Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Mar 16, 2023

By Michael Dall

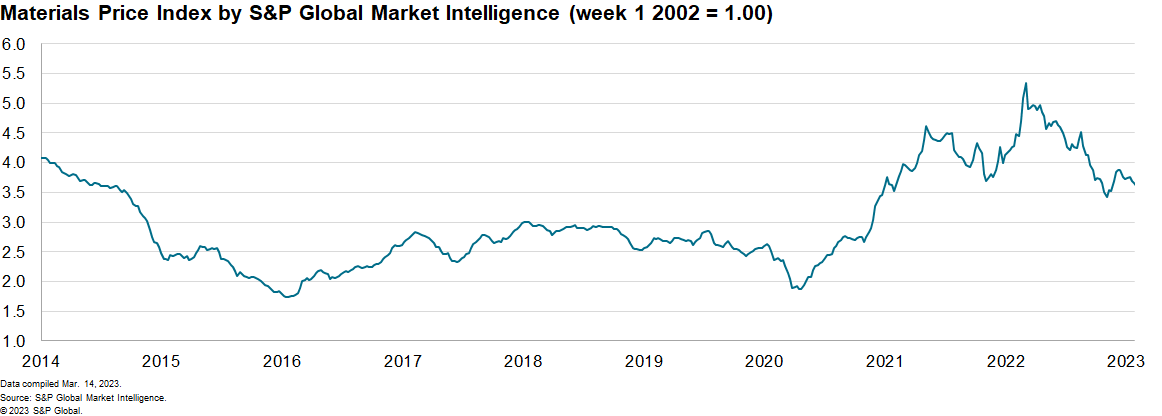

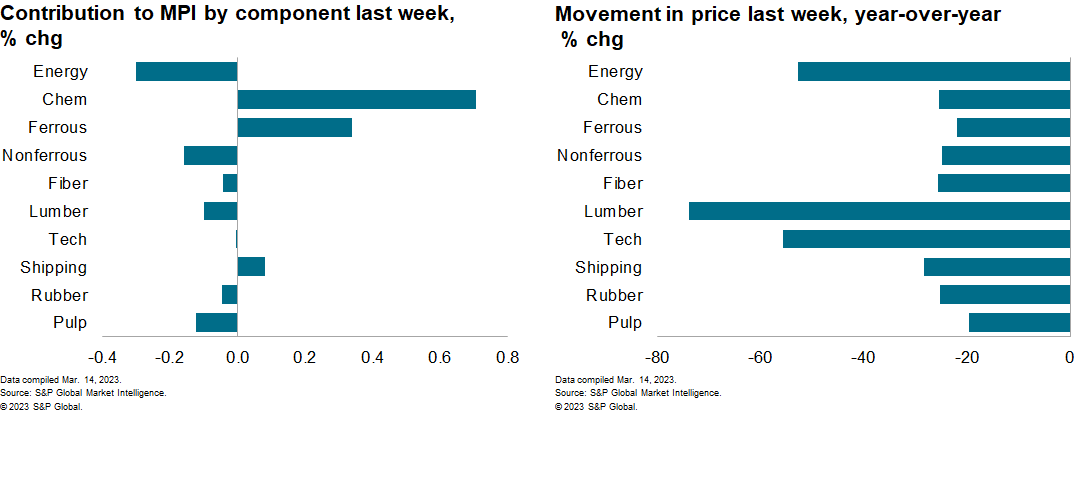

The Material Price Index (MPI) by S&P Global Market Intelligence increased 0.3% last week, its second consecutive marginal increase. The increase was narrow, however, with only three of the ten subcomponents climbing. The MPI still sits 34% lower year on year (y/y) which was the all-time peak. Prices, however, remain far higher (38%) than the pre-pandemic levels of the fourth quarter 2019.

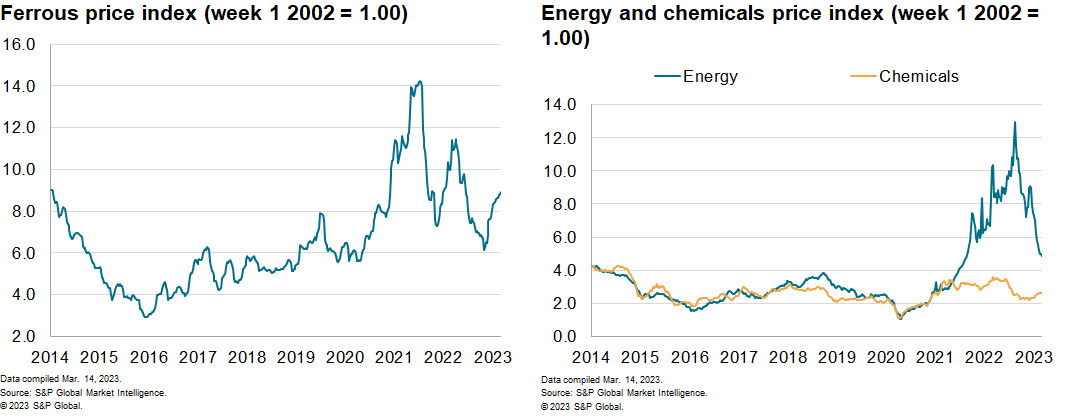

A rebound in chemical prices was the single largest upward move across commodity markets last week. In fact, the MPI excluding chemicals declined 0.4%. The chemical sub-index climbed 3.8% with propylene spot prices in the United States soaring. The average spot price of propylene rose to 76 cents/pound, up from 51.50 cents/pound the previous week. This is the largest weekly increase ever recorded but it partially reflects recent weak trading conditions. Buyers returned to the market after a three-week absence. At the same time, unexpected supply tightening occurred impacting around 20% of US capacity. This, combined with low operating rates at other US plants, significantly tightened the supply/demand balance and caused the 40% price increase. Chemical demand remains weak by historical standards. We expect maintenance outages will only have a short-term effect on prices which fades within a month. Overall weakness remains in the MPI and prices in our technology sub-index fell further last week. DRAMs prices decreased by 1.9%, the ninth consecutive weekly decline as the semiconductor shortage continues to unwind. The latest S&P Global Electronics PMI™ showed the level of work outstanding at manufacturers fell for an eighth straight month in February and this is reflected in lower prices.

Markets continue to grapple with mixed signals on global economic growth. Equities were rattled by the collapse of the Silicon Valley Bank which sparked a broad sell-off in bank shares and caused the S&P 500 to have its worst trading week in six months. However, US nonfarm payroll employment rose 311,000 in February, topping both our and the consensus expectation. This report is the first "solid" piece of data for February covering the entire US economy, and the picture it paints is one of continued expansion. On balance, markets still expect central banks to continue to implement aggressive interest rate rises in 2023. In the US, despite the financial turbulence surrounding the failure of Silicon Valley Bank, S&P Global Market Intelligence expects the Fed to continue with at least one more rate hike, with perhaps more to come if financial stability concerns continue to wane and inflation remains at unacceptably high levels. This, combined with falling energy costs for producers, will ultimately lead to lower commodity prices overall this year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.