Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jan 13, 2023

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

The week ahead will again be adorned with an abundance of economic data including December's retail sales and industrial production figures from both the US and China. Fourth quarter GDP from China will also be released. Bank of England watchers will meanwhile be eager to see UK labour market and retail sales data.

Additionally, US, UK and German PPI plus eurozone and Japanese CPI will help assess the global inflation trend. On the central bank front, monetary policy meetings in Japan, Norway, Malaysia and Indonesia unfold.

The data come amid a busy week for US earnings and follow news that investors in the US are growing increasingly concerned over the impact of higher interest rates on corporate health (see box). Despite robust-looking GDP data for the US in the fourth quarter, various forward-looking survey gauges are flashing warning signals of rising recession risks. The updates to industrial production and retail sales data will therefore be important to watch to see if the US official data are starting to more closely mirror the weakness seen in the surveys, as such a development could encourage a less aggressive policy path from the FOMC.

That said, the longer-term outlook to the end of 2023 offers a glimmer of hope, with indications from the approximate 300 survey participants - managing roughly $3,500 billion assets - pointing to bullish sentiment across all four major asset classes, including equities. Asian markets were notably the most favoured in the equity space, with the loosening of restrictions in mainland China helping boost positive expectations on economic conditions. The upcoming flurry of data releases from China data will therefore be eagerly assessed in tracking the early economy reopening performance.

More central bank meetings and inflation indications will also help in the assessment of both economic and market trajectory into 2023. In particular, the Bank of Japan meeting will likely be scrutinised in the coming week after delivering a surprise that shook the FX market.

In the UK, inflation and labour market updates will meanwhile be key inputs to the scale of the next rate hike at the Bank of England, and downside surprises could even lead to talk of a pause in the hiking cycle.

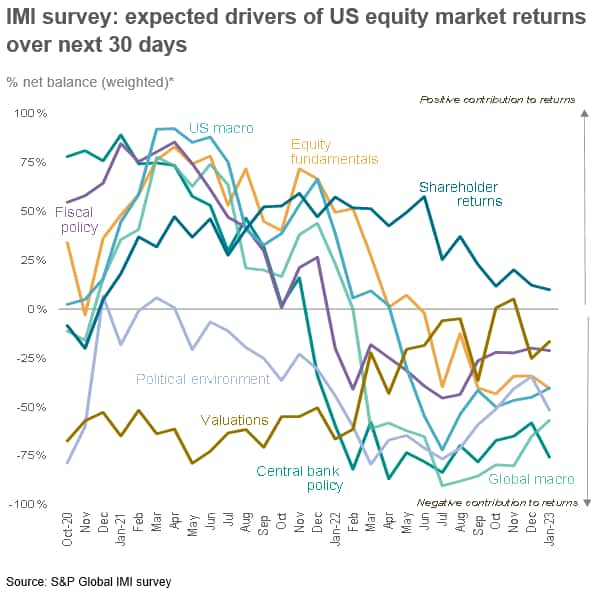

The year had barely started and reinforcements of the Fed's hawkish views had already landed via both the Fed minutes from the December meeting and recent policymaker comments. It is perhaps of little wonder that the latest S&P Global Investment Manager Index reflected a sombre mood amongst US equity investors, based on results collected at the start of the year.

Risk appetite and expected near-term US equity market returns remained in negative territory in the opening trading sessions of 2023, albeit improving from December. Furthermore, the greatest perceived drag on the market is now viewed to stem from central bank policy, overtaking the global macroeconomic environment as the biggest concern.

Shareholder returns remain the only factor perceived to be supportive of equities, albeit to a waning degree due to concerns over dividends. Equity fundamentals meanwhile seen as increasing drag, hinting at concerns over earnings.

Monday 16 January

US Market Holiday

Japan Corporate Goods Prices (Dec)

South Korea Export and Import Growth (Dec)

Indonesia Trade Balance (Dec)

India WPI Inflation (Dec)

Germany ZEW Economic Sentiment (Jan)

Canada Manufacturing Sales (Nov)

Tuesday 17 January

Singapore Non-Oil Exports (Dec)

China (Mainland) Retail Sales, Industrial Output and Urban FAI (Dec)

China (Mainland) GDP (Q4)

Germany HICP (Dec, final)

United Kingdom PPI (Nov)

United Kingdom Labour Market Report (Nov)

Canada CPI (Dec)

Wednesday 18 January

Taiwan Market Holiday

Japan Machinery Orders (Nov)

Malaysia Trade (Dec)

Taiwan Jobless Rate (Dec)

Eurozone HICP (Dec)

United States PPI (Dec)

United States Retail Sales (Dec)

Canada Producer Prices (Dec)

United States Industrial Production (Dec)

United States Capacity Utilization (Dec)

United States Business Inventories (Nov)

United States NAHB Housing Market Index (Jan)

Japan BOJ Rate Decision

United States Fed Beige Book

Thursday 19 January

Taiwan Market Holiday

Japan Trade (Dec)

United Kingdom RICS Housing Survey (Dec)

Australia Employment (Dec)

Malaysia Policy Rate (19 Jan)

Norway Key Policy Rate (19 Jan)

United States Building Permit and Housing Starts (Dec)

United States Initial Jobless Claims

Canada Wholesale Trade (Nov)

Indonesia 7-Day Reverse Repo (Jan)

Friday 20 January

Taiwan Market Holiday

Japan CPI (Dec)

United Kingdom GfK Consumer Confidence (Jan)

China (Mainland) Loan Prime Rate 1Y and 5Y (Jan)

Germany Producer Prices (Dec)

United Kingdom Retail Sales (Dec)

Canada Retail Sales (Nov)

United States Existing Home Sales (Dec)

Thailand Manufacturing Production (Dec)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

Americas: US PPI, retail sales, industrial production, Canada CPI

Following the December US CPI release, US PPI will be watched in the week ahead with the Refinitiv consensus expectation pointing to no changes on a month-on-month (m/m) basis after rising 0.3% m/m previously. Inflationary pressures at goods producers have eased markedly according to the S&P Global US Manufacturing PMI.

Separately, retail sales and industrial production figures will also be due from the US to outline consumption and production conditions respectively. Consensus expectations currently suggest retail sales and production will have continued to fall on a month-on-month basis in December. A clutch of housing market data are also updated for the US, which will be assessed for the impact of higher rates.

Europe: UK inflation, labour market data, retail sales, eurozone inflation, German inflation, ZEW survey

Inflation readings from the UK, eurozone and Germany will be updated in the coming week. The numbers will be eagerly anticipated after PMI data outlined how lower costs are feeding through to lower selling price inflation for goods and services across both the UK and the eurozone.

At the same time, labour market data will shed light on employment conditions in the UK. As far as the KPMG / REC UK Report on Jobs, compiled by S&P Global Market Intelligence, indicated, uncertainties around the outlook have led to further caution around hiring in the UK with permanent placements declining in December and vacancies rising at a slower rate. UK retail sales data are also updated for the important Christmas holiday period. Also watch out for producer price data for Germany and the UK.

Asia-Pacific: BoJ, BNM, BI meetings, Japan CPI, China retail sales, industrial production, loan prime rates and Q4 GDP

Monetary policy meetings will unfold in Japan, Malaysia and Indonesia in the coming week. The Bank of Japan had previously surprised the market by tweaking its yield curve control policy in December and markets will be closely watching for any further hints of policy shift.

Meanwhile China's retail sales and industrial production numbers arrive in the coming week, capturing early reopening effects, in addition to Q4 GDP.

Special reports:

Global Business Activity Contracts for Fifth Successive Month as Demand Downturn Accelerates - Chris Williamson

Singapore Economic Expansion Moderates as Global Economy Slows - Rajiv Biswas

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location