Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 29 Mar, 2022

"Options trading has become so popular that the current value of these contracts in circulation has surpassed that of stocks" (Investopedia).

Retail investors have historically and consistently traded stocks, leaving options trading to the professionals who understood the nuances and mathematics related to options. Recently, retail traders have began to explore options trading due to low upfront cost, well-defined risk profile, and leverage that may be gained.

Some attribute this increase to day-traders’ curiosity booming during the volatile Covid era, some say it’s because they have more access to educational tools. Whatever the reason, if you are managing a trading platform or market data portal, you may want to consider providing an options analysis solution for your users.

Here are some more astounding facts; the first three drawn from the Investopedia article, Options Trading Hits Record Highs.

Platform providers across the board are looking for increased education and additional functionality. It’s no secret that options trading is booming, it’s simply what providers do to support their users with tools and analytics that will help their clients be successful.

In 2019, led by Robinhood, big players like E*TRADE, Schwab, and Fidelity offered no-fee trading. Most of these providers have per contract fees for executing option trades, such as E*TRADE ($.65 each). With this fee and booming retail options trading, E*TRADE has not only profited from options trading, it’s one of their largest revenue generators.

According to Bloomberg, options trading accounted for 61% of Robinhood’s third-quarter trading revenue. Even though Robinhood pioneered the commission-free trading, their users don’t trade options for free (Robinhood receives a fixed percentage of the difference between the publicly quoted bid and ask at the time the trade is executed).

Providers are scrambling to come out ahead in the options game. Last year, IG Group Holdings acquired Tastytrade for a mere $1 Billion, drawn to their “strong position in options trading for individual investors. Additionally, the merger of Ameritrade and Charles Schwab in October 2021 created a “powerhouse for options traders of all stripes” (Source:Best Online Brokers Met Rise in Options Accounts with Tools, Education).

We launched our Options Analytics platform in 2021 to meet the predicted needs of our clients and prospects as we saw this options wave coming. Our ChartIQ development team is actively developing new innovative solutions as part of our premium Options Analytics module to support the needs of this segment.

Options trading has exploded over the last few years and a large contingent of our members trade options. The more tools we can give our members to help them make informed trading decisions, the more successful they will be. ChartIQ continues to be a leader and innovator of trading tools, and this makes them a perfect technology partner for Blackboxstocks, says Eric Pharis, COO and Founder of Blackboxstocks.

We all know that one of the main issues with options trading is the complicated and sometimes confusing aspect of the process. As a data visualization company with our charts found on millions of screens worldwide, we strongly believe the age-old adage that a picture is worth a thousand words.

In 2021, we decided that options traders should not be left in the dark working only with tables, and we introduced graphic solutions for options traders to visualize the options chain.

With ChartIQ, traders can:

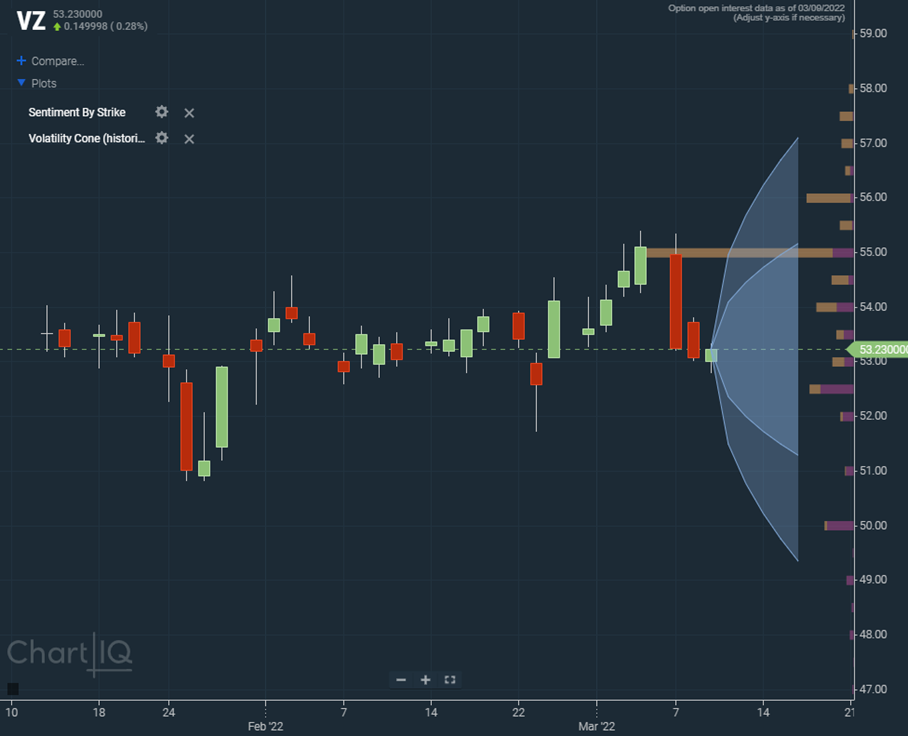

One of the innovative features of our Options Analysis is the Sentiment by Strike study, which overlays options volume or open interest on the price chart. This allows users to combine their technical analysis with an understanding of how traders are positioned in the options market. It’s a straightforward solution to help drive traders’ interest in options by presenting the data in a format they use every day to trade the underlying equities. We believe this one-of-a-kind system will be a huge draw for traders looking for tools to improve their trading performance.

Price chart with Volatility Cone and Sentiment By Strike studies displayed.

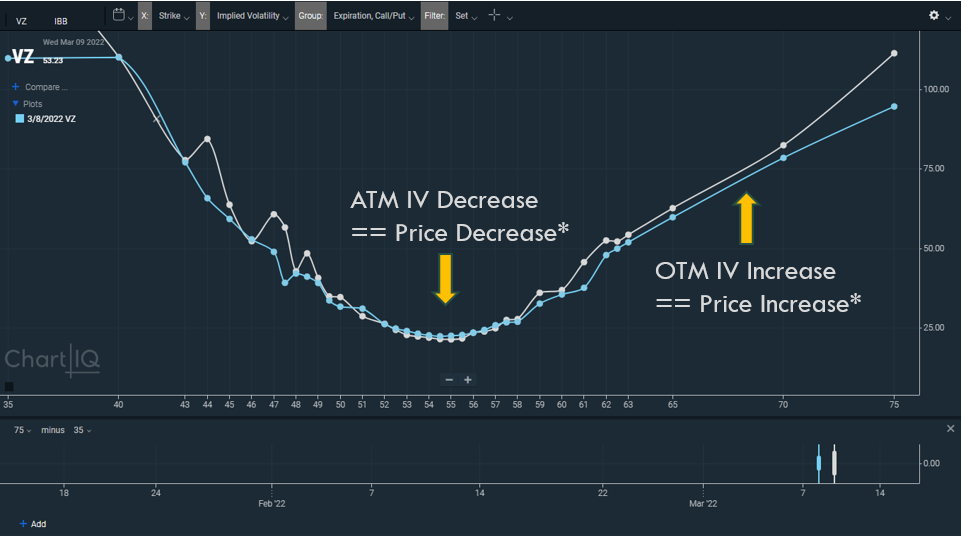

Additionally, our proprietary graphic tools to analyze option vol curves and greeks will keep the most advanced options traders engaged. Traders can visualize changes in the shape of these curves over time, or compare them to related instruments to identify optimal trading strategies based upon market outlook. The curve graphics are designed to interoperate with a historical price chart, creating a dynamic visual solution. Being ChartIQ graphics, they are robust and dynamic web solutions: fully interactive with real-time updates.

Call Option Skew change over two days.

I have been building option analytics for over twenty years, and believe what we’ve done so far is merely the tip of the iceberg. As we move forward, we plan to leverage both the time series and cross-section graphics to create innovative solutions to help traders understand the market and build effective trading strategies.

To that end, education will be a central consideration in how we design and build the product. CNBC recently reported that 11% of Robinhood's monthly active users made an options trade in the first three quarters of 2021. Meanwhile, fewer than 1% executed a multi-leg options trade, which involves two or more transactions at the same time.

This fact emphasizes that the retail trading community needs better tools to learn about options and how to excel in this market. Brokerages, market data portals and fintech vendors have done a phenomenal job in providing solutions for retail investors, but it’s time to take it one step further.

The time is now to get Options Analytics built into your platform. Every day that you wait is a day that a new equity trader starts researching and trading options.

We feel strongly about a number of ways that your users are going to go:

Not only is our offering engaging, but ChartIQ decreases time to value by providing an extensive SDK. Our documentation is easy, our getting started guide is top notch, and our clients love our customer support. Built by developers, for developers, your Options Analysis package will be off the ground in no time and will continue to grow as we enrich it on your behalf.

Contact us for a personalized Options Analysis demo.