Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Feb, 2025

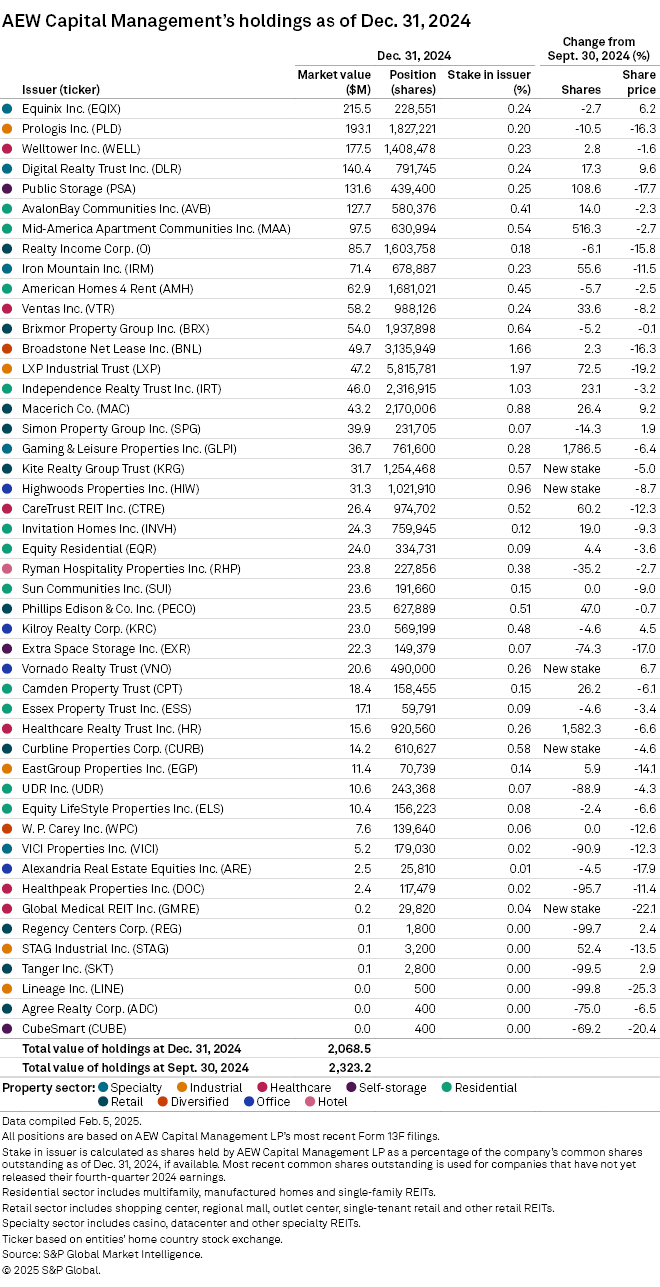

AEW Capital Management LP added five new positions to its US real estate investment trust portfolio in the fourth quarter of 2024 while also selling off six of its REIT holdings during the period, its latest Form 13F filing shows.

The total market value of the firm's holdings fell 11% quarter over quarter to just under $2.07 billion. This is as share prices across the REIT sector plunged near 2024-end.

New additions

The largest new addition to the firm's portfolio was Kite Realty Group Trust, with AEW buying more than 1.2 million common shares in the shopping center REIT during the quarter, a position valued at $31.7 million at year-end.

AEW also purchased more than 1 million shares in office REIT Highwoods Properties Inc. during the quarter, a position valued at $31.3 million as of Dec. 31, 2024.

Other new additions included office REIT Vornado Realty Trust and retail REIT Curbline Properties Corp., valued at $20.6 million and $14.2 million at year-end, respectively.

AEW also bought back into healthcare REIT Global Medical REIT Inc. during the quarter, having previously sold the position in 2022. The firm's shares in Global Medical REIT were valued at roughly $230,210 as of Dec. 31, 2024.

– Set email alerts for future Data Dispatch articles.

– For further institutional investor research, try the Investor Targeting tool.

– View AEW Capital Management's holdings history here.

Position increases

In addition to the firm's new positions, AEW increased share count in 20 of its existing REIT holdings.

AEW increased its stake significantly in Gaming & Leisure Properties Inc., adding another 721,230 shares of the casino REIT to its investment portfolio. The firm's position in Gaming & Leisure Properties was valued at $36.7 million as of Dec. 31, 2024 — its 18th-largest position by market value.

The investment firm also increased share count in healthcare REIT Healthcare Realty Trust Inc., boosting its holding by 865,840 shares to $15.6 million at year-end.

AEW increased its position in multifamily REIT Mid-America Apartment Communities Inc. more than six-fold during the quarter, making it the firm's seventh-largest holding by market value at year-end, at $97.5 million.

The firm also doubled its share count in self-storage REIT Public Storage. This is now its fifth-largest position and is valued at $131.6 million at year-end.

Exits

AEW sold out of six REIT positions in the fourth quarter. The largest was a 203,452-share stake in communications REIT American Tower Corp., a position valued at roughly $47.3 million the quarter prior.

The investment firm sold a 498,060-share stake in office REIT BXP Inc., a stake valued at $40.1 million the prior quarter.

AEW also exited its stake in two industrial REITs, Americold Realty Trust Inc. and Rexford Industrial Realty Inc., as well as positions in ground lease-oriented Safehold Inc. and office REIT Empire State Realty Trust Inc.

Position decreases

In addition to the firm's exits, AEW trimmed share count in 20 of its existing REIT positions during the fourth quarter of 2024.

The firm sold the vast majority of stakes in industrial REIT Lineage Inc., shopping center REIT Regency Centers Corp., outlet center REIT Tanger Inc. and healthcare REIT Healthpeak Properties Inc. It also sold more than 90% of its stake in casino REIT VICI Properties Inc. during the quarter as well as nearly 89% of its share count in multifamily REIT UDR Inc.

Largest holdings

Datacenter REIT Equinix Inc. was the firm's largest position by market value at year-end, at $215.5 million.

Industrial REIT Prologis Inc. followed next at $193.1 million, followed by healthcare REIT Welltower Inc. at $177.5 million.

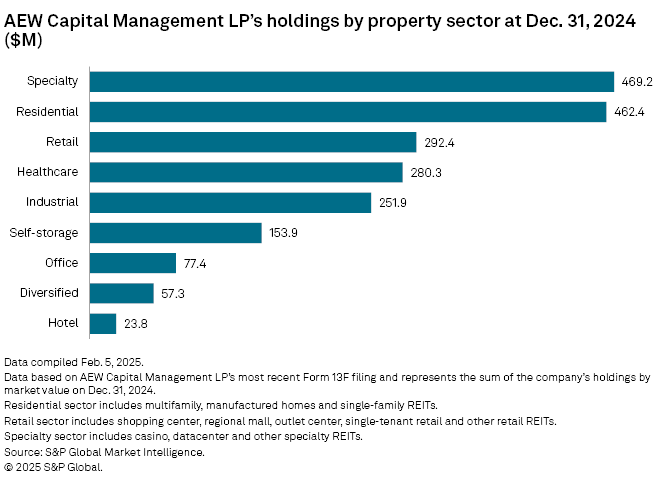

By property sector, AEW held the largest exposure in specialty REITs — which consists of casino, datacenter and information storage REITs — at $469.2 million in aggregate.

The residential REIT sector — including multifamily, manufactured homes and single-family REITs — followed next at $462.4 million.