially lower brokered deposit balances. The median ratio of brokered deposits to total liabilities for the 20 banks was 9.3% in the first quarter, down from 12.6% at the end of 2024.

Wells Fargo Bank NA was still the bank with the most brokered deposits in the first quarter, followed by Bank of America NA and Goldman Sachs Bank USA.

However, Wells Fargo's brokered deposits dropped to $90.46 billion in the first quarter, $8.93 billion less than the previous quarter and $48.97 billion less than the year-ago quarter. Brokered deposits fell to 5.9% of Wells Fargo's total liabilities from 6.5% in the linked quarter.

Bank of America's brokered deposits fell to $89.50 billion in the first quarter from $91.73 billion in the previous quarter. Its brokered deposits-to-total liabilities ratio also ticked down sequentially to 3.8% from 3.9%.

Flagstar Bank NA, a subsidiary of Flagstar Financial Inc. and one of the 20 US banks with the most brokered deposits in recent quarters, is ridding its balance sheet of the costly funding source.

During Flagstar Financial's first-quarter earnings call, CFO Lee Matthew Smith disclosed that the company paid off about $1.9 billion of brokered deposits during the quarter with a weighted average cost of 5%. Although it reduced deposits by about $2 billion, the payoff was "consistent with management's strategy to reduce reliance on wholesale funding," Smith said.

The CFO said Flagstar Financial's roughly $30 billion worth of cash, borrowing capacity and highly liquid assets represent 231% of its uninsured deposits, enabling the paydown of brokered deposits and wholesale borrowings and the purchase of investment securities.

Flagstar Financial expects to further slash its brokered deposits by about $3 billion more over the next three quarters, Smith said.

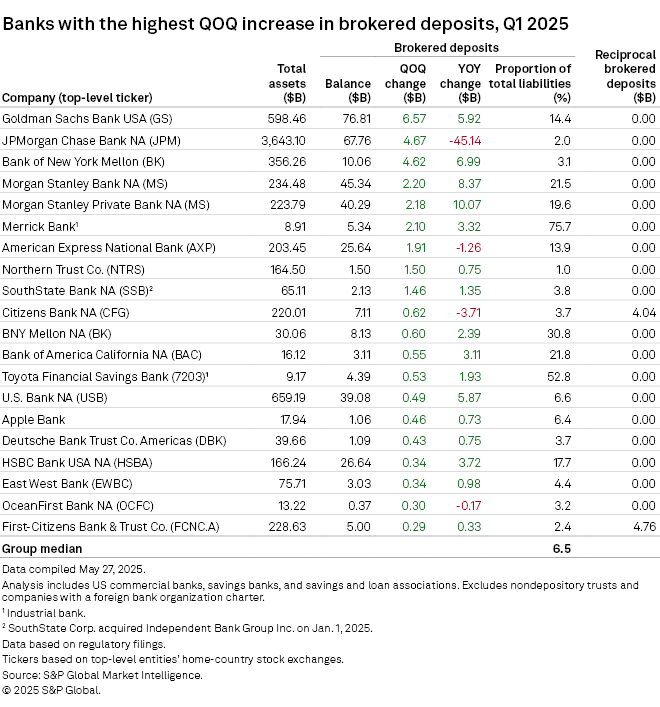

Goldman, JPMorgan log increases

Goldman Sachs Bank and JPMorgan Chase Bank NA were among the banks that reported sequential increases in brokered deposits during the first quarter.

Goldman Sachs Bank ended the period with $76.81 billion in brokered deposits, up $6.57 billion from the end of 2024. Its brokered deposits-to-total liabilities ratio also ticked up sequentially to 14.4% from 14.2%.

JPMorgan Chase Bank posted a sequential increase in brokered deposits of $4.67 billion, although its first-quarter brokered deposit balance was $45.14 billion less than what it posted a year ago. The proportion of brokered deposits to JPMorgan's total liabilities was unchanged at 2.0%.

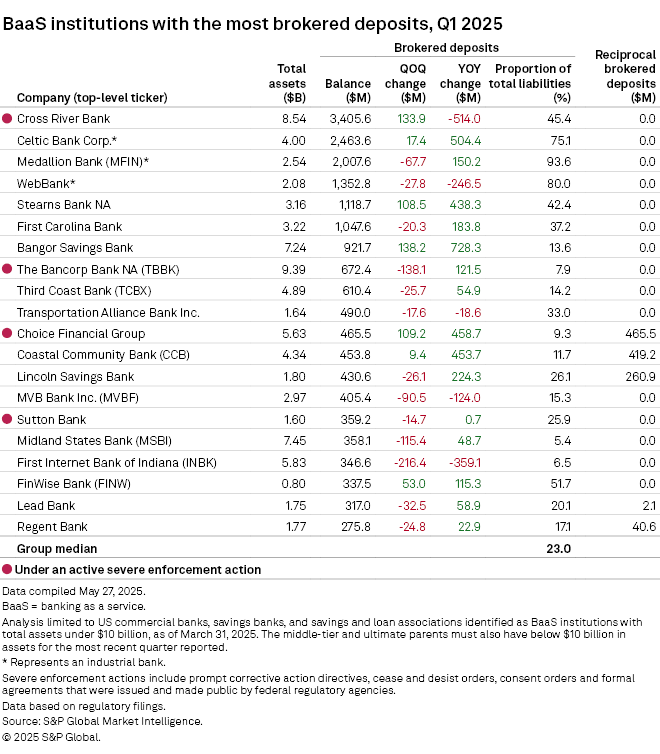

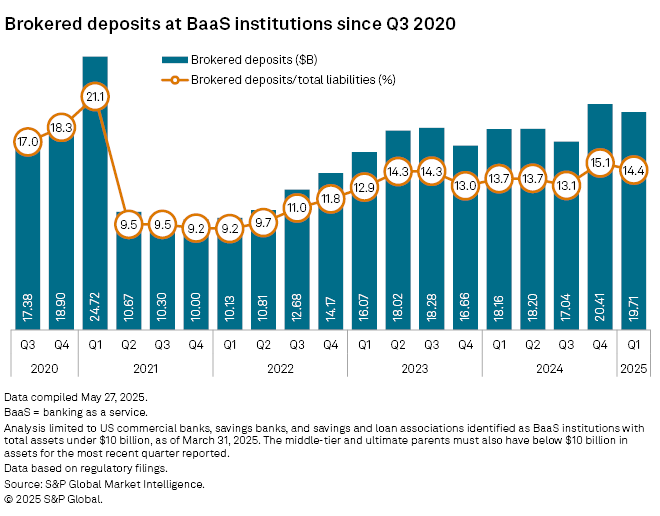

Brokered deposits at BaaS institutions drop

Brokered deposits at banking-as-a-service (BaaS) institutions with total assets below $10 billion also dropped sequentially in the first quarter. The segment posted a brokered deposit balance of $19.71 billion, down from $20.41 billion in the previous quarter, but still up from $18.16 billion a year before.

The ratio of brokered deposits to the institutions' total liabilities also edged lower to 14.4% from 15.1% in the previous quarter, but is still higher than 13.7% in the year-ago quarter.

BaaS institutions with most brokered deposits

Salt Lake City-based Celtic Bank Corp. remained in second place, with a $2.46 billion brokered deposit balance. Accounting for 75.1% of Celtic Bank's total liabilities, the amount was up by $17.4 million from the previous quarter and by $504.4 million from the year-ago quarter.

Medallion Bank, also based in Salt Lake City, booked the third-largest dollar amount of brokered deposits among BaaS institutions. The Medallion Financial Corp. subsidiary recorded brokered deposits of $2.01 billion, $67.7 million less than in the previous quarter but $150.2 million more than in the year-ago quarter. Brokered deposits accounted for 93.6% of Medallion Bank's total liabilities in the first quarter, down from 95.6% in the linked quarter.