Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Apr 08, 2022

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Central bank meetings will be in abundance in the coming week across the eurozone, Canada, New Zealand, South Korea and Singapore. Other key economic events include US, UK, and mainland China inflation releases for March as well as US retail sales and industrial production. Also watch out for UK March GDP data while the advance Q1 GDP in Singapore offers a first look into 2022 growth conditions in the APAC region.

With the US Fed gripped firmly by inflation concerns according to the latest March Fed FOMC minutes, next week's US CPI data will be amongst the top watched economic releases around the globe. As far as March's PMI data suggested, US firms' selling prices continued to climb last month, notching up the joint-sharpest rise since data collection began in October 2009. Consensus expectations similarly point to quicker inflation against the backdrop of the Ukraine war and the consequent commodity price hikes. Accompanying the CPI and PPI data updates will also be Fed comments through the week, rhetoric crucial in guiding the market with respect to their accommodative removal plans, as well as retail sales and industrial production updates to guide on economic trends in March.

More central banks are meanwhile expected to follow the Fed's lead in taking a more aggressive policy stance the coming week. Specifically, the Bank of Canada (BoC) and Reserve Bank of New Zealand (RBNZ) are both expected to raise interest rates in the fight against inflation, with the BoC potentially delivering more than the 25-basis points moves that we have seen of late from other central banks. The European Central Bank's (ECB) post meeting communique will also be crucial following recent signals of rate hike intentions, though any moves are not expected until later 2022. The Monetary Authority of Singapore's (MAS) exchange rate settings will also be in focus.

Finally, GDP data from the UK and Singapore come at an interesting time, with both regions showing continued growth despite indications of a slowdown in global growth in March, according to the latest PMI data.

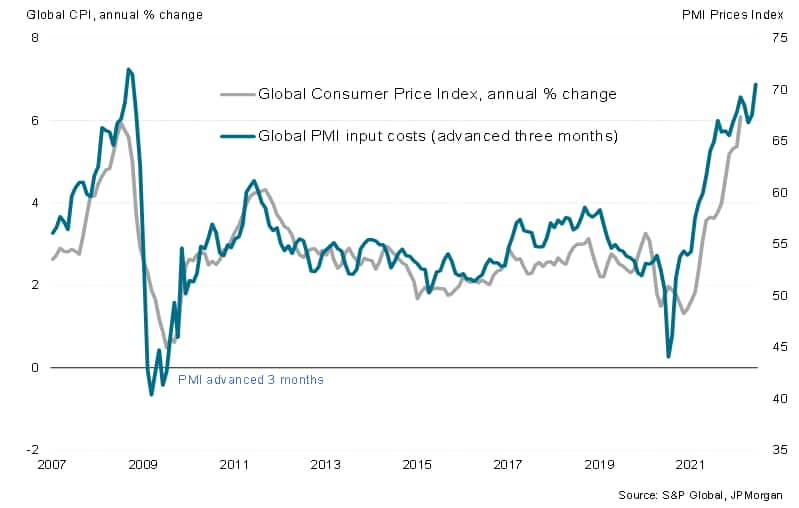

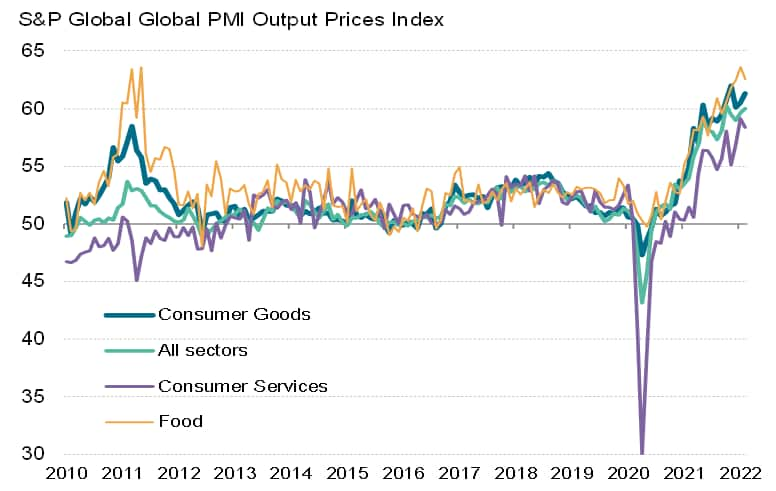

The coming week sees inflation updates for the US, mainland China and the UK, which are expected to show the cost of living crisis intensifying. Worse is yet to come, as signalled by new highs for many PMI survey price indices, which showed business costs rising at a rate not seen since 2008 in March. These higher costs are being increasingly passed on to customers, leading to record rates of inflation in the US and Europe.

Perhaps of greatest concern is the soaring cost of food, the S&P Global PMI price index for which remained close to record highs again in March, with the Ukraine invasion widely expected to create additional upward pressure on agricultural commodity prices. Further increases in food cost inflation will hit the poorest the hardest. Such pressure on those with the lowest incomes adds not only to risks of demand growth weakening, but in the past has also been a catalyst of social unrest.

Monday 11 Apr

China (Mainland) CPI, PPI (Mar)

Malaysia Industrial Output (Feb)

United Kingdom monthly GDP, incl. Manufacturing, Services and Construction Output (Feb)

United Kingdom Goods Trade Balance (Feb)

Norway Consumer Price Index (Mar)

Norway Core Inflation (Mar)

China (Mainland) M2, New Yuan Loans, Loan Growth (Mar)

Tuesday 12 Apr

Thailand BoT Meeting Minutes (Mar)

Germany CPI Final (Mar)

United Kingdom Labour Market Report (Mar)

Germany ZEW Economic Sentiment (Apr)

India CPI (Mar)

India Industrial Output (Feb)

United States CPI (Mar)

Wednesday 13 Apr

Thailand, Norway (partial) Market Holiday

Japan Machinery Orders MM (Feb)

New Zealand Cash Rate (13 Apr)

China (Mainland) Trade (Mar)

United Kingdom Inflation (Mar)

United States PPI Final Demand (Mar)

Canada BoC Rate Decision (13 Apr)

Thursday 14 Apr

Thailand, India, Norway Market Holiday

Singapore GDP (Q1, advance)

Singapore MAS Monetary Policy Decision

United Kingdom RICS Housing Survey (Mar)

South Korea Bank of Korea Base Rate (Apr)

Australia Employment (Mar)

India WPI (Mar)

Eurozone ECB Deposit and Refinancing Rate (Apr)

United States Initial Jobless Claims

United States Retail Sales (Mar)

Canada Manufacturing Sales (Feb)

Canada Wholesale Trade (Feb)

United States Business Inventories (Feb)

United States UoM Sentiment (Apr, prelim)

Friday 15 Apr

US, Canada, UK, Germany, Switzerland, Norway, Australia, Singapore, India, Indonesia, Thailand Market Holiday

South Korea Export, Import Growth (Mar, revised)

United States Industrial Production (Mar)

United States Capacity Utilization (Mar)

* Press releases of indices produced by S&P Global and relevant sponsors

can be found here.

North America: US March CPI, PPI, retail sales, industrial production data, BoC rate decision

March consumer and producer price data out of the US will be closely watched and follows the release of the March Fed FOMC meeting minutes which signalled the Fed's growing determination in tackling high inflation. Consensus expectations currently point to an acceleration of headline CPI from the 40-year high of 7.9% year-on-year (y/y) in February to 8.3% in March. Core CPI is likewise expected to tick up to 6.6% y/y, which could garner further concerns from a market that is already pricing in a 50-basis points (bps) interest rate hike in May. The S&P Global US Composite PMI showed output charges rising at the joint-sharpest pace since data were first available in 2009. Fed comments across the week are also expected to be in focus. US retail sales will also be eagerly assessed for signs how spending is holding up amid the soaring cost of living.

Meanwhile we anticipate the Bank of Canada to deliver a 25bps hike at its April meeting, followed by two more thereafter. Improving domestic demand conditions is expected to enable the BoC to focus on tackling inflation.

Europe: ECB policy meeting, UK March inflation and February output data, Germany CPI and ZEW survey

The ECB convenes in the coming week with their rhetoric in focus after having signalled intentions to potentially raise interest rates later this year despite the Ukraine war uncertainties. While we are not expecting rate hikes until Q4 2022, how aggressive the ECB may be remains a key question for the market.

UK March inflation data come into focus as well after the latest S&P Global / CIPS UK PMI indicated faster input cost inflation across both manufacturing and service sectors.

Asia-Pacific: China inflation and trade figures, RBNZ, BoK policy meeting, Singapore MAS decision and advance Q1 GDP, Australia employment

China release March inflation and trade figures following the Caixin PMI's reflection of increased inflationary pressures and deteriorating export performance.

Central bank meetings in New Zealand, South Korea and Singapore will also unfold, with the RBNZ expected to raise interest rates and the MAS to make changes to the Singapore dollar NEER at the upcoming meetings.

Global Growth Slows as Pandemic-reopening is Offset by Ukraine War and Omicron - Chris Williamson

Australia and India Agree New Bilateral Trade Deal - Rajiv Biswas

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.