Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Mar, 2022

HSBC Holdings PLC will supplement its latest net-zero goals with targets for capital markets activities once an industry standard is launched in 2022.

The U.K.-based bank on Feb. 22 said it aims to reduce emissions linked to loans to the oil and gas sector 34% by 2030, among other goals, in line with industry guidance from the Net-Zero Banking Alliance. But that guidance only requires targets for investment and lending, meaning banks can omit off-balance sheet activity such as underwriting.

Investor activist groups ShareAction and Market Forces criticized the fact that HSBC's targets cover on-balance sheet activity only. ShareAction said it is "concerning," given that research suggests most of HSBC's financing to upstream oil and gas majors is via capital markets underwriting. HSBC's decision to categorize the distribution of syndicated loans as capital markets activities is "controversial," ShareAction said.

Market Forces said HSBC's targets can be met by moving exposures off the bank's balance sheet instead of actually restricting financing to the oil and gas sector.

HSBC said it has committed to setting short- and medium-term targets for financed emissions in the oil and gas sector, including capital markets activities.

An industry-accepted approach for assessing capital markets-based financing is being developed by the Partnership for Carbon Accounting Financials, or PCAF, a global partnership of financial firms that provides a framework for banks to assess and disclose greenhouse gas emissions, an HSBC spokesperson told S&P Global Market Intelligence.

"As soon as an industrywide capital markets methodology is launched in 2022, we will work to set short-term targets here too," the spokesperson said. In its 2021 annual report, HSBC reported capital markets-financed emissions, and the bank is engaging with clients who are major oil and gas producers on their net-zero transition plans regardless of on- or off-balance sheet funding, the spokesperson said.

Creating an industry standard

Banks face a range of challenges in agreeing on such industry standards, including how underwriting activity is captured, Market Intelligence previously reported, citing PCAF Executive Director Giel Linthorst. Institutions measure on-balance sheet emissions at a certain point in time, but this does not lend itself well to measuring underwriting activity, which is short-term in nature and can fluctuate significantly, the executive said.

While PCAF discussions are progressing, the Net-Zero Banking Alliance said it will consider off-balance sheet activities in the next version of the guidelines, which are due in April 2024.

By 2030, HSBC aims to cut on-balance sheet financed emissions — Scope 1, 2 and 3 — for upstream oil and gas companies and integrated or diversified energy companies. Scope 1 and 2 emissions are those linked to a company's own operations and Scope 3 are those associated with their value chains.

The bank also set a 75% reduction target for the power and utilities sector. It aims to reach on-balance sheet financed emissions intensity of 0.14 million tonnes of CO2 equivalent/TWh by 2030, compared with its 2019 baseline of 0.55 Mt CO2e/TWh. This captures Scope 1 and 2 emissions of upstream power generation companies.

Market Forces said this target is a "major loophole" since it does not guarantee absolute emissions reduction from power plants.

HSBC said it has adopted an emissions intensity metric for power and utilities companies to account for an expected rise in electricity demand.

The bank's targets demonstrate that management is addressing risks related to these business activities and the concerns of external stakeholders, Pauline Lambert, executive director of financial institutions ratings at Scope Ratings, told Market Intelligence.

Scope includes environmental considerations when assessing banks' long-term sustainability, but HSBC's latest targets are "not currently a driving factor" for its credit rating, Lambert said.

Road to sustainable finance

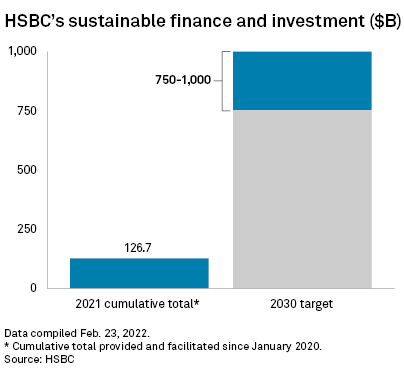

HSBC said it provided and facilitated $82.6 billion of sustainable finance and investment in 2021, bringing the cumulative amount since January 2020 to about $126.7 billion. It is targeting a total of between $750 billion and $1 trillion by 2030.

The bank is working on its climate transition plan, which will be published in 2023, and will request science-based transition plans from clients, CEO Noel Quinn said during the bank's full-year 2021 earnings call on Feb. 22.

The lender launched a new climate strategy in 2021, including a commitment to phase out coal financing, following pressure from an investor campaign led by ShareAction to align its financing policy closer to the Paris Agreement on climate change.

It intends to disclose targets for the coal mining, aluminum, cement, iron and steel, and transport sectors in its 2022 annual report.