Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Mar, 2025

By Nick Lazzaro

|

China-based online retail platforms Shein and Temu held a combined 17% share of the US discount retail market in 2023, according to a Feb. 3 Congressional Research Service report. The companies utilize a direct-to-consumer sales model to ship goods to the US, often with duty-free benefits due to the US de minimis tariff exemption. |

A proposal to end US tariff exemptions for low-value shipments from China may force e-commerce businesses to redefine their business models.

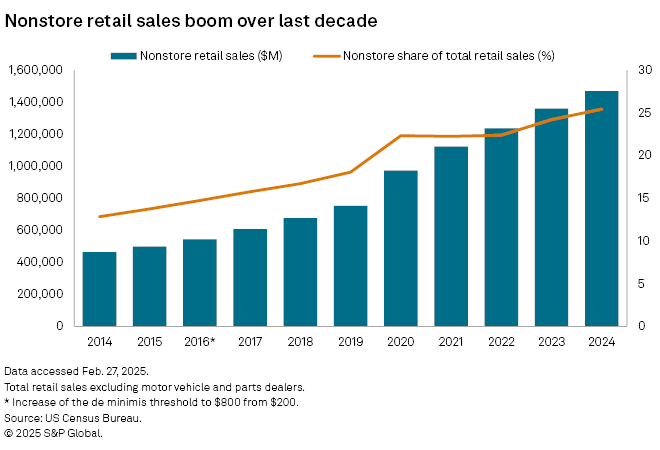

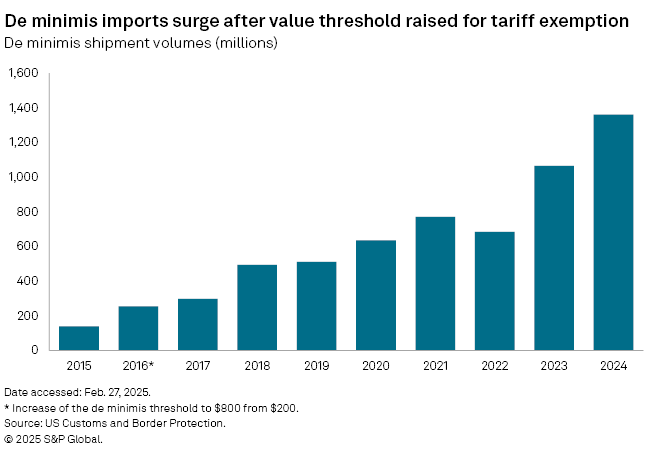

President Donald Trump's administration wants to end the "de minimis" exemption to tariffs as part of a broader campaign of actions targeting US trade partners. The exemption waives duties for shipments below a certain value. The US processed over 1.36 billion shipments under the de minimis exemption in 2024, up over 800% from about 139 million shipments in 2015, the year before the value threshold on shipments was raised to $800 from $200, according to US Customs and Border Protection.

Meanwhile, e-commerce-centric nonstore retailer sales ballooned to $1.470 trillion in 2024 compared with $498.37 billion in 2015, according to US Census Bureau data. Ending the de minimis exemption would add costs for popular e-commerce companies such as Roadget Business Pte. Ltd.'s Shein and PDD Holdings Inc.'s Temu, as well as many third-party sellers on Amazon.com Inc. who source goods from China, threatening the direct-to-consumer model. Many of these businesses rely upon online services in conjunction with the tariff exemption to sell goods to consumers at lower prices.

"The removal of de minimis could be the biggest impact in terms of what has been rolled out [with tariff policy under Trump]," said Matt Lekstutis, director at procurement and supply chain consultancy Efficio, in an interview. "The de minimis exemption has been around for a long time, but with the rise of e-commerce and direct sales, in particular from Chinese manufacturers into the US, the use of it has just exploded."

Pushback against de minimis

Trump attempted to remove the de minimis exemption in a Feb. 1 executive order that also slapped new tariffs on China, Mexico and Canada, but reversed course a few days later. The exemption was indefinitely reinstated Feb. 5, the day after it was supposed to have been revoked, while a new 10% tariff on imports from China went into effect. Similar actions against Canada and Mexico were delayed until at least early March.

"The 48-hour notice served as a wake-up call, signaling to the industry that things were going to change quickly," said Ram Ben Tzion, CEO and co-founder of digital vetting platform Publican, in an email. "Marketplaces, logistics operators and customs brokers need to adjust quickly to the new rules set in place by the Trump administration."

Trump's actions followed attempts in 2024 by former president Joe Biden's administration to limit the scope of the de minimis exemption by requiring more comprehensive shipment reporting and denying exemptions for products subject to certain duty programs, such as the 301 tariffs on China.

As de minimis shipments are monitored much less than other imports, the Biden administration's proposed changes sought to reduce abuse of the exemption. CBP subsequently proposed new rulemaking Jan. 17, which is currently proceeding through a 60-day public comment period.

"This exponential increase [in de minimis imports] has created challenges for CBP's effective enforcement of US trade laws, health and safety requirements, intellectual property rights, and consumer protection rules," CBP said in a statement announcing the proposed rulemaking.

E-commerce disruptions

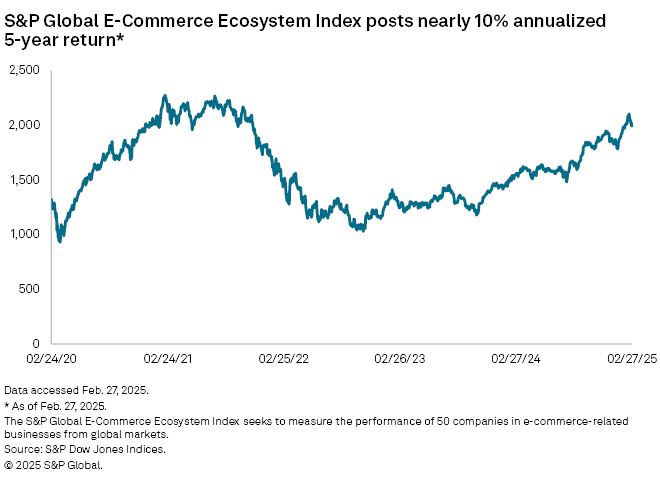

The e-commerce sector has boomed over the last decade. The S&P Global E-Commerce Ecosystem Index, which measures the performance of 50 companies across the world engaged in e-commerce, posted a 28.04% 1-year return and a 9.99% five-year annualized return as of market close Feb. 27, according to S&P Dow Jones Indices data. The S&P 500 overall, meanwhile, recorded a total return of about 17% over the past year.

China-based e-commerce would feel an immediate impact from a de minimis exemption rollback. About 67% of US de minimis imports from 2018 to 2021 were sourced from China, according to a Feb. 3 Congressional Research Service report referencing CBP estimates. Meanwhile, Shein and Temu held a combined 17% share of the US discount retail market in 2023, according to the CRS report.

"Shein, Temu, and similar companies thrived by shipping individual parcels under de minimis," said John Lash, group vice president of product strategy at connected supply chain platform e2open, in an email. "Now, they may have to shift their business models, likely by consolidating shipments into bulk imports and setting up US-based distribution centers to store goods and handle local deliveries."

Shein, Temu and Amazon did not respond to requests for comment.

In the interim, e-commerce trade flows are likely to be affected while changes are made to supply chains.

"In the short term, there's going to be slowdowns in these packages and delays, and then a lot of additional administrative costs as the controls and customs actions get put into place and sorted out," Lekstutis with Efficio said.

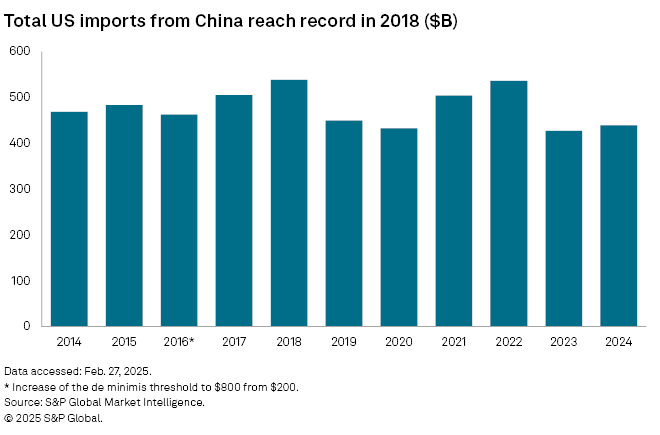

Total US imports from China reached a record $538.51 billion in 2018, up over 11% from 2015, the year before the de minimis threshold was raised, according to S&P Global Market Intelligence data. Imports have subsequently declined since 2018 due to the enforcement of other tariffs and supply chain disruptions, but shipments in 2022 did creep back up near the 2018 level.

Impact on low-income consumers, small businesses

Low-income US consumers would likely experience the biggest impact from the removal of the de minimis exemption, according to a report published by Amit Khandelwal, the Dong-Soo Hahn Professor of Global Affairs and Economics at Yale University, and Pablo Fajgelbaum, a professor of economics at UCLA.

De minimis shipments represent a larger share of imports among low-income consumers, with 73% of direct shipments imported by the poorest zip codes benefitting from the exemption compared to a 52% share for the highest-income zip codes, according to Khandelwal and Fajgelbaum. Without the exemption, lower-income zip codes would be exposed to an overall average tariff rate of 11.8%, higher than the average rate of 6.5% for the highest-income regions, according to the report.

Due to their reliance on e-commerce for their inputs, small businesses would also be disproportionately affected by cost increases if the exemption was revoked, according to the National Foreign Trade Council. A removal of the de minimis exemption would be especially harmful at a time when small businesses are still facing inflationary cost pressures and supply chain issues that are slowly recovering, according to the organization.