Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Sep, 2023

By Lauren Seay and Ronamil Portes

Constant communication with the Street, better-than-feared quarterly results, and nondisclosure agreements with top depositors allowed Western Alliance Bancorp. to survive being caught in the crosshairs of the March bank failures while other banks met different fates.

A handful of banks found themselves facing stock price pressure and large deposit outflows after the failures of Silicon Valley Bank and Signature Bank, as the market looked for banks with similarities. Among those, First Republic Bank failed in May, while PacWest Bancorp stuck it out by making drastic moves to shrink before eventually selling to Banc of California Inc. Western Alliance, on the other hand, emerged on the other side of the spring tumult alive and independent.

The company was able to pull through thanks to its frequent communication with investors, analysts and key depositors, and with strong quarterly results that highlighted its differences from the banks that failed, equity analysts and the company told S&P Global Market Intelligence.

"Once the passage of time happened and we've seen two quarters from Western Alliance, the market began to say, 'OK, this feels like the end of it.' The company has made progress on what they told us they're going to do strategically, and there's really no weak link anymore," Keefe, Bruyette & Woods analyst Christopher McGratty said in an interview. "They've made a lot of progress in a very short amount of time."

Surface similarities

Like PacWest and First Republic, Western Alliance faced stock price pressure and deposit outflows in the wake of the first two failures.

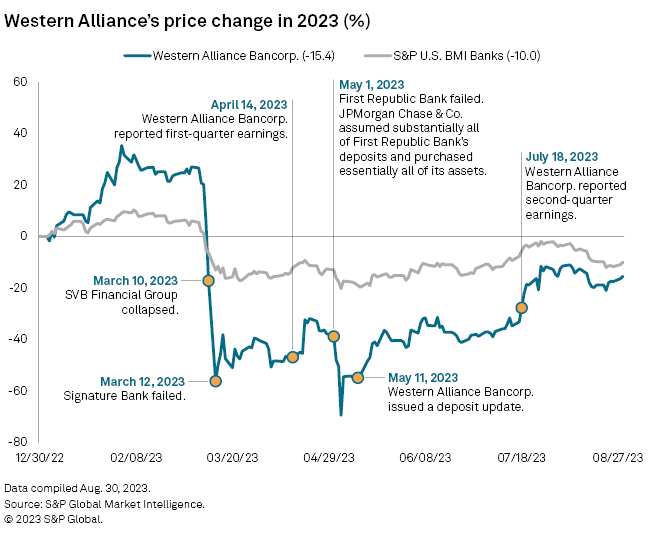

On March 13, the Monday after Silicon Valley Bank and Signature failed, Western Alliance's stock price dropped over 63% from its closing price on March 7, prior to the tumult. The company's stock quickly became the cheapest US bank stock by price to estimated earnings per share as of March 16 and the fourth-worst performing US bank stock by total return in March, according to Market Intelligence data. Then, Western Alliance's stock price took another hit after First Republic's failure.

The company also saw large deposit outflows in the immediate aftermath of the March failures, and $8 billion was withdrawn from the bank on March 13 alone.

Western Alliance was caught in the crosshairs after the market began screening for banks with similarities to Silicon Valley Bank and Signature Bank, such as venture capital and technology sector deposit exposure and high levels of uninsured deposits. While some market participants likened the company to the banks that had failed, those comparisons were unfair and just a "knee-jerk reaction," D.A. Davidson analyst Gary Tenner said in an interview.

Western Alliance had exposure to venture capital and the technology industry, but it made up a small portion of the bank's deposit base, a "very manageable" level of exposure, McGratty said.

According to an intra-quarter update issued March 10, Western Alliance had technology-related deposits of $6.5 billion and equity fund resources and life sciences deposits of $1.5 billion, making up 13% of the company's $61.5 billion in total deposits at March 9.

"People perceived them to be a lot more private equity- or tech-focused, kind of the customers that Silicon Valley had, and while they did have that, that wasn't really a huge portion of the business," Hovde analyst Ben Gerlinger said in an interview. "It wasn't really fair, in my opinion, to essentially say that they're going to fail or were doomed [after] the stock move that Monday because if you were to wipe out the entire private equity business ... the bank is still solvent and still operates quite well."

Another focus of investors looking for banks similar to Silicon Valley and Signature was uninsured deposits, which made up more than half of Western Alliance's total deposits at Dec. 31, 2022. However, that was well below Silicon Valley Bank and Signature Bank's 93.8% and 89.3% in the fourth quarter of 2022, respectively.

Solace for the Street

In the face of those comparisons, frequent communication with stakeholders was a key part of Western Alliance's survival. The company provided intra-quarter updates including details on deposits and available liquidity, which the market was "relying [on] and looking at those as key indicators," Tenner said.

"That's where Western Alliance shined because, in the aftermath, they put out as many press releases as they deemed necessary," Gerlinger said.

The company used those updates to "clearly and consistently communicate what sets us apart from those banks that failed," Western Alliance President and CEO Ken Vecchione said in a statement to Market Intelligence. "The way Western Alliance Bank reacted to the banking industry challenges this year has everything to do with who we are as a company: We're agile, we're resourceful and we're committed to transparency."

Those updates held investors over until the company's first-quarter earnings report in April, which was better than some observers feared. While there was still a lot of uncertainty in April, Western Alliance showed that deposit outflows had quickly stabilized and it "communicated a clear plan on capital, clear plan on liquidity, clear plan on deposits and the market believed them," McGratty said.

While first-quarter results helped boost the market's confidence, second-quarter results were the "all clear," Tenner said. The bright spot for the quarter was the company's deposit growth of $3.5 billion, which "validated the deposit franchise and all the work they had done," Tenner said.

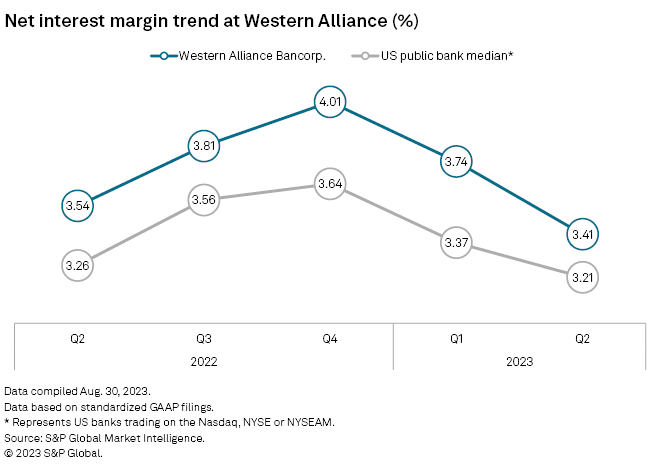

Moreover, investors were encouraged by the bank's net interest margin and net interest income outlook, after fearing large downward revisions, analysts said.

Besides the frequent intra-quarter updates and quarterly results, a more unique approach the company employed was signing nondisclosure agreements (NDAs) with large depositors to give them up-to-date deposit information when requested.

"The big core depositors, the ones you don't want to lose, had inside information at that time that allowed for them to kind of quell any fears. So you didn't see the ripple effect," Gerlinger said. "You might lose customers in a number of accounts, but you didn't lose the big ones."

The NDAs were "paramount to building trust and retaining relationships," Western Alliance's CEO said in the statement.

Balance sheet moves

Still, even with its good communication, Western Alliance had to move quickly to prove its strength. In order to restructure its balance sheet and bolster capital, the company sold $1.74 billion in assets and reclassified $6 billion of held-for-investment loans to held-for-sale during the first quarter.

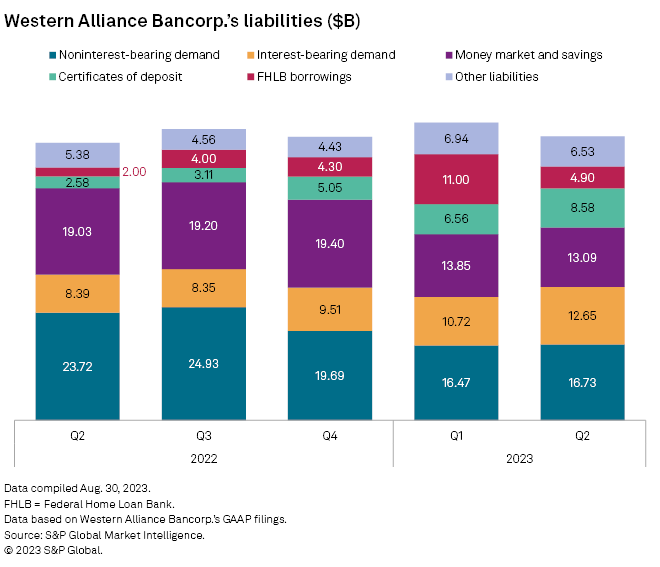

To shore up liquidity, the company tapped into Federal Home Loan Bank borrowings, which increased to $11.0 billion in the first quarter from $4.30 billion in the prior quarter.

Availing itself of that wholesale funding allowed the bank to avoid paying up for deposits — a worry among investors. There was a fear the company would hurt its profitability by bringing on deposits at an above-market rate and offering high-rate certificates of deposit in order to restore its deposit base, Gerlinger said.

By tapping FHLB borrowing, the company could get the extra liquidity it needed without disrupting its profitability for a long duration, he said.

Western Alliance's net interest margin has moved largely in line with industry trends, falling to 3.41% in the second quarter from 4.01% in the fourth quarter of 2022.

Moving forward

While Western Alliance will grapple with the headwinds that all banks are facing, such as funding cost pressures, analysts are bullish on the company's future.

"It's probably set up better than most of the bank space," Gerlinger said. "Functionally, I think Western Alliance has a better opportunity because they're growing deposits at a faster rate. They have a healthy credit underwriting."

In the company's second-quarter earnings call, executives guided to $2 billion in deposit growth per quarter and $500 million in loan growth. Western Alliance will also continue to build capital, with a goal of getting its common equity Tier 1 ratio to

The only hurdle that could arise is credit, as the industry waits for credit quality metrics to normalize after remaining pristine since the COVID-19 pandemic, analysts said.

"Credit really becomes the next great unknown to the group overall as we get into the back half of the year and 2024," Tenner said. "There's a very well-known and well-discussed concern over office [commercial real estate (CRE)], but [Western Alliance doesn't] actually have a ton of office CRE. They've got exposure in areas like hotels, hospitality, but have continued to express a high degree of confidence in their credit book."

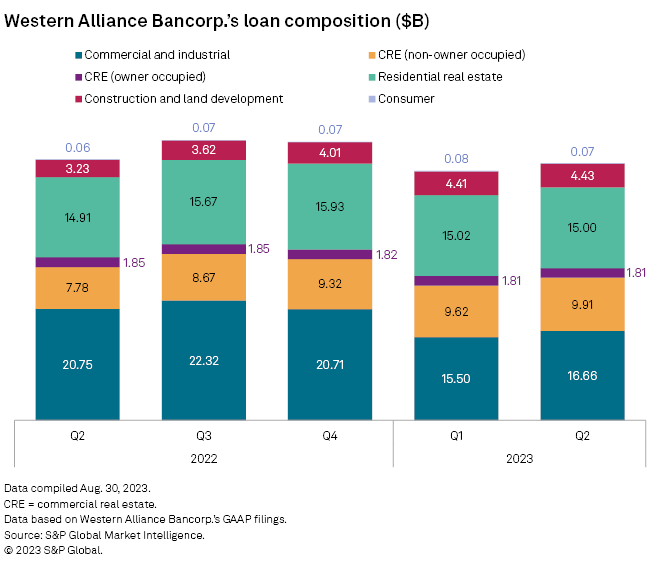

The company's non-owner-occupied CRE book totaled $9.91 billion at June 30 while owner-occupied comprised $1.81 billion.

Like most banks right now, Western Alliance likely will not aggressively pursue growth in the near future due to recent events and the current operating environment.

"They were playing defense," Gerlinger said. "They've moved to offense and the last thing you want to do is really press the gas when people are a little skittish of the overall story and the banking industry in general in terms of credit and profitability."

Analysts are also bullish that the company's stock will continue to move higher. The company is currently trading at 1.11x tangible book value, up from 0.65x on March 13 but still down from 1.79x on March 7.

"They're pretty discounted relative to where they have been, competitors and the industry as a whole. So it seems like it's a pretty solid opportunity for the stock to continue to outperform," Gerlinger said.