Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 26 Apr, 2023

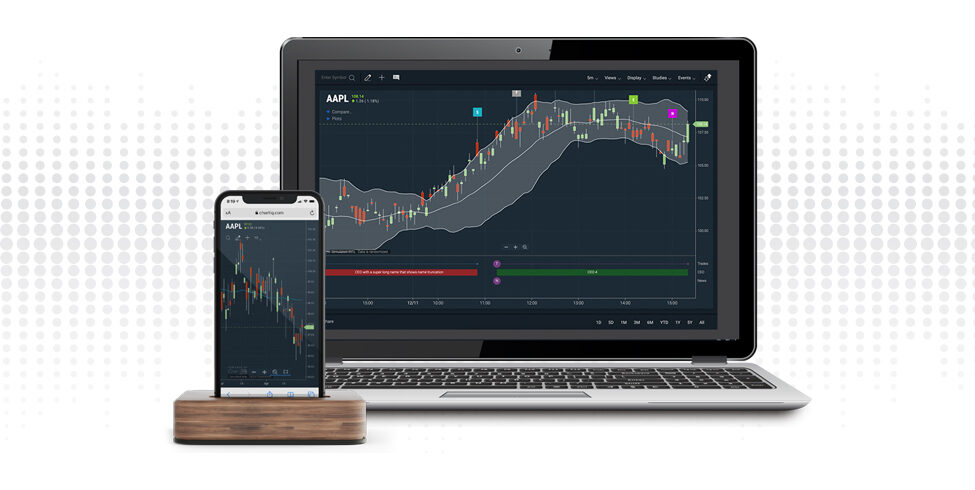

For illustrative purposes only

Differentiation is key in the brokerage, market data analytics, and trading platform markets. Despite all the numerous platforms out there, high-quality charting and customization tools are hard to find. Active traders are expensive to attract, and tough to keep engaged and impressed with limited offerings. How strong is your mobile offering? Can they trade directly from the chart, on their phone, in an instant? What if they demand a market depth chart, but you don’t offer one? The result for you as a platform provider is clear if these specifications can’t be met—churn. Today’s active traders will quickly leave and find another platform that is better suited for their trading workflow. That’s what we refer to as “the cost of free."

Is minimizing your development costs by using a free library worth losing users?

If you’re reading this article you’ve probably embarked on launching a trading or analytics platform, or you’ve spent time and effort configuring the back-end of your platform and are looking for a powerful user interface to tie it all together. What should you look for when it comes to choosing a charting package?

You want a user interface that delivers high-quality charting, contains a library of trading and analysis tools, and is data agnostic—that is, you can integrate a spectrum of different data into the chart. Also, don’t overlook integrated analytics tools like order books, market depth charts, scripting, quick trade execution functionality, and displaying trade history.

Have you researched what tools your traders are going to want when they use your platform? Do you have the necessary tooling required to meet those needs? Check to make sure the software you choose is used by other leaders in the space—being industry tested may save you headaches down the road. And lastly, cut through the noise. There are many vendors out there claiming to have the same or better technological expertise in the charting industry. Do your research so that you can make a smart and confident business decision.

To get your research underway, here are two things to consider before choosing an off-the-shelf charting product.

Time to market

In order to get a trading platform up and running, charting product teams seek out free and easy ways to implement the core tools that users typically expect to see in a trading platform including charts, order books, and a market depth graph. While free tools and rudimentary software may be a quick fix, this route will leave you diminished profits and performance in the long term. In addition to trying to keep up with the growing demands of modern traders, inferior tools can quickly hinder the user experience and encourage your users to experiment with a host of other trading platforms offered by other brokerages.

For many brokerages, the effort required to build a quality front end on top of the core development and infrastructure requirements of the back end leaves teams scrambling. Sacrifices are often made that compromise the vision and goals of the final product. The back end of your platform is the core foundation, however, choosing to cut corners or save money on the front end is a mistake—active traders demand a professional, intuitive user interface.

Don't underestimate the long tail of charting technology or your users demands—when it comes to developing a unique trading experience. Central to traders workflow is technical analysis—charts with deep functionality, rich data, and trade execution directly from the chart. Building out these features on your own can take man years of expensive engineering time to implement, which can exhaust R&D budgets quickly.

Starting with a free or cheap charting library may get you to the 80% mark quickly and cheaply, but the final 20% required to satisfy the deep functionality and performance requirements of today’s active traders will be death by a thousand cuts.

White Labeling and Customization

Charts are a cornerstone application of every trading platform, but delivering differentiated value to your users means going above and beyond those table stakes. Many firms are inclined to simply drop in a charting widget and check the box, but that means you’ve surrendered your ability to differentiate your product from every other broker who drops in that same widget. Worse yet, many firms will use a free branded widget to cut corners on costs. As the old saying goes, “if you’re not the customer, you're the product”—it’s only free because they want to pull your users away from you.

You need to make sure that the charting tool you choose allows for easy customization, so that you can build a differentiated user experience. Your own colors, fonts, icons, logos, and layout are a key part of this, but even more important is the integration into your platform’s workflow and unique data sets. Do you have, or license, novel data sets? Trading signals and analytics? Those are things you should be able to layer into the charting experience. What about trade execution—frequently, the whole point of the platform? Trading from the chart is not only a convenience to your users, it ensures the analysis and decision support tools you provide are directly tied to the metrics that matter to your business—DARTs. If I execute a trade, shouldn’t I see it on the chart, along with any other pending orders (stop-loss, take-profit, etc) and be able to modify those orders right then and there?

Advantages to white label and customizable solutions:

By white labeling and customizing, you are leveraging a vendor’s market-leading technology enabling you to focus on building the value-add differentiators on top of the chart that will set you apart. Arguably, the best part of white labeled solutions is that your users will be none the wiser about it, and your brand reaps all of the benefits.

For illustrative purposes only

ChartIQ Active Trader

ChartIQ has built Active Trader + Trade from Chart, a powerful technology and user interface package, that allows you to reduce your time to market, customize to your heart’s content, and have the ability to grow your business as your client base grows and user needs evolve. Unique tools, like ChartIQ’s ScriptIQ, allow more advanced traders to develop their own custom technical indicators within minutes, personalizing their trade experience and increasing engagement on your platform. Trade From The Chart allows a trader to execute trades directly on the chart without leaving the screen. Other tools that are popular with advanced traders like market depth charts and order books are available as part of our Active Trader package.