Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 2 Aug, 2021

Highlights

Companies with similar patent portfolios exhibit peer group momentum. A strategy that buys (sells) stocks of focal companies in the Russell 3000 with outperforming (underperforming) technology peers produces an annualized risk-adjusted return of 5.23% in a historical backtest.

The strategy returns are more pronounced for smaller companies. In the Russell 2000, the strategy demonstrates more efficacy with annualized long-short return of 7.32%.

The strategy is distinct from sector momentum strategies. After controlling for sector momentum, 3.60% excess return in the Russell 3000 can be attributed to technology peer group momentum.

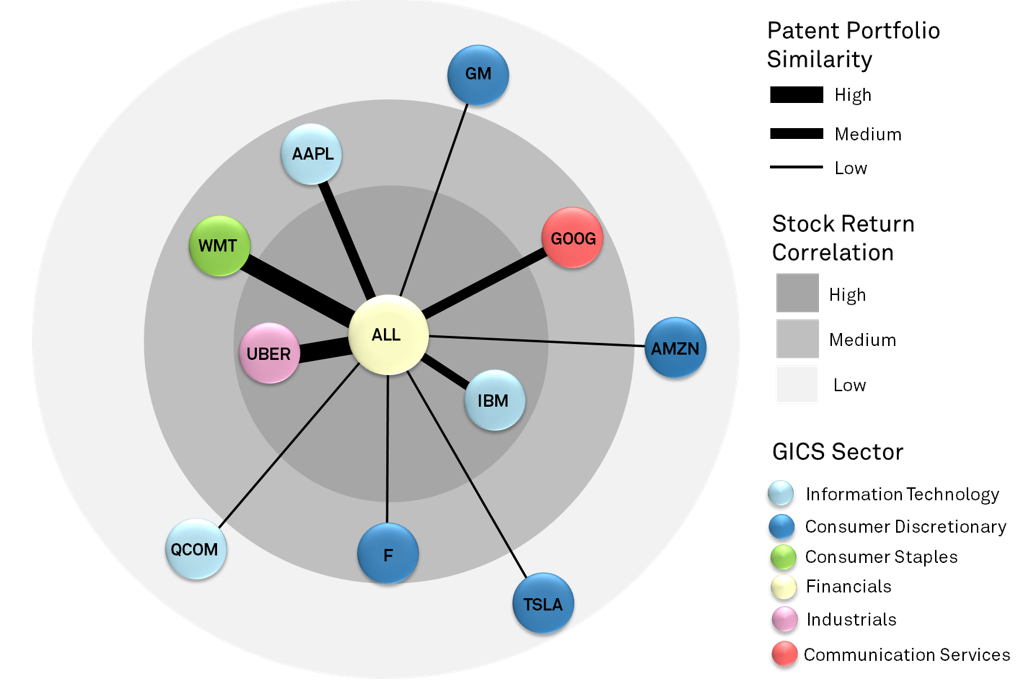

Companies strategically innovate and acquire intellectual property. That innovation is increasingly taking place outside of a firm’s traditional business focus and varies widely between companies in the same sector. Investors can group firms by their shared technology attributes using patent data. Because of the importance of intellectual property in a firm’s value, stock prices of companies with similar patent portfolios exhibit peer group momentum. For example, Allstate and Uber each hold more than 50 patents in autonomous driving technology and have highly correlated stock returns, despite the two having different sector assignments (Figure 1).

Figure 1: Patent Portfolio Similarity and Stock Return Correlation, 2015 –2021

Allstate and Top 10 U.S Autonomous Driving Patent Holders

Source: IPQwery and S&P Global Market Intelligence Quantamental Research. Data as of 06/20/2021.

Findings in this report include:

Download the full report

Theme

Products & Offerings