Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Feb, 2025

By Ranina Sanglap and Uneeb Asim

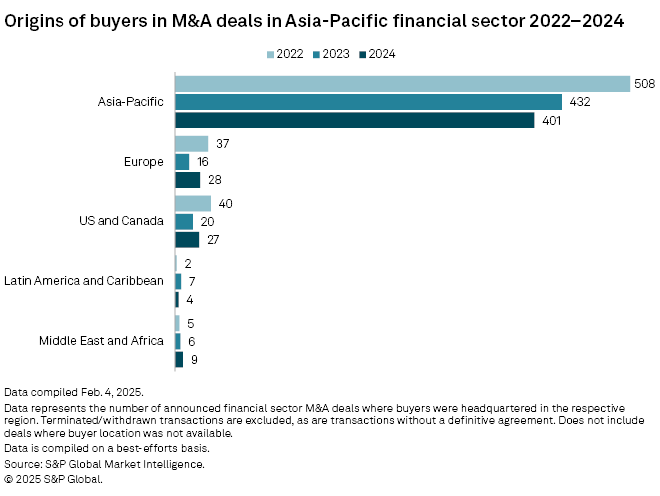

M&A activity in the Asia-Pacific financial sector is expected to recover in 2025, as falling interest rates and easing inflationary pressures create favorable conditions for dealmaking in the region.

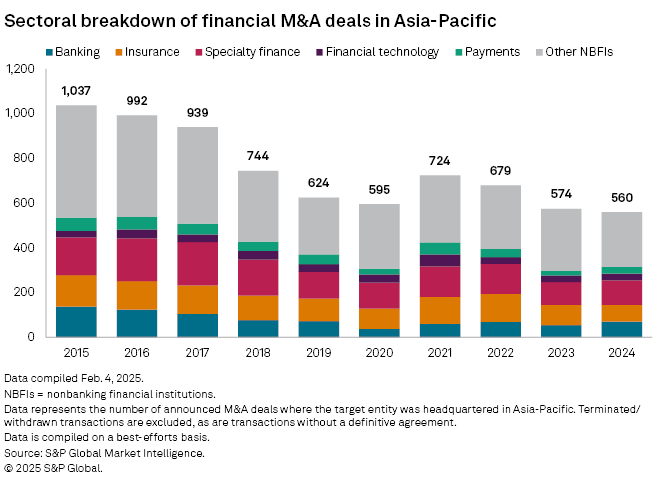

The number of deals in the region's financial sector dropped 2.4% to 560 in 2024 from 574 in 2023, dragged by slower activity in the insurance and other nonbanking financial industries, according to data compiled by S&P Global Market Intelligence. The banking, specialty finance and payments industries recorded year-over-year increases in deal counts in 2024.

"APAC's financial sector M&A will be shaped by Japanese expansion, [private equity] capital deployment and strong growth in India and Southeast Asia," Wiljadi Tan, founder and managing partner of Protemus Capital, told Market Intelligence in an email.

Interest rate cuts

Most of Asia's central banks are expected to cut interest rates two or three times in 2025, analysts at BNP Paribas said Feb. 12, as subdued domestic demand, potential global trade disruptions and limited room for fiscal stimulus all combine to make looser monetary policy an attractive option for policymakers.

Japan, however, could be an exception, as the country's central bank is widely anticipated to raise rates later this year after ending its negative interest rates policy in March 2024.

Easing of inflation and falling interest rates could positively impact dealmaking, with buyers more likely to transact where their borrowing costs are lower, according to M&A advisers at global law firm Norton Rose Fulbright.

"This acts as a lowering of the barrier to entry on deals, and with such lowering, we expect to see greater dealmaking in Asia," the advisers said in a report published in January.

Bucking the trend

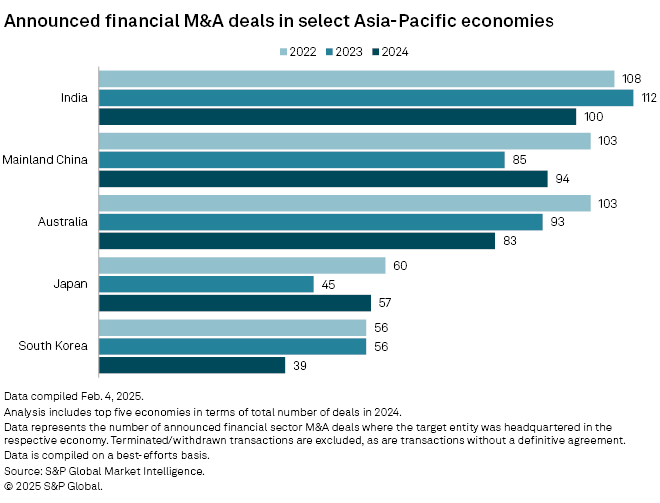

Mainland China and Japan bucked the trend of a decline in M&A activity in the region last year. Deal count in mainland China rose to 94 in 2024 from 85 in 2023, while deals in Japan climbed to 57 from 45.

The increase in M&A activity in Japan is likely to persist in 2025 as financial firms seek acquisitions to bolster their bottom lines. Japanese megabanks, for instance, are actively pursuing deals in Indonesia and India to capitalize on their excess liquidity and high profits, according to Tan of Protemus Capital.

In one such deal, Sumitomo Mitsui Financial Group Inc. acquired the remaining 25.1% stake in SMFG India Credit in March 2024, making it a wholly owned subsidiary. Meanwhile, Mitsubishi UFJ Financial Group Inc. is looking into potential acquisitions in India to bolster its presence in the world's most populous nation, a bank executive told Bloomberg News in November 2024.

Overall, the region's banking sector is set to continue its dealmaking momentum in 2025 as regulators push for consolidation, analysts said.

"Regulators in China, India and Indonesia are pushing for bank mergers to strengthen balance sheets and address nonperforming loan issues, particularly among smaller banks," Tan said.

The wealth management space is among the bright spots for dealmaking, Tan said. "APAC remains a key market for wealth management M&A, particularly in India and China, with robo-advisory services projected to capture a growing share of high-net-worth assets," he noted.

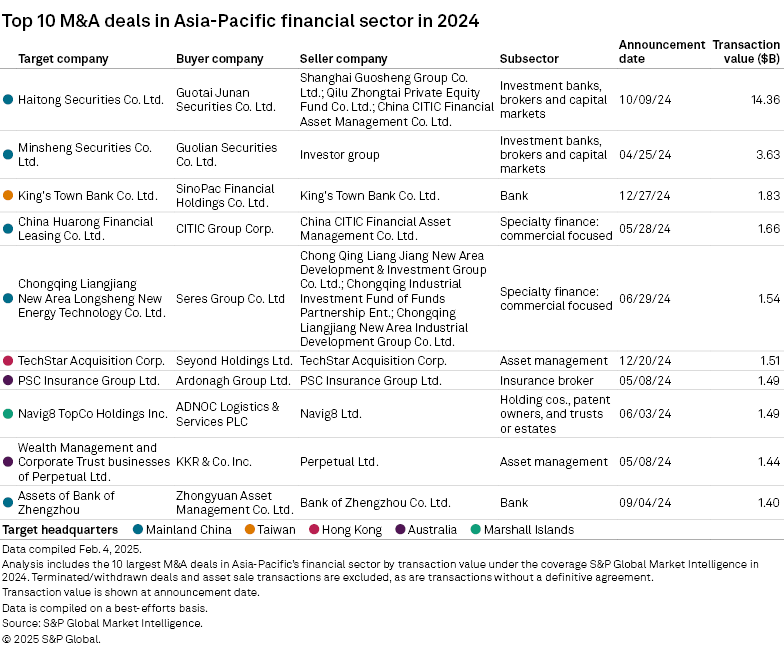

Largest deals

Mainland China was home to five of the 10 largest M&A deals in the financial sector in 2024, with Guotai Junan Securities Co. Ltd.'s proposed $14.36 billion acquisition of Haitong Securities Co. Ltd. topping the list, according to Market Intelligence data. The deal is expected to create the largest brokerage in mainland China with about 1.619 trillion yuan in assets.

Other notable deals in 2024 included Taiwan-based SinoPac Financial Holdings Co. Ltd.'s pending acquisition of King's Town Bank Co. Ltd. for $1.83 billion and KKR & Co. Inc.'s planned acquisition of the wealth management and corporate trust businesses of Perpetual Ltd. for $1.44 billion.