Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Jan, 2022

By Pam Rosacia and Dylan Thomas

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Private equity managers shared generally optimistic outlooks on the industry's year ahead, though they are keeping close watch on inflation and sky-high valuations, according to industry sources.

With global unspent capital at an all-time high of $1.32 trillion as of September 2021 and ample interest from investors, the asset class was in a position to carry its post-vaccine momentum into the new year. The managers predicted continued strong fundraising in 2022, and several shared their expectation that limited partners would focus on re-ups with established managers over the next 12 months.

While some private equity managers expect valuations to remain high in 2022, others see the potential for moderation as central banks dial back the stimulus that has pumped liquidity into the global economy.

"If global liquidity starts to stabilize and maybe even pull back, those are de-stimulative policies," said Norm Alpert, founding partner of Vestar Capital Partners LLC, referring to expectations that the U.S. Federal Reserve will taper bond purchases and allow interest rates to rise in 2022.

In addition to inflation, which has been exacerbated by supply chain issues, private equity managers are also wary of the growing challenges portfolio companies face in acquiring and retaining talent. David Barbour, managing partner at technology-focused U.K. firm FPE Capital LLP, said the software industry was struggling in particular with talent poaching between companies at a time when there is rising demand for software services.

"It's going to just become a bigger issue," Barbour said.

Read more on the 2022 outlook here.

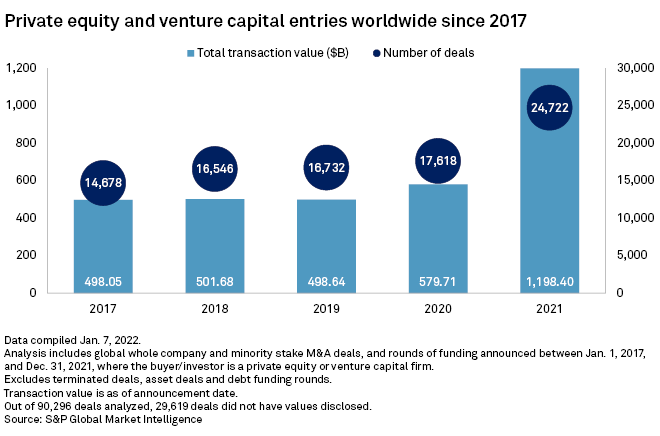

CHART OF THE WEEK: Global PE deal volume surged in 2021

➤

➤

➤

FUNDRAISING AND DEALS

* TPG Inc. reached a valuation of approximately $10 billion in its first day of trading, with its stock opening at $33 per share, above its IPO price of $29.50 apiece. TPG Capital LP struck a $4.3 billion deal to sell intelligent-edge software solutions provider Wind River Systems Inc. to Irish auto-parts maker Aptiv PLC, Dow Jones Newswires reported.

Separately, TPG Growth LLC took a minority stake in specialty pharmacy service provider AnovoRx Holdings.

* Warburg Pincus LLC agreed to sell Navitas Midstream Partners LLC to energy service provider Enterprise Products Partners LP in an all-cash transaction worth $3.25 billion, Dow Jones reported.

* Blackstone Inc. raised its cash buyout offer for Australian gaming operator Crown Resorts Ltd. to A$13.10 per share from A$12.50 per share, a move welcomed by Crown shareholder Forager Funds Management Pty. Ltd., Dow Jones reported.

* KKR & Co. Inc. tapped the Public Investment Fund of Saudi Arabia and other possible co-investors to support its proposed takeover of Telecom Italia SpA, Bloomberg News reported, citing sources.

ELSEWHERE IN THE INDUSTRY

* MBK Partners is divesting a roughly 13% stake to Dyal Capital Partners in a deal valued at about $1 billion, Bloomberg Markets reported, citing people with knowledge of the matter.

* Cerberus Capital Management LP is unloading some of its shares in Deutsche Bank AG and Commerzbank AG with a combined value of approximately €450 million, Bloomberg reported, citing terms seen by the news outlet.

* Sequoia Capital Operations LLC and Paradigm Operations LP invested $1.15 billion for minority stakes in Citadel Securities LLC.

* Leonard Green & Partners LP acquired a majority stake in analytical and life sciences testing company Pace. Former Pace majority owner Aurora Capital Partners reinvested in the business.

FOCUS ON: HEALTHCARE TECHNOLOGY

* New Mountain Capital LLC is selling Cloudmed to R1 RCM Inc. in an all-cash deal that values the healthcare software company at $4.1 billion, including $857 million of net debt, Dow Jones reported.

* GTCR LLC is likely to reach a deal within days to acquire healthcare IT company Experity Inc. from Warburg Pincus for approximately $1.2 billion, Bloomberg reported, citing people with knowledge of the matter.

* Nordic Capital purchased a minority stake in healthcare solutions provider RLDatix Ltd.