Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Feb, 2021

|

EDF's Desert Harvest solar and storage complex in Southern California delivers power to MCE Energy, |

As a candidate, U.S. President Joe Biden set an ambitious goal to eliminate carbon from America's power mix by 2035 to generate clean energy jobs for the nation's battered workforce and to slow down climate change. With Biden now in the White House, many utilities are skeptical that such a feat is possible in a mere 15 years.

But in California, where the electric grid powers the world's fifth-largest economy with 80% renewable energy at times, calls are growing louder for the state to accelerate its current zero-carbon target date of 2045. And California's fastest-growing retail power suppliers, local government-run community choice aggregators, or CCAs, are well ahead of the curve.

"We are setting the pace," said Ted Bardacke, executive director of the Clean Power Alliance, the state's largest CCA by demand, which buys power on behalf of three million people in 30 cities in Southern California and unincorporated parts of Ventura and Los Angeles counties. "Whether we end up hitting 100% by 2030 or [by 2035], we'll see."

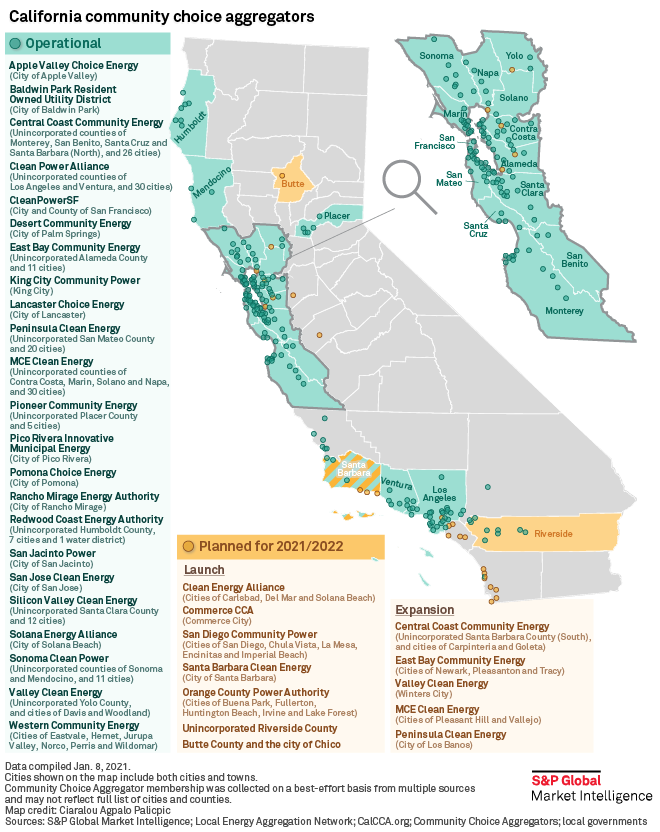

Underpinned by a state law that requires automatic customer enrollment when cities and counties form CCAs, and driven by communities that desire ever-cleaner electrons, CCAs have in a few years taken over responsibility from California's big three investor-owned utilities for procuring electricity for some 11 million residents, more than one-quarter of the state's population, according to the California Community Choice Association, or CalCCA, an advocacy group.

Promising to make the Golden State greener at a faster rate and lower cost, California's 23 operational CCAs have seized 28% of the demand from Pacific Gas and Electric Co., Southern California Edison Co. and San Diego Gas & Electric Co..

Central Coast Community Energy, California's largest CCA by geography, and East Bay Community Energy in Alameda County both aim to establish 100% zero-carbon power portfolios by 2030. Peninsula Clean Energy in San Mateo County and San Francisco's CleanPowerSF hope to reach that milestone as soon as 2025.

MCE Clean Energy, California's first CCA, which started in Marin County in 2010 and has since spread into Napa, Solano and Contra Costa counties, says its default power mix will be 95% free of greenhouse gas emissions by 2022.

'Making a big bet'

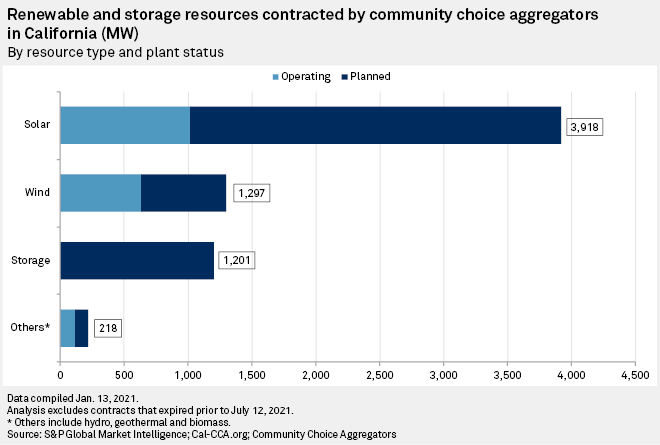

That figure could hit 20,000 MW by 2030, according to CalCCA.

Long-term deals for battery storage, both at standalone stations and solar-plus-storage projects, now total more than 1,200 MW, up from only 158 MW in August 2019.

"With batteries, we are making a big bet that that's going to enable this decarbonization to be done reliably and affordably," Clean Power Alliance's Bardacke said in an interview.

Clean Power Alliance has signed contracts for several battery-backed solar facilities and energy storage complexes, including 350 MW of storage on track to come online this summer and fall, according to Bardacke.

But to reach 100% clean energy, "we're going to need a broader set of generating resources," he said, pointing to the need for more around-the-clock geothermal energy and out-of-state wind energy, in addition to battery storage, to plug gaps in California's clean power mix.

Several CCAs also are exploring long-duration energy storage to help balance their renewables-heavy portfolios and reduce their reliance on natural gas generation when variable wind and solar resources are unavailable.

"We all know that the [California ISO] has said we're going to have natural gas on the grid for a long time, but our role is to help accelerate and deploy those affordable resources such that they may not need to keep those [resources] on," said J.R. Killigrew, director of communications and outreach at Central Coast Community Energy.

Expanding model

Central Coast Community Energy, which rolled out service to eight additional cities in San Luis Obispo County in January and is also expanding into Santa Barbara County, is part of an ongoing expansion of a business model that continues to proliferate despite exit fees charged by traditional utilities that CCAs say have cost their customers hundreds of millions of dollars.

Under the model, the utilities maintain responsibility for physically supplying the power contracted by CCAs, as well as billing customers and providing other services. They also still supply customers who live in areas not covered by CCAs or who opt out of their service.

Utilities "have been great partners, but there is an argument to be made for cutting out the middleman for procurement," said José Trinidad Castañeda, a community energy advocate at the Climate Action Campaign and planning commissioner for the city of Fullerton, in Orange County. Fullerton, along with Irvine, Huntington Beach, Lake Forest and Buena Park in late 2020 voted to form a new CCA called the Orange County Power Authority, which plans to launch service in 2022.

By that time, CCAs collective share of investor-owned utility load could reach 36%, CalCCA estimates.

"People just want more choices, local control, cost savings and local power," Castañeda said.