Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

01 Apr, 2025

By Iuri Struta

| Neocloud operator CoreWeave saw explosive revenue growth in 2024, but its IPO on March 28, 2025, underwhelmed amid concerns about its profitability and revenue sources. Source: Michael Santiago/Getty Images News via Getty Images. |

The rapid evolution of AI has led to a new breed of cloud service providers known as AI neoclouds, which are attracting considerable investment despite lingering questions about their long-term prospects.

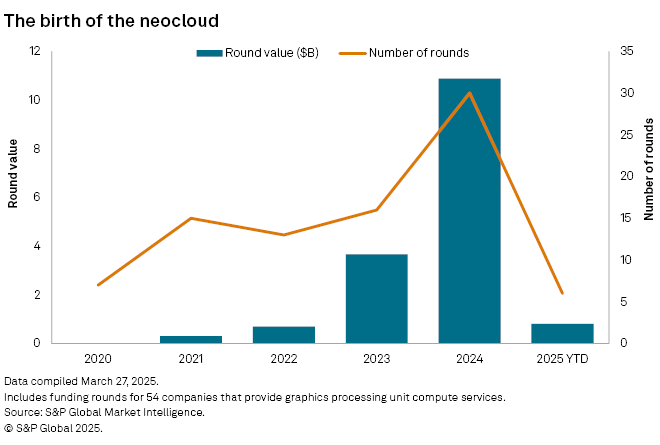

These platforms, often startups, specialize in AI infrastructure by renting out advanced graphics processing unit (GPU) computing resources, generally at a lower cost than the larger hyperscalers. In 2024, venture capital funding for neoclouds hit a record in terms of the number of deals and aggregate round value, which approached $10.9 billion, according to data from S&P Global Market Intelligence. That was up from $3.7 billion a year earlier; more, just four years ago, funding activity for these companies was insignificant. Three months into 2025, the year is already starting off strong, with neoclouds raising more than $800 million across six rounds, signaling continued investor interest.

CoreWeave Inc., a leader in the neocloud industry, hoped to tap into this investor enthusiasm for its March 28 IPO. While the debut succeeded as the largest tech IPO since 2021, raising $1.5 billion, it was nevertheless considered a bit of a disappointment, with shares closing flat at $40 apiece.

"The CoreWeave IPO will likely serve as a bellwether for the market's view on AI," said Melissa Otto, head of TMT investment research at Visible Alpha.

AI hypergrowth

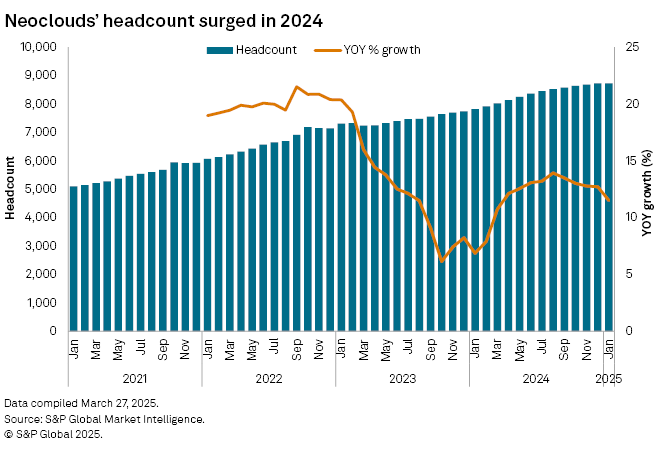

The growth rate of many neocloud companies has been significant. Head count growth started to pick up at the start of 2024, reaching a peak in June, before slightly tailing off in the following months, according to data from S&P Global Market Intelligence.

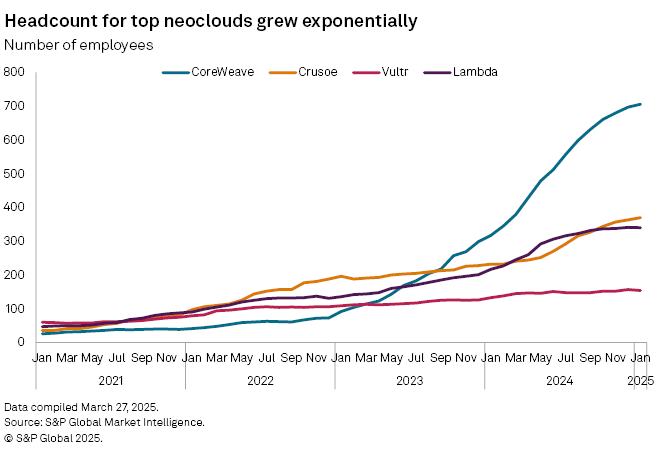

Neocloud companies such as CoreWeave and Crusoe Energy Systems LLC have seen exponential growth in head count, according to data from S&P Global Market Intelligence. The head count growth has followed revenue growth. CoreWeave's revenue surged to $1.9 billion in 2024 from $228 million in 2023.

Fueling this growth is the fact that organizations are open-minded about the cloud provider they use for their AI workloads, making it possible for neocloud operators to compete with the large cloud hyperscalers such as Alphabet Inc., Amazon.com Inc. and Microsoft Corp. A recent 451 Research survey reveals that about 25% of organizations are choosing a different cloud provider for their AI workloads than their primary one for general purpose workloads.

"Dominance as the go-to provider for general-purpose workloads does not translate into generative AI primacy as well," said Melanie Posey, an analyst at S&P Global Market Intelligence 451 Research.

Chipmaker connection

The rise of the neoclouds has been actively supported by chipmakers like NVIDIA Corp. and its smaller competitor Advanced Micro Devices Inc. (AMD). Across a universe of more than 54 neoclouds identified by S&P Global Market Intelligence, NVIDIA invested in five, including Lambda Inc., Crusoe, Replicate Inc., Together Computer Inc. and CoreWeave.

The relationship between CoreWeave and NVIDIA runs deep. CoreWeave touts 32 datacenters with more than 250,000 GPUs, including NVIDIA's newly launched Blackwell chips. NVIDIA not only sells chips to CoreWeave, but it also rents them back for its own AI workloads. NVIDIA owns a 6% stake in CoreWeave and anchored the company's IPO with a reported $250 million share order.

AMD, meanwhile, has its own neoclouds. TensorWave Inc. and Hot Aisle Inc. only offer AMD-branded GPUs for rent. AMD's venture investments arm is an investor in TensorWave and another neocloud, The Constant Co. LLC, also known as Vultr. Hot Aisle announced a funding round in early 2024 to purchase AMD chips but did not disclose the size of the round or the names of investors.

Unproven business

Despite promising growth, the business rationale for neoclouds is still being tested. CoreWeave reported a net loss of $863 million in 2024, versus a net loss of $594 million in 2023. In 2024, 77% of its revenue came from two key customers: Microsoft and NVIDIA.

"Surging demand for AI infrastructure has driven the emergence and growth of these companies, but their business models and return on investment have yet to be established," 451 Research analyst John Abbott said. "There are numerous challenges, including the availability of silicon, getting the supporting power infrastructure for massive energy consumption in place and (not least) evolving and unpredictable geopolitical forces."

CoreWeave is seeking to improve the breadth of its services as it looks to avoid the image of a pure GPU renter. It recently acquired AI development platform Weights and Biases Inc. in a bid to create an end-to-end AI solution for developers.

If further neocloud IPOs are unlikely, M&A could serve as an alternative exit strategy. AI neocloud Lepton AI is reportedly in discussions to sell to NVIDIA for a few hundred million dollars, The Information reported.