Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

05 Jun, 2025

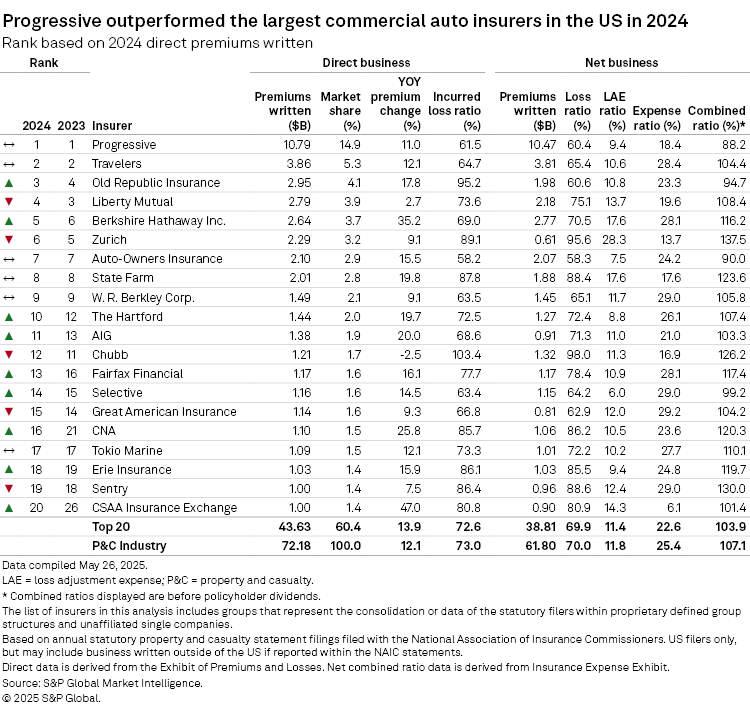

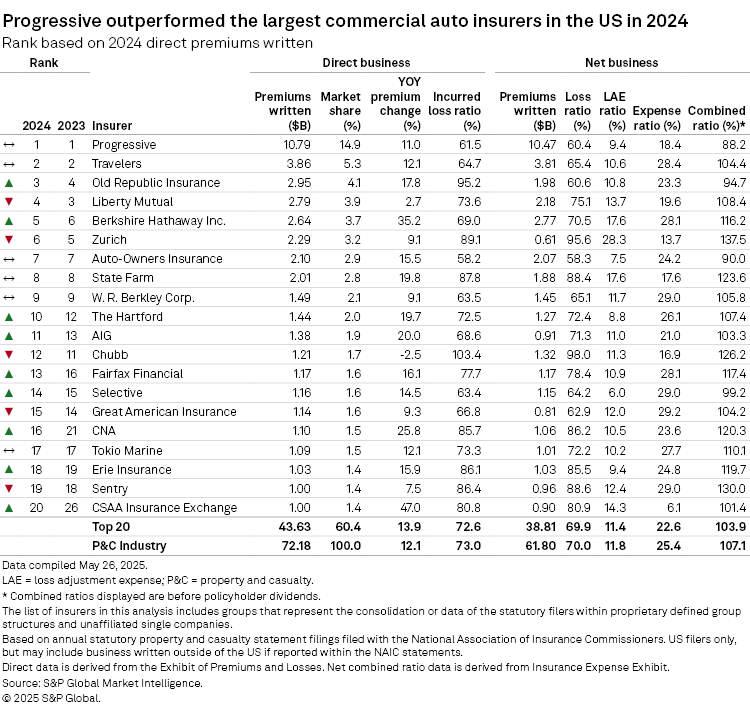

The Progressive Corp. posted the best underwriting performance among the country's largest auto insurers in 2024 with a net combined ratio of 88.2%, an improvement of 10.3 percentage points from 98.5% it recorded in 2023, according to an analysis by S&P Global Market Intelligence.

The country's largest commercial auto insurer also grew its direct premiums written year-over-year by 11% to $10.79 billion, equaling a 14.9% market share. The company credited the strong profitability in its commercial lines segment in part to higher average earned premium per policy in its commercial auto businesses due to 2023 rate increases and lower incurred loss frequency in core commercial auto products.

Progressive in its most recent Form-10K further explained that the most significant premium growth came from its contractor and business auto business market targets (BMT) primarily driven by the aggregate core commercial auto rate increases of 17% taken during 2023. Meanwhile, on a calendar-year basis, its commercial auto products' incurred frequency decreased 7% in 2024. Core commercial auto products represent 80% of the segment's net premiums written.

Auto-Owners Insurance Group saw the largest improvement in commercial auto net combined ratio among the top 20. The Michigan-based underwriter's net combined ratio improved by 35.8 percentage points from 125.8% in 2023 to 90% in 2024.

Old Republic International Corp. saw a slight deterioration of 1.3 percentage points but remained profitable in 2024 with a net combined ratio of 94.7%. Old Republic's CFO Francis Sodaro stated in the company's fourth quarter earnings conference call that commercial auto continued to have strong favorable development, although lower than the previous year.

The other insurer with a net combined ratio under 100% was Selective Insurance Group Inc., with a figure of 99.2%. CFO Patrick Brennan said in Selective's fourth quarter earnings call that commercial auto, not general liability, was the first shoe to drop as it relates to social inflation. He expressed confidence in the company's reserving process, and CEO John Marchioni pointed out the company's quick reaction to increases in expected loss trends for the commercial auto bodily injury line dating back to 2021.

CNA, CSAA joins top 20

CNA Financial Corporation, which was among the 20 largest US commercial auto underwriters from 1996 to 2013, joined the rankings after climbing five spots from 21st to be the 16th largest commercial auto insurance underwriter in 2024. CNA recorded a 25.8% year-over-year growth in direct premiums written to nearly $1.10 billion. The last time CNA logged commercial auto direct premiums written worth more than a billion dollars was in 2001.

CSAA Insurance Exchange, which is the largest excess and surplus (E&S) writer of commercial auto insurance, also became a Top 20 commercial auto insurer in 2024 after seeing its direct premiums written grow by 47% to nearly a billion from roughly $680 million in 2023. Among other factors, the renewal of commercial rideshare agreements at higher rates largely drove the increase in its net premiums written.

Among the Top 20, Chubb Ltd. was the only insurer that saw its direct premiums written decline and incurred a direct loss ratio of over 100%.

Consistently unprofitable

The net combined ratio for the business line improved slightly yet remained above 100% for the third consecutive year, recording a combined ratio of 107.1% in 2024. Insurance carriers have employed a range of strategies to address elevated combined ratios, particularly in the form of rate increases. Even as direct premiums written increased year-over-year each year since 2011, the business line remained consistently unprofitable, having generated combined ratios in excess of 100% in 13 of the past 14 years. Adverse prior-year reserve development in the commercial auto liability lines, a common topic among the earnings calls along with social inflation, has served as a driver of net combined ratio.

Among the country's largest commercial auto underwriters, Zurich Insurance Group AG had the worst combined ratio at 137.5%. Zurich Group CFO Claudia Cordioli quickly mentioned in an earnings call that teams in the US have been exiting some unprofitable relationships in commercial auto, pruning some parts of the company's book, specifically the motor monoliner relationships.

Four other insurers in the analysis had combined ratios of over 120%: Sentry Mutual Holding Co. at 130%, Chubb at 126.2%, State Farm Mutual Automobile Insurance Co. at 123.6% and CNA at 120.3%.

– Read an article about Q1 2025 US commercial auto insurance rates.

– Read an article about the largest private auto insurance underwriters in the US.

Direct loss and DCEE ratio over 100% in two states

New York logged the largest direct incurred loss and defense and cost containment expenses (DCCE) ratio in 2024 at 113%, a 15.6 percentage point deterioration from 2023.

Nevada, which saw the largest year-over-year growth in direct premiums written, also logged a direct loss and DCCE ratio of more than 100%.

In terms of direct premiums written, Texas and California are the largest states for commercial auto direct premiums in the US. When combined, it represents roughly 23.3% of the industry's total direct premiums written in 2024. Insurers reported more than $8 billion in each state for the year.