Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 10 Jan, 2024

Digitization of the economy is underway, and the process is supported by datacenter providers with the digital infrastructure needed to house, connect and power IT servers, which enable companies to offer services or operate their businesses. The more the economy digitizes, the faster the demand for colocation services will grow.

In 2024, we expect year-over-year datacenter industry revenue to grow by 14% in Europe and 18% in the US. In this framework, datacenters are becoming an attractive asset class for institutional investors, which are increasingly committed to fighting climate change and decarbonizing their investment portfolios to comply with their fiduciary duties. Indeed, many surveys suggest that a significant number of institutional investors believe that reducing CO2 emissions increases the value of their portfolios.

Institutional investors' commitment to environmental sustainability can potentially help accelerate datacenter indury decarbonization from two directions. First, institutional investors own private datacenter providers or are shareholders of public datacenter companies, and can directly influence datacenter companies' environmental sustainability policies and strategies. Second, the largest institutional investors have a stake in the equity of major hyperscalers — Microsoft Corp., Amazon.com Inc.'s AWS, Google, Oracle Corp. and International Business Machines Corp. — that are among the drivers of global demand for colocation services. For these shareholders, eliminating Scope 3 emissions in their investment portfolios entails minimizing the carbon footprint of the value chain. In the case of hyperscalers, this includes emissions from datacenter facilities that offer colocation services for their servers. Overall, we think the rise of the datacenter industry as an attractive asset class for institutional investors will accelerate the process of the industry's decarbonization in advanced economies, especially in the EU.

The problem

Discussions around climate risk are no longer the prerogative of scientists, politicians and environmentalists — this has evolved into one of the main topics in corporate governance, embraced by international business forums and multinational boards of directors. Indeed, climate change poses two challenges to companies' long-run profitability, varying according to industry and geographical market area.

Scientific literature demonstrates that climate change in the form of global warming is associated with intensified extreme weather like floods, storms, wildfires and hurricanes. Over the past decade, a number of businesses have suffered significant losses from extreme weather that has physically damaged their operational capabilities. This challenge is commonly defined as "physical risk," and the impact of climate change has tangible financial implications.

Perhaps even more important to investors are "transition risks." Climate change also triggers changes in policies and regulations, spurs technological innovation, and creates social pressures (changing consumer preferences), which may translate into liability and reputational risk. The datacenter industry, large datacenter providers and hyperscale customers that institutional investors hold a stake in are not exempt from such risks.

The UN Principles for Responsible Investment

The Principles for Responsible Investments (PRI) is a UN-supported network of institutional investors that help support signatories in incorporating environmental, social and governance (ESG) factors into their investment or ownership strategies. The initiative was launched in 2006 by the UNEP Finance Initiative and the UN Global Compact.

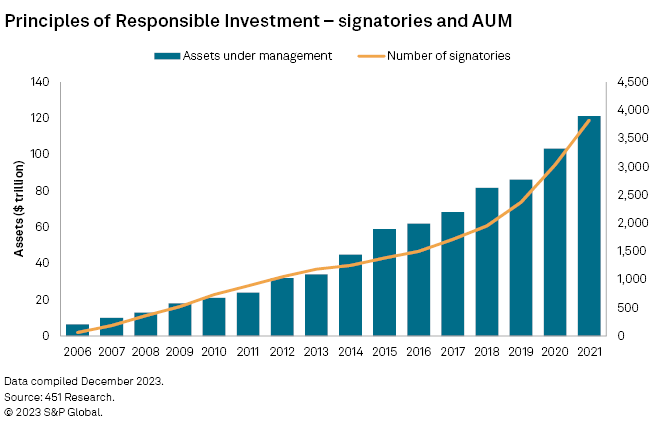

The goal is to develop a more sustainable global financial system by helping investors understand the implications of sustainability. Institutional investors invest money on behalf of their customers, so their fiduciary duties also include protecting their investment from physical and transition risks arising from climate change. The year-to-year increase in the number of the PRI's signatories provides an idea of how seriously the financial system is making sustainability a priority.

In 2006, there were fewer than 100 signatories with $6 trillion assets under management (AUM). In 2021, there were 3,826 signatories with $121.3 trillion AUM. The world's largest asset managers, including BlackRock Inc., Vanguard and State Street Corp., are signatories of the PRI. BlackRock joined the initiative in 2008, State Street joined in 2012, and Vanguard joined in 2014.

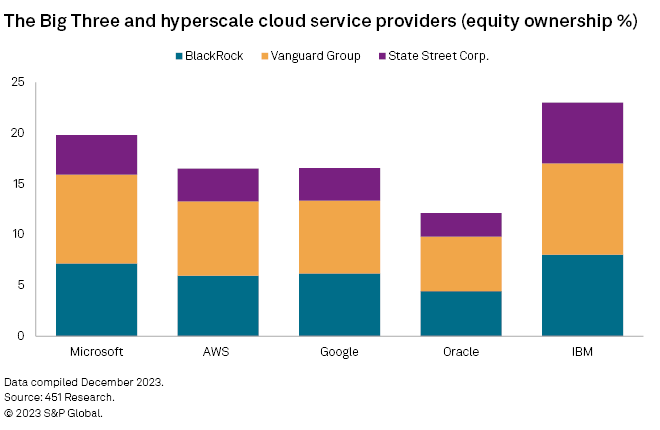

The Big Three and cloud decarbonization

BlackRock, State Street Global Advisors (a division of State Street Corp.) and Vanguard are the three largest US index fund managers, collectively known as the Big Three. Index funds are investment vehicles that replicate stock market indices (e.g., S&P 500) and track their performance. These asset managers own an increasingly large portion of US public companies operating in the digital industry, including Microsoft, AWS, Alphabet Inc., Meta Platforms Inc., Equinix Inc. and Digital Realty Trust Inc. Consequently, stewardship decisions and sustainability strategies of index fund managers are likely to have a significant impact on the governance and sustainability performances of such public companies.

Shareholders usually influence firm strategy through three mechanisms: selling (or not buying) the stock, exercising voting rights, and engaging with the boards and voicing their concerns — in this case about CO2 emissions. The Big Three are increasingly visible, and under growing pressure to exercise their stewardship rights. They exercise their behind-the-scene power in two ways: via private engagements with management and the boards of the invested companies, and through their voting activities.

Today, hyperscalers account for a substantial portion of the customer base in the main colocation markets in Europe (Frankfurt, London, Amsterdam and Paris) and the US (Northern Virginia). Their businesses have served to bolster a wholesale segment in the datacenter market, which is now the primary growth driver for the industry worldwide. In fact, in the 2019-2025 time frame, wholesale datacenter developments are expected to account globally for 88% of total new leased datacenter capacity. In addition, by 2025, it is projected that wholesale leased operational power will make up the vast majority of the total installed base of leased datacenter capacity globally, at about 71% or 37,000 MW worldwide, according to 451 Research's Leased Datacenter Retail vs. Wholesale report.

Cloud providers typically do not rely solely on their own infrastructure for cloud regions, often leasing space in three or more datacenters in a market. Hence, specialized datacenter providers have emerged to build out this infrastructure. A cloud player's presence in a market often propels its datacenter industry forward, because a hyperscaler can serve as a major client to not just one but multiple datacenter firms.

Under pressure from institutional shareholders, which have stated their intention to decarbonize their investment portfolios, hyperscalers have committed to eliminating Scope 3 emissions between 2040 and 2050. This means that in upcoming years, hyperscalers will privilege colocation providers with low carbon footprints. As a consequence, datacenter providers seeking to attract customers like Microsoft, AWS and Google will be obliged to decarbonize their operations or face the transition risk of failing to do so.

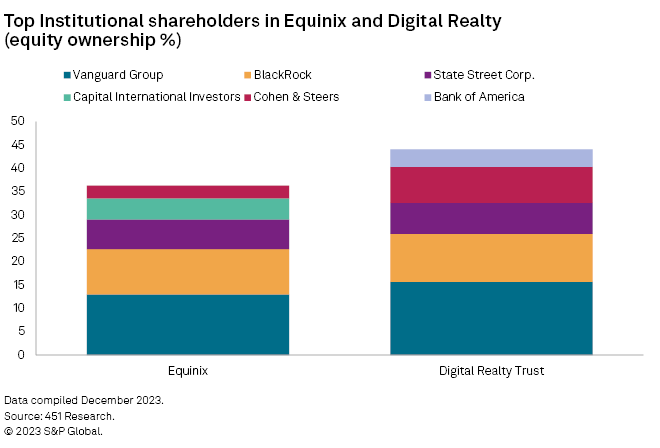

Institutional investors, private equity funds and decarbonization

The Big Three and other institutional investors that are publicly committed to decarbonization also hold a significant stake in the equity of major colocation providers, which implies the capability to influence the corporate policy of those firms. Equinix and Digital Realty, the world's two largest colocation providers, are good examples. Equinix has publicly committed to reduce its Scope 1 and 2 emissions by 50% by 2023 (base year 2019). Similarly, Digital Realty has publicly committed to achieve carbon neutrality for its EU datacenter portfolio in 2030, within the framework of the EU Climate Neutral Data Centre Pact.

Environmentally responsible investment is also naturally aligned with private equity through its long-term investment horizon and stewardship-based style. Many datacenter providers have been taken over by private equity funds.

The largest deal in the datacenter industry was closed in March 2021 with the acquisition of CyrusOne by PE firm KKR & Co. Inc. in a transaction of $15 billion. KKR is the largest PE fund in the world and is a signatory of the PRI. CyrusOne operates more than 50 datacenters worldwide, and in 2021 announced that all its datacenters in Europe were running 100% on renewable energy.

Similarly, in April 2023, Brookfield Corp., a Canadian institutional investor with AUM over $850 billion, acquired DATA4 for AXA IM, a leading European provider with a footprint of 780 MW across Paris (375 MW), Frankfurt (180 MW), Madrid (150 MW), Milan (67 MW), Luxembourg (4 MW) and Warsaw (4 MW). Both KKR and Brookfield are signatories of the PRI and are publicly committed to achieving net-zero emissions across their assets under management by 2050.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.