Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 May, 2025

| Charter agreed to combine with Cox to create the largest US cable operator. Source: Charter Communications Inc. |

Amid declining cable video and broadband subscriptions, Charter Communications Inc. and Cox Communications Inc. just announced the biggest US pay TV deal in a decade.

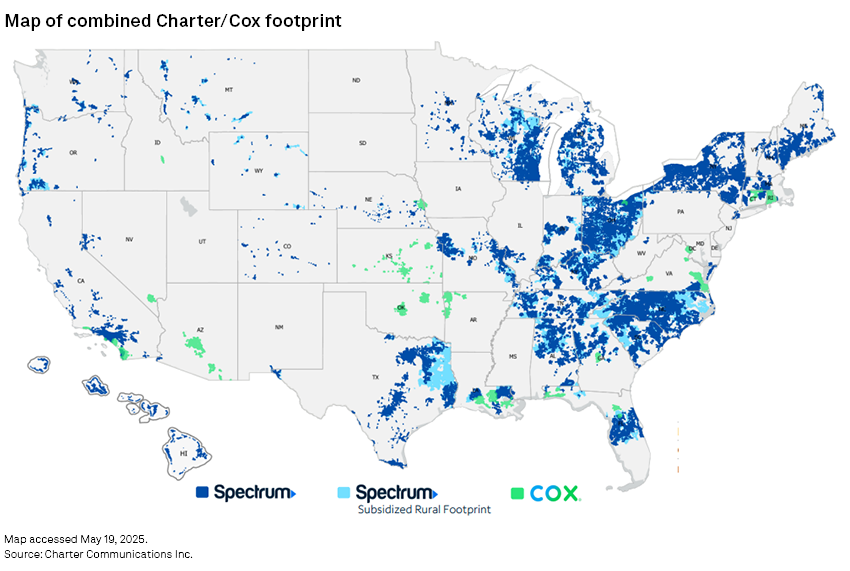

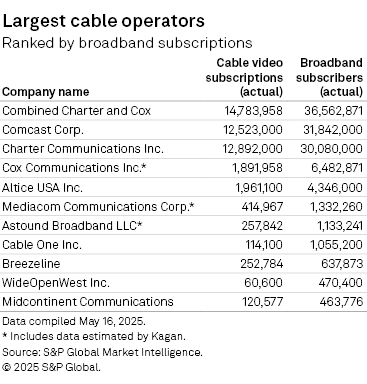

The two cable operators agreed to combine in a $34.5 billion deal that would form the largest US cable TV and broadband provider, the parties said May 16. Based on year-end 2024 figures from S&P Global Market Intelligence Kagan, the combined entity would have over 36 million broadband customers and almost 15 million pay TV customers. Its network would span 46 states, passing nearly 70 million homes and businesses.

|

The transaction represents an industry shakeup at a time when cable mergers and acquisitions were trending downward, both in terms of deal volume and enterprise value. A decade-earlier consolidation wave left potential buyers with a limited pool of targets and balance sheets that made further acquisitions difficult. At the same time, cable operators have been shedding video subscribers amid continued cord cutting and recently started losing broadband customers to increased competition from fixed wireless providers. Now, the Charter-Cox deal is aimed at trying new strategies in an industry often viewed as being in secular decline.

"Through two decades of cable consolidation, Cox has ever been the bridesmaid but never the bride," MoffettNathanson analyst Craig Moffett wrote in a May 16 analyst note. "That Cox was at last willing to accept a merger proposal after saying 'no' so many times is a testament to the recent success, or perhaps rather to the promise, of Charter's still relatively new bundling and packaging strategy."

What each side brings

Starting with its September 2023 deal with Walt Disney Co., Charter has been striking hybrid linear and digital distribution pacts so that it can offer its video customers access to a number of direct-to-consumer streaming services, including Disney+, Max, Paramount+ and Peacock. The company plans to begin marketing these services in earnest in the middle of 2025.

Charter has also been building out its Spectrum Mobile offering, ending the first quarter with 10.4 mobile lines.

"Charter has really impressed us above all others with the way they have spent capital. In the last 5 years, they've spent over $50 billion investing in multi-gig speeds, DOCSIS 4.0 and their wireless offering," Cox Enterprises Inc. Chairman and CEO Alex Taylor said in a call with analysts. "I think they're best positioned for success going forward. The seeds that they have planted are going to grow very, very high."

Cox brings its own strengths to the deal, particularly its success in the business-to-business, or B2B, market.

"Cox was the first and most successful operator to focus on business-to-business communication services starting back in the late 1980s," said Charter CEO Chris Winfrey. The executive noted that Cox has since grown to include Segra, a fiber network operator with assets across 24 states, and RapidScale, a managed services provider. "I think we'll find real upside from Cox's B2B assets and operations over time."

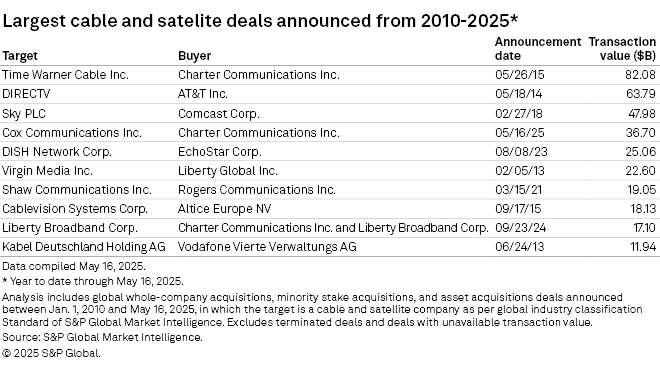

Past deals

Charter is no stranger to big acquisitions. Looking at the biggest cable and satellite deals announced since 2010, Charter has been the buyer in three of the top 10. This list includes Charter's 2015 deal to acquire Time Warner Cable in a transaction valued at $82.08 billion and its more recent combination with Liberty Broadband Corp., valued at $17.10 billion.

Although the Cox deal is much smaller, the 2015 Charter-Time Warner deal could serve as a potential precedent for regulators. To win approval from the Federal Communications Commission under the Obama administration, Charter agreed to extend both low-cost and high-speed broadband service and to adhere to net neutrality principles even in the event such rules were overturned. Specifically, Charter agreed to no data caps or usage-based pricing, and it was prohibited from charging interconnection fees to streaming providers like Netflix Inc. and Hulu LLC for seven years.

The Department of Justice barred Charter from entering into content agreements that could hinder online video providers from licensing content to distributors.

Regulatory approval

The public interest group Public Knowledge said the Trump administration could seek to apply its own conditions on the Cox transaction, a possibility the group called "troubling."

"Will the companies drop cable channels critical of this administration, or agree to censor online content or sites that the administration disapproves of?" Public Knowledge legal director John Bergmayer said.

FCC Chairman Brendan Carr has signaled that he will look to block mergers if companies have policies related to diversity, equity and inclusion. Amid Paramount Global's pending deal with Skydance, Carr has also launched an investigation of a '60 Minutes" interview on CBS News with then-Vice President Kamala Harris.

Winfrey said Charter expects "a fulsome process" in terms of the regulatory review of the Cox deal. "We respect that process, and we're going to do everything we need to to demonstrate why this is really good for America, and it is," he said.

As far as the timing to complete the regulatory review, "We think that could be mid next year," the executive added.