Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Apr, 2025

| Proposed fees on ships built or operated by China could affect the economics of several metals and mining products, companies and organizations have warned. Source: Posnov/Moment via Getty Images. |

A brewing storm looms over a big chunk of the US economy, with exporters and importers across the metals and mining sector pleading with the Trump administration to reverse course on plans for steep fees for Chinese-built and -operated shipping vessels.

The Office of the US Trade Representative (USTR) is looking to quash China's dominance of the global shipping and shipbuilding industry with a proposed rule that would impose fees as high as $1.5 million each on China-affiliated ships entering US ports. However, companies warn the proposal threatens to upend the economics of a variety of industries, several of which the Trump administration has vocally supported. Mining and metals companies and their trade organizations have spoken out against the rule, with domestic steelmakers presenting a notable exception to the wave of opposition.

"Virtually all mining exports move to their final destination by deepwater maritime vessel," Rich Nolan, president and CEO of the US-based National Mining Association trade group, wrote in comments on the rule.

The trade group's members are generally supportive of President Donald Trump's industrial policies aimed at making the US an "industrial powerhouse," Nolan added.

"The administration is doing this by aggressively focusing on policies and actions that will revitalize the US industrial base, secure US energy dominance, protect American jobs, and level the global playing field for American businesses and workers," Nolan wrote. "Unfortunately, the proposed action will have the opposite effect on each of these stated goals."

Many opponents to the rule support the administration's intent to build up domestic shipbuilding, but worry that it would take longer than the proposed rule would allow. The proposed rule would charge $1 million per docking for a ship operated by a Chinese company, $1.5 million for a Chinese ship regardless of the operator, and a fee of up to $1 million based on how many orders for new vessels the operator has with Chinese shipbuilders.

Currently, the US shipbuilding industry produces about five ships per year compared to China's 1,700, according to a March 6 report by S&P Global Commodity Insights.

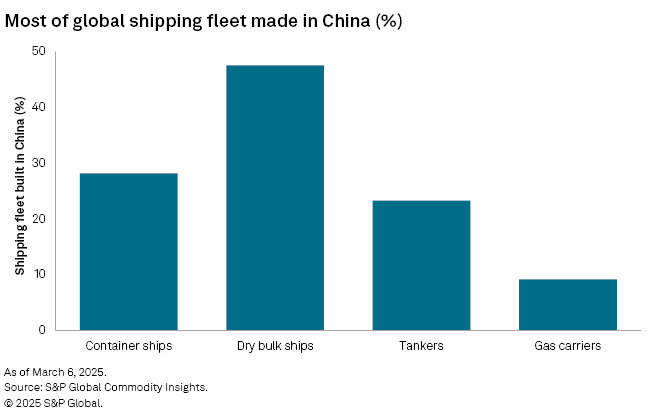

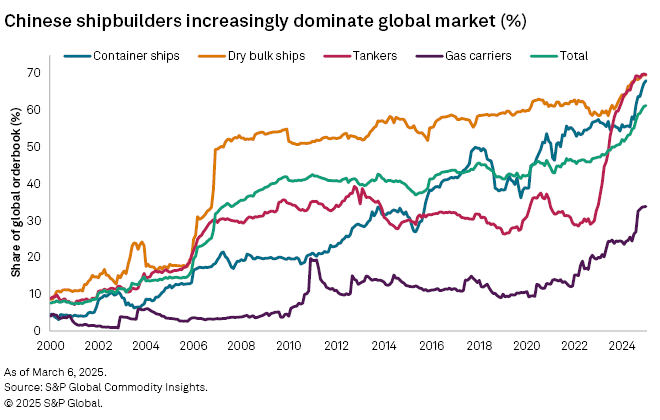

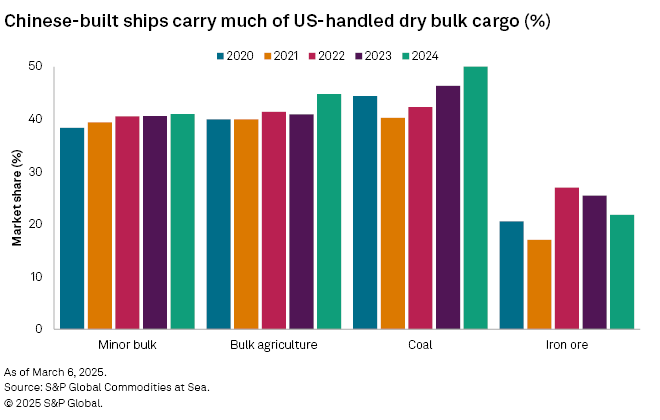

About 48% of the dry bulk fleet, comprising ships that carry large volumes of unpackaged material such as coal or iron ore, were made in China. In 2024, more than half of US-handled coal was shipped on Chinese built ships, while 45% of bulk agriculture and 22% of iron ore handled in the US was shipped on Chinese-built ships, according to Commodity Insights. Chinese companies had captured about two-thirds of the order book for new ships by January 2025.

Many commenters on the rule said they see why the US would want to recapture control manufacturing of global shipping. However, some also raised concerns that the current proposal ignores the drastic near-term impacts and downplays the length of time it would take to build out a domestic ship fleet.

It is unclear how the White House might react to some of the backlash from the rule, particularly as it has roiled segments of the country that are typically supportive of Trump. Representatives for the White House and the USTR did not respond to requests for comment.

Shippers may seek to consolidate their cargoes onto fewer, larger ships to reduce fees. There will be fewer port calls as a result of the rule, so more traffic will be diverted to larger ports at the expense of smaller ports, according to the American Association of Port Authorities (AAPA) and the US Chamber of Commerce.

The Chamber of Commerce warned that the proposed fees mean the congestion and backlogs seen during the COVID-19 pandemic could be the "new normal," raising prices on groceries, energy, automobiles and other manufactured goods. The AAPA, which represents over 80 US ports, said the proposed action could lead to a nearly 12% decline in exports of US goods as "once profitable" products become "impossible to sell abroad."

Metals and mining hit hard

"It's very staggering to see this proposal," Rahul Kapoor, global head of shipping analytics and research for Commodity Insights, told Platts. "If it were to go through in the current form, this is as bad as, I would say, a black swan event for the shipping markets."

Platts is a part of Commodity Insights.

Pittsburgh-based aluminum giant Alcoa Corp., in a letter to the USTR, warned that the potential shipping fees pose a threat to the US aluminum industry and could send alumina shipping costs surging by as much as 140%.

Another aluminum producer that ships alumina on Chinese vessels told Platts that the fees would add $33 per metric ton of alumina on a 30,000-metric-ton cargo. The added cost per metric ton would be even higher for smaller cargo.

"The proposal doesn't take into account ship size, so if you bring in a 20,000-ton cargo, instead of a 50,000-ton cargo, the cost per ton would be greater on the smaller cargoes," a US-based aluminum raw materials trader told Platts. "That could be the biggest driver in freight rates that we've ever seen for those ships."

Mesabi Metallics Company LLC, a subsidiary of India's Essar Group conglomerate, is developing a $1.8 billion iron ore mine in Nashwauk, Minnesota. Mesabi wrote in comments that the USTR's proposal could upend its business plans to begin shipping its iron ore in 2026.

"These measures will not expedite the development of a domestic fleet sufficient for our needs; rather, they are likely to elevate our operational costs and hinder our ability to enter the market efficiently," Mesabi said in its comment.

"We've been looking at this and the cost added on bringing in manganese ore could be more than double the value of the cargoes," a US manganese alloy producer told Platts.

"When you book your containers with a shipping line, you've got no real control over which ship they get loaded on. It could be Chinese-built, or it could be South Korean, you just know date and location," a US-based cobalt trader told Platts. The trader worried that shippers could get hit with the tariffs unexpectedly.

Steel in favor

The US steel sector is one of the few major industry supporters of the USTR proposal.

"[The American Iron and Steel Institute] and its member companies strongly support efforts to address China's unfair trade practices targeting the maritime, logistics and shipbuilding sectors and our members are well-positioned to provide the critical steel products needed to revitalize American shipbuilding," the trade association said in a public comment.

US steel giants Nucor Corp. and Cleveland-Cliffs Inc., which are member companies of the American Iron and Steel Institute, also indicated strong public support of the proposal during a March 24 hearing in Washington, DC.

"Cleveland-Cliffs is supportive of the proposed service fee on Chinese maritime transport operators, as well as the restrictions on services to promote the transport of US goods on US vessels," Patrick Bloom, executive vice president of government relations for the company, said during the hearing.

"I want to assure you that we have the capacity necessary to support the growth of our domestic shipbuilding industry," Bloom added.

In its written comments, Nucor acknowledged April 2 that, despite its general support of efforts to build more ships in the US, the USTR proposal would "reduce the industry's competitiveness" and conflict with the administration's other efforts to promote domestic steel. US steelmakers still lean heavily on a supply chain that goes beyond the country's shores.

"For example, there is currently little to no domestic merchant market supply of major steelmaking raw materials like pig iron and direct-reduced iron and limited domestic supply of other materials like ferroalloys," Nucor said in a statement submitted on its behalf. "The domestic steel industry must therefore rely on international shipping to support steelmaking and commercial operations, both for trade in downstream products and for upstream inputs that cannot be sourced domestically."

The US imported 21.4 million metric tons of iron ore and steel products via ships in 2024, according to data from Commodity Insights. The heavy reliance on maritime supply chains leaves the US steel industry exposed to a surge in input costs should the USTR proposal go through.

"With over 63% of [the US'] iron ore and steel imports conducted via ships and approximately 45% of cargoes carried by Chinese-built vessels, any proposed tariffs by the USTR could significantly increase delivered costs, creating a multiplier effect throughout the supply chain," said Pranay Shukla, S&P Global's head of dry bulk freight and commodities research.

Protectionist measures on steel generally increase steel prices for major consumers such as the automotive and construction sectors, but US steel producers have been historically supportive of these actions as they make domestic steel more competitive compared to imported steel products.

The US produced 48 MMt of iron ore and consumed 37 MMt in 2024, according to the US Geological Survey.