Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Oct, 2022

By Avery Chen

|

Coal-fired generators at a steel factory in China's steelmaking hub Hebei province in 2015. |

China is not expected to set bold new climate targets at the United Nations Climate Change Conference, but the world's biggest emitter still has room to make modest progress, including on methane, carbon-intensive sectors and overseas green financing.

The COP27 talks, which start Nov. 6 in Sharm el-Sheikh, Egypt, face multiple headwinds that could distract governments from climate issues, including Russia's war in Ukraine and a freeze of U.S.-China climate negotiations.

China has signaled its intense focus on energy security, energy shortages, the economic slowdown and keeping tight pandemic controls in place. Yet experts said the country still has options to add to its nationally determined contributions or at least get started on new commitments at COP27.

Best-case scenarios include adopting a detailed plan to reduce methane emissions, setting specific targets to decarbonize carbon-intensive sectors and accelerating climate financing for emerging economies.

"It's a year that is very difficult for anybody to concentrate on the climate agenda [or] even the economic agenda," said Li Shuo, a Beijing-based policy analyst for Greenpeace East Asia.

Li does not expect China to accelerate its current targets for peak carbon emissions by 2030 and carbon neutrality by 2060. "I don't think the political and economic conditions are there," Li said. "But people should pay attention to smaller issues, and hopefully, we can still make progress on most issues."

Climate change mitigation and international climate financing are areas where China can show leadership, said Lucie Qian Xia, China policy fellow at the Grantham Research Institute of the London School of Economics and Political Science.

"China [has been] intensifying its climate action abroad, and it will continue to do so because it is a way of showing its aspiration to be a responsible great power," Xia said.

Beyond China's borders

China is set to represent the Global South in urging developed countries to live up to their 2009 promise to jointly raise $100 billion annually by 2020 to support developing countries' efforts to address climate change and its impacts.

"It would not be surprising to me if China took [COP27] as an opportunity to demonstrate leadership in trying to push for support for emerging economies," said Cory Combs, associate director at policy research consultancy Trivium China.

China could also use the talks to highlight its support of renewable and low-carbon energy projects in developing countries, especially in Asia-Pacific and Africa, where China has massive investments in energy transition supply chains.

In 2021, Chinese President Xi Jinping pledged to stop financing overseas coal projects. Green Belt and Road Initiative Center data showed that the country has not funded any such new coal projects since then, although most of the outbound investment flowed into oil and natural gas projects rather than renewables, said Alice Lei Bian, a policy fellow at the Grantham Research Institute.

Chinese investment in overseas renewables projects is much slower than overseas coal financing in the 2010s, Greenpeace's Li said. The key challenge for China over the next few years is to address the mismatch between renewable energy projects and the country's state-backed overseas infrastructure development model, Li said.

China could leverage its battery supply chain in countries with Belt and Road projects to facilitate renewable investment, analysts said.

Chinese companies have been doubling down on Indonesian nickel mining investments after Jakarta banned nickel ore exports in 2020. Mining for nickel, a battery metal, is still largely powered by coal and comes with a host of environmental concerns. China could export environment-friendly technologies and practices tested in its China-Singapore Suzhou Industrial Park to use in Indonesia's industrial parks, Bian said. China could also require its Indonesian projects to have stricter emissions limits, in line with those back home, Bian added.

Curbing methane, heavy industry emissions

U.S.-China coordination on advancing an action plan to cut methane emissions will be key at COP27, said Greenpeace's Li, especially after Beijing cut off climate dialogue with Washington in August.

The two nations announced a joint agreement in November 2021 to cooperate in slowing global warming, in which China pledged to develop a "comprehensive and ambitious National Action Plan on methane" and aimed to achieve a significant effect in the 2020s.

"The U.S.-China agreements' work on methane was never really dependent on them working with each other," Combs said. There could be some lost opportunity for technical cooperation on methane emissions, but the two countries will likely keep working on the issue at a high level, Combs said.

China could add decarbonization targets for steel and cement sectors to its nationally determined contributions, said Lauri Myllyvirta, lead analyst at the Centre for Research on Energy and Clean Air. In February, the central government set a target for the steel industry to peak emissions by 2030, five years later than the original plan. The China Building Materials Federation said in September that the cement sector will peak emissions by 2023.

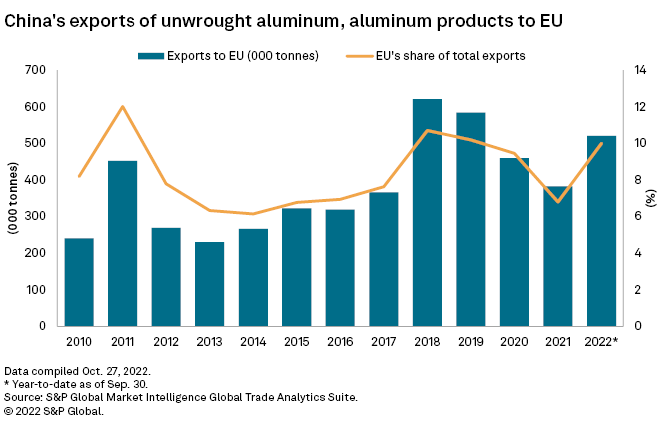

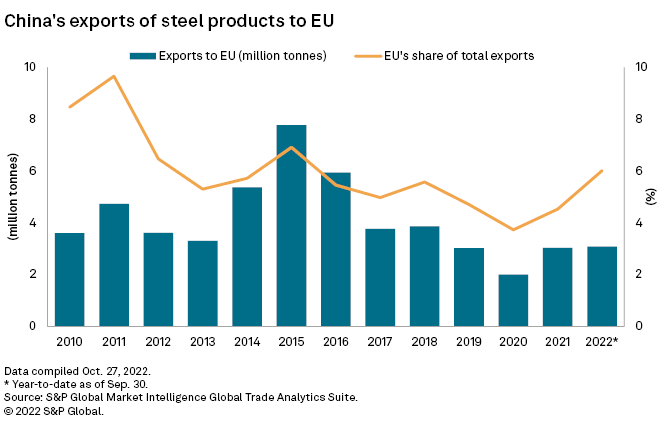

Pressure to act comes in part from the European Commission's July 2021 proposal for a carbon border adjustment mechanism, which would impose tariffs on carbon-intensive products imports, including power, iron, steel, aluminum, cement and fertilizer. China's steel and aluminum exports to the EU are at risk, which could be a lever to induce international carbon tax cooperation, Bian said.

China could also strengthen coordination with the World Trade Organization and the Group of Twenty and move forward with international cooperation on carbon pricing. A carbon price floor could help China address the risks posed by carbon border adjustment mechanisms and accelerate developed countries' delivery of international climate finance, Bian said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.