Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 May, 2025

By Chris Hudgins and Joyce Guevarra

|

Modern skyscrapers in Midtown Manhattan, New York City. |

Of 132 US equity real estate investment trusts that trade on the Nasdaq, NYSE or NYSE American, 56, or 42% of analyzed REITs, paid lower dividends in 2024 compared with 2019, prior to the COVID-19 pandemic, according to an analysis from S&P Global Market Intelligence.

By contrast, dividend levels for 69 REITs, or 52% of the sector, have increased their regular dividend payments over their 2019 level.

The pandemic, coupled with ongoing macroeconomic uncertainties, weakened the underlying fundamentals of several REIT subsectors, leading to reduced dividends across the hotel, office and retail segments, Nitin Mehndiratta, research analyst of dividend forecasting at Market Intelligence, wrote in an emailed commentary.

"REITs were historically viewed as income-generating vehicles with stable and growing dividends. The pandemic served as a stark reminder that payout levels are not immune to economic shocks," Mehndiratta said.

Hotels

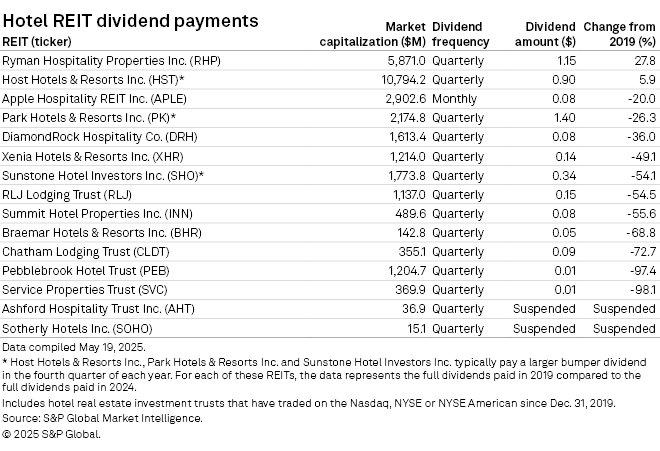

Two hotel REITs, Ashford Hospitality Trust Inc. and Sotherly Hotels Inc., continued suspending their common stock dividend payments, while Pebblebrook Hotel Trust and Service Properties Trust cut their quarterly dividend payments to 1 cent per share.

Conversely, Ryman Hospitality Properties Inc. raised its quarterly dividend payment on Nov. 4, 2024, to $1.15 per share, 27.8% higher than its pre-pandemic dividend rate of 90 cents per share.

Additionally, Host Hotels & Resorts Inc. in 2024 distributed 90 cents per share in aggregate dividend payments, 5.9% higher than the 85 cents per share paid in 2019. For REITs such as Host Hotels, which has consistent year-end bumper dividends, total dividend payments in 2019 were compared with total dividend payments in 2024.

"Hotel REITs remain highly sensitive to fluctuations in business and group travel, which have yet to return to pre-pandemic levels, particularly in urban and convention-focused markets," Mehndiratta said.

Some REITs resumed paying dividends as travel gradually resumed, though often at more conservative levels, he said. "This reflects a cautious approach to capital allocation, as REITs prioritize balance sheet strength in the face of ongoing uncertainty in the corporate travel segment."

Office

The majority of office REITs also paid lower dividends compared with pre-pandemic levels.

Four office REITs — Paramount Group Inc., Piedmont Office Realty Trust Inc., Hudson Pacific Properties Inc. and Creative Media & Community Trust Corp. — suspended dividend payments, while Franklin Street Properties Corp. and Office Properties Income Trust both reduced their quarterly dividend payments to 1 cent per share.

The dividend levels for Vornado Realty Trust, City Office REIT Inc. and Empire State Realty Trust Inc. fell more than 50% compared with pre-pandemic level.

Alternatively, five office REITs in the analysis paid higher dividends compared with pre-pandemic levels.

Office landlords grapple with long-term uncertainty driven by the widespread adoption of hybrid and remote work models, Mehndiratta said, adding that this has fundamentally reduced demand for traditional office space. "Broader macroeconomic headwinds — such as slower economic growth and reduced corporate investment — are further dampening demand for office space, particularly in noncore and secondary markets."

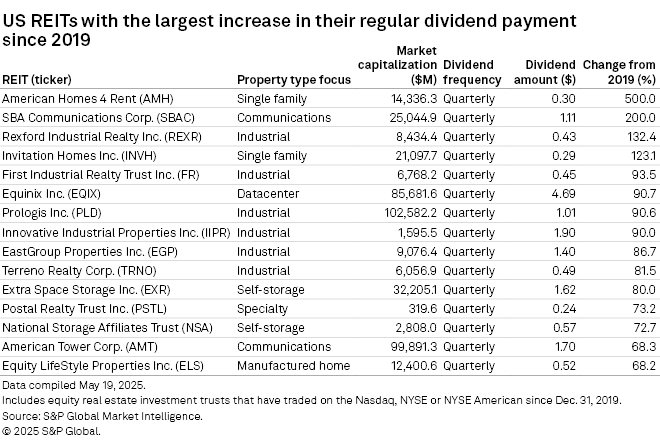

Largest increases

Quarterly dividend payments for two single-family rental REITs are far above their pre-pandemic levels. American Homes 4 Rent declared a 30-cent-per-share dividend in February, six times higher than its pre-pandemic dividend level of 5 cents per share, while Invitation Homes Inc. more than doubled its quarterly dividend payment since 2019 to 29 cents per share.

Two communications REITs also grew their dividends by a significant margin since 2019. SBA Communications Corp. tripled its quarterly dividend since 2019, up to $1.11 per share, while American Tower Corp. increased its quarterly dividend by 68.3% over the same period.

Nine of the 11 industrial REITs in the analysis have increased dividends since 2019, six of which were among the 15 REITs with the largest increases to their regular dividend payments since 2019.

Within the industrial sector, Rexford Industrial Realty Inc. raised its quarterly dividend by 132.4%, the third-largest increase among all REITs in the analysis. Other top industrial REITs by quarterly dividend growth included First Industrial Realty Trust Inc. with a 93.5% increase, Prologis Inc. at 90.6%, Innovative Industrial Properties Inc. at 90%, EastGroup Properties Inc. at 86.7% and Terreno Realty Corp. at 81.5%.

Expected dividend growth

US REITs are forecast to show a 1.9% year-over-year dividend gain on a median basis in 2026, followed by 2.0% growth in both 2027 and 2028 and a 1.9% increase in 2029, according to Market Intelligence dividend analysts, based on historical payment data, news, guidance, financial estimates, debt levels and capital expenses.

REITs remain attractive to income-seeking investors as they must distribute 90% of taxable income to qualify for tax benefits.

As positive macroeconomic shifts, including lower inflation, reduced interest rates and eased trade tariffs emerge, the underlying fundamentals across REIT subsectors are expected to improve, "enabling REITs to incrementally increase dividend payouts while maintaining financial flexibility and reinvestment capacity," Mehndiratta said.