Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 17, 2023

By Michael Dall

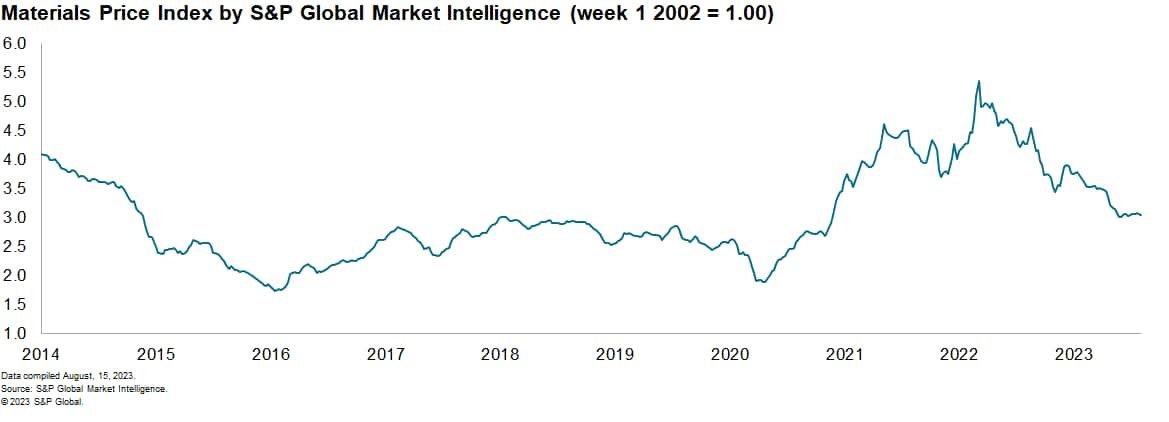

The Material Price Index (MPI) by S&P Global Market Intelligence decreased 0.4% last week, the second consecutive decline in August after rising each week in July. Last week's decrease was broad with eight out of the ten subcomponents falling. A return to price declines in the last two weeks reinforces the trend so far in 2023 with the index 28.5% lower than its year-ago level.

Price declines last week were most significant in industrial metals. The nonferrous metals sub-index declined 1.8% with all six base metals in the sub-index falling. Nickel recorded the biggest drop with prices falling below $20,000/tonne for the first time since late June. Prices are now 10% lower than those recorded at the start of the month. Copper prices lost 2.3% for the week, dropping to $8,241/tonne, a six-week low.

Data from the People's Bank of China showed that new bank loans in July totaled 345.9bn yuan ($47.80bn), down from 3,050 bn yuan ($419 bn) in June. This fell short of market expectations and came after several recent interest rate cuts by the central bank. The steel making raw material sub-index also dropped last week, falling 1.3%. Iron ore traded at $104/tonne from $112/tonne the previous week on news that real estate developer Country Garden was looking to restructure its debt commitments.

![]()

Market sentiment further weakened last week as the S&P 500 chalked its second week-on-week decline for the first time since May. In the US, July producer prices firmed at the fastest pace since January causing concern over the stickiness of inflation. It remains the S&P Global Market Intelligence view that further central bank action is needed in the short term to control inflation.

Weak global demand remains the significant downward pressure on commodity prices as shown by last week's price decline. However, supply side tightening has been effective in supporting prices in oil markets. We expect this to be the case in other commodity markets over the next six months, resulting in flat prices over the remainder of 2023.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.