Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Mar, 2024

By Ben Dyson and Jason Woleben

Shareholders of Direct Line Insurance Group PLC face a choice of a quick gain or possible higher rewards down the line after ageas SA/NV indicated its interest in buying the UK personal lines insurer.

Ageas said Feb. 28 that it was considering an offer equivalent to 233 pence per share for Direct Line, whose valuation has yet to fully recover from the capital trouble it hit at the beginning of 2023, which led to the cancellation of its final 2022 dividend. The potential offer values Direct Line at just under £3.1 billion.

Direct Line said it rebuffed Ageas's "uncertain, unattractive" approach, which it received Jan. 19, as it "significantly undervalued" the group and its prospects. But the door is now open to further offers from Ageas or other suitors. At the same time, Direct Line is in the middle of a turnaround, and new CEO Adam Winslow, whose tenure began just two days after Ageas announced its bid, has not yet had a chance to make his mark on the company.

Repairing the company rather than selling it is "obviously a slower way to do it, but ultimately should lead to a higher value recognition over time," Abid Hussain, analyst at Panmure Gordon, said in an interview. "Both of those options need to be considered by shareholders, and those are both a reasonable path to follow."

Direct Line's management and new CEO were "right to defend their position and show the path that they would want to follow," Hussain said, noting that the company was quick to take action to restore its capital after its problems in early 2023. But the analyst added that the company now faced the "slow, hard work" of improving processes and culture, and "that will take time."

More money

Direct Line warned in early January 2023 that a combination of winter weather claims, motor claims inflation and a drop in the valuation of its commercial property investments meant its 2022 solvency ratio would be at the lower end of its 140% to 180% target range, and so it was cancelling its final 2022 dividend. Two weeks later, group CEO Penny James stepped down. The company eventually reported a solvency ratio of 145%. To bolster its solvency capital, Direct Line sold its brokered commercial lines business to fellow UK insurer RSA Insurance Group Ltd., a subsidiary of Intact Financial Corp., which it estimated would raise its solvency ratio by 45 percentage points.

The effect of the commercial sale has yet to show up in Direct Line's published numbers, but the sale means "the solvency position is now fixed in our view," UBS analyst Nasib Ahmed said in a March 4 research note.

While Direct Line has defended its independence so far, a firm and higher offer from Ageas or another suitor could change its mind. "I think the issue is just the valuation," Thomas Bateman, analyst at Berenberg, said in an interview, adding that Direct Line's shareholders "have gone through quite a period of pain." If a suitor upped the offer slightly from Ageas's 233 pence, "I wouldn't be surprised if they take that deal," Bateman said. "It's not often these types of acquisitions get voted down."

One reason Direct Line likely felt it could push back on Ageas's offer so strongly is because it was not a firm one, Bateman added.

Hussain said an offer would need to be at least 30 pence higher to start a conversation, and the cash and share balance might need to be tweaked. But the analyst added that a new offer "doesn't need to be a materially higher number" because the group's earnings base is now lower following the sale of the brokered commercial lines business.

Ageas has not ruled out a further offer. Under the UK Takeover Code, Ageas has until March 27 to either make a firm offer or announce that it does not intend to make one.

When asked for comment, an Ageas spokesperson pointed to the Takeover Code deadline and noted that it can be extended with the consent of Direct Line's board and the Takeover Panel. "We will communicate in due time," the spokesperson said in an email. Direct Line declined to comment beyond its Feb. 28 response to Ageas's announcement.

An offer from another suitor is also possible, analysts said. An offer would be more likely to come from an insurer elsewhere in Europe than the UK, Hussain said. He added that private equity companies have also been known to buy UK insurers, an example being Bain Capital's purchase of UK personal lines insurer esure Group PLC in 2018. "It's not a huge deal, so private equity could also be interested," Bateman said.

Direct Line's investors, at least, seem to think that some kind of deal is likely. Direct Line's share price jumped 23.8% to 202.20 pence on the day of Ageas's announcement, from 163.35 pence the day before, and has gone up further since, closing at 209.80 pence March 4. "That implies that at least the people who are looking into this more think that a deal is becoming more likely," Bateman said.

Logical combination

Ageas's acquisitions over the past three years have been smaller, minority deals, which included upping its stake twice in India-based joint venture Ageas Federal Life Insurance Co. Ltd. The company now writes life and nonlife business in 13 countries following the sale of its French life business in 2023. It derived just under 30% of its €17.12 billion of 2023 inflows from its home market of Belgium, 21.1% from other European countries and 47.7% from Asia.

Ageas said when announcing its interest in Direct Line that its proposed offer is in line with its mergers and acquisitions criteria and its current three-year plan because it would further strengthen its position in a European market where it already operates and shift its profile toward controlled entities and nonlife business.

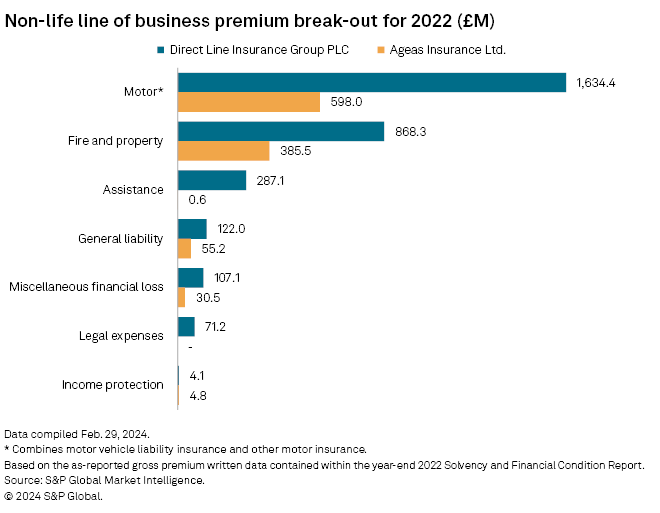

A deal between the two companies would make sense, according to analysts. A combination of Direct Line Group and Ageas's existing motor- and home-focused UK insurer, Ageas Insurance Ltd., would take the No. 1 spot in UK nonlife personal lines. The advent of the UK Financial Conduct Authority's general insurance pricing practices, which prevent insurers offering cheaper rates to new customers than existing customers with the same risk profile, should curb customers' tendency to switch insurers every year, benefiting those with larger books of business, according to Hussain. "You need scale even more so than in the past to make this business work."

As both Direct Line and Ageas' UK unit play in similar areas, there is scope to lower costs and capital requirements. UBS' Ahmed estimated €120 million of cost savings, which would cost €180 million to implement, and €175 million of capital synergies arising from increased diversification and capital model optimization.