Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Jul, 2022

By Bill Holland

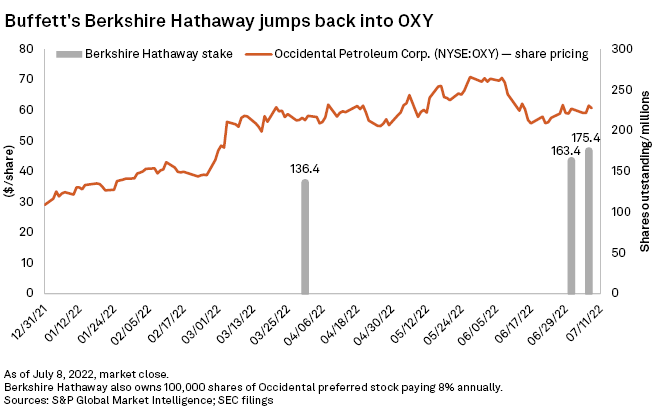

Billionaire Warren Buffett's holding company, Berkshire Hathaway Inc., purchased an additional 12 million shares of oil and gas major Occidental Petroleum Corp. in July for nearly $698 million, increasing its stake in Occidental to 18.7% of the common stock, according to SEC filings.

Berkshire Hathaway sold all its common shares of Occidental during the oil crisis of 2020 but has been buying again over the past six months. Berkshire Hathaway is now Occidental's single largest shareholder.

At least one analyst sees these moves as a sign that Buffett is eyeing full Occidental ownership. Berkshire Hathaway did not respond to a request for comment on its Occidental share purchases.

Berkshire Hathaway also owns 100,000 shares of preferred stock in Occidental that pay an 8% annual dividend. Berkshire Hathaway bought the preferred issue in 2019 for $10 billion in cash, which Occidental used as part of its successful $57 billion bid for Oklahoma oil and gas company Anadarko Petroleum Corp., beating out Chevron Corp. Berkshire Hathaway still holds warrants from that deal giving it the option to buy 83.9 million more common shares of Occidental, or another 9% of the company, at $59.624 per share.

Occidental opened the market July 11 at $59.58 per share.

Truist Securities Inc. oil and gas analyst Neal Dingmann suspects that Buffett will pull the trigger on those options and more when the credit rating agencies move Occidental up to investment-grade status, probably later this year. Occidental is rated BB+, one notch below investment grade, by S&P Global Ratings.

"We believe there is good chance billionaire investor Warren Buffett buys the remaining two-thirds of Occidental that he and Berkshire Hathaway do not own once the company becomes investment grade," the Truist analyst said in a June 23 note.

Truist thinks that Occidental's geographic and commodity offerings fit well with the investment-grade pipeline and utility holdings of privately held subsidiary Berkshire Hathaway Energy. Occidental's new low-carbon business unit makes it even more attractive, Truist said.

"We believe Occidental is ideal to be fully purchased by Buffett once investment-grade status is met and more Low Carbon Ventures business is generated," Truist said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This S&P Global Market Intelligence news article may contain information about credit ratings issued by S&P Global Ratings. Descriptions in this news article were not prepared by S&P Global Ratings.