Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Aug, 2017 | 16:00

Highlights

There has been no threat to production in Peru, despite the recent two-day nationwide action against the government's proposed labor reforms in mining.

Peru's strike actions are somewhat more peaceful and better organized when compared with those in countries like South Africa and Chile

From time to time, strikes, or the threat of them, are a legitimate union weapon to create a bargaining position on wages and working conditions. However, an industry faces real and costly impacts when situations spin out of control. Nevertheless, based on our analysis of strikes in recent years, Peru's industry-wide commodity production has not been significantly affected by mining labor strikes, compared with other major commodity producers such as South Africa or Chile.

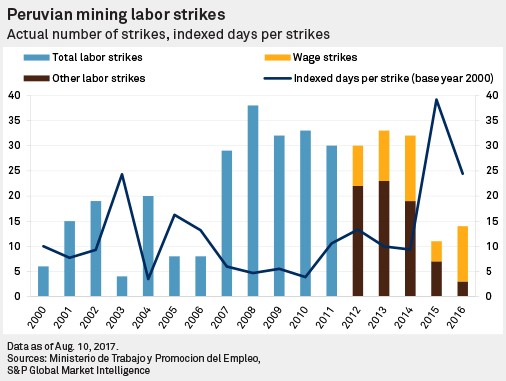

There has been a large increase in the number of strikes in Peru's mining industry over the years, with an average of 11 strikes annually between 2000 and 2006, to an average of 32 strikes between 2007 and 2014. These strikes involved a relatively low number of people and total man-hours lost. The incidence rate of strikes then fell significantly to 10 strikes in 2015 and to 14 strikes in 2016, far lower than the preceding eight years. However, the number of people involved and total man-hours lost per strike were notably higher; while the incidence of strikes were fewer in number, each one had more individual impact in terms of employee numbers and hours.

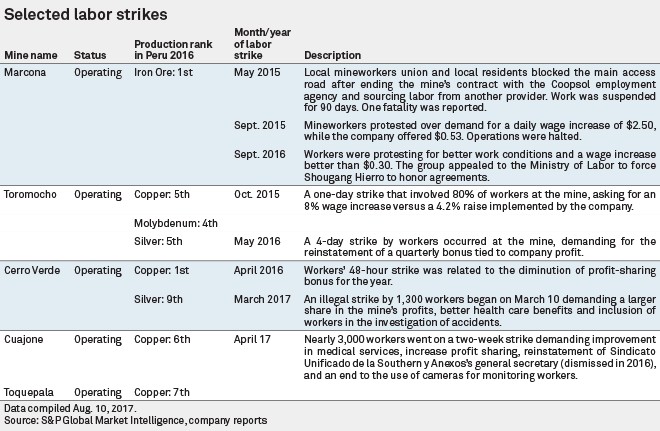

Notable strikes within the last couple of years have included the national strike organized by the National Federation of Miners, Metalworkers, and Steelworkers of Peru, or FNTMMSP, against labor reforms in mid-2015 and, more recently, workers' strikes in the Marcona iron ore mine and the Toromocho, Cerro Verde, Cuajone, and Toquepala copper mines took place in July. With the exception of Marcona, the strikes led to no significant impact to production at these mines.

Peru is one of the leading producers of silver, copper, zinc, molybdenum, and lead. While the Cerro Verde and Toromocho copper mines are fairly large operations from a global perspective, the companies have not noted any significant losses to output due to the labor strikes. The strike held by 1,300 workers from Cerro Verde early this year was declared illegal by the government's Labor Regional Management, which allowed the mine to continue metal shipments. On the other hand, Southern Copper Corp.'s Cuajone and Toquepala were reported to have lost 1,400 tonnes of copper from the two-week workers' strike this year, but this represents only 0.5% of the expected total production at both mines this year.

Meanwhile, Marcona is the only iron ore mine in the country. The strikes here are known to be long and violent most of the time, and there is clear tension between the management and its workers. The strikes have made the company declare force majeure on contracts more than once within the past three years. On these strikes, roads were blocked for a longer period by workers and community supporters of the union, effectively distorting the flow of production.

In aggregate, the effects of labor strikes on the industry may also be offset by newer projects ramping up operations and capacity expansions implemented in the country. Significant impacts of strikes on production, if any, will be evident at the mine level following the strike, but this can be offset by contingency plans companies will have in place. As strikes block roads and access points, delivery of mine supplies and produced commodities in and out of the property will have a greater chance of disrupting production schedule. Companies' contingency plans on these occasions will differ and determine how this will affect production and delivery of output.

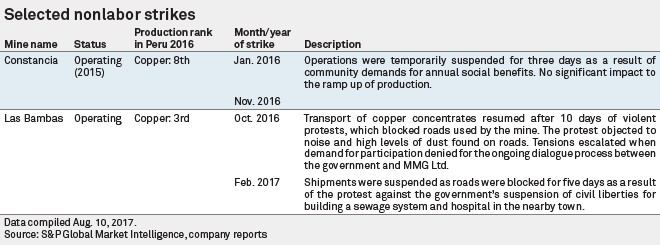

In contrast to labor strikes, community-related "strike" action can effectively delay implementation of new projects and delay operating schedules — a prominent example being Tia Maria. Community-related strikes can be about environmental concerns or welfare of the indigenous population around the area of operation. These actions can potentially have serious implications for continued mining, most infamously at the Papua New Guinean Bougainville copper mine in 1989 where a civil war, in part caused by the mine, forced its closure.

More recently, Tahoe Resources Inc.'s Escobal silver mine in Guatemala is temporarily on hold following the Supreme Court of Guatemala's decision to suspend its mining license, which was on the back of a filing by an anti-mining organization claiming that Tahoe had violated indigenous rights.

Other data from the Ministry of Labor and Employment Promotion highlights those regions that constantly suffer from strike action, and include Ica, La Oroya, Arequipa, Huancavelica, and Camana. Meanwhile, strikes in which more man-hours and workers have been involved over the past three years can be identified as Trujillo, Ica, Huacho, Camana, and Huancavelica, most of which are south of metropolitan Lima.

The recent two-day nationwide strike action organized by FNTMMSP was held in Lima starting July 19 and involved 56 unions. Unlike mine-specific labor strikes, Peru's nationwide strike actions are often political in nature and participating unions actively express opposition to labor reforms proposed or implemented by the government. The recent strike was cut short after FNTMMSP and the government agreed to create a task force that will oversee discussions of proposed labor reforms with workers. Among the proposed reforms are a collective redundancy pay reduction of 50%, the burden of payment to an unemployment fund shifting from employers to workers, and improved rules on safety.

Peru's strike actions seem somewhat more peaceful and better organized when compared to those held in countries like South Africa and Chile, with the evidence showing lower impact to overall supply. In South Africa, two large, highly competitive unions have, in the past, directly influenced gold and platinum output for the whole country over extended periods. Recent proposed job retrenchments in the South African gold and platinum industry have been met with hostility by the unions, with the National Union of Mineworkers referring to the retrenchments as being politically motivated rather than cost-versus-revenue driven. Our data indicates that the latter is a factor in the South African industry, with South Africa as a whole plotting in the upper quartile of the all-in sustaining cost curve. A strengthening South African rand year-to-date will certainly not help the situation.

The strike action in Peru year-to-date is also in contrast with recent strikes in Chile, which seem to have a more meaningful market impact on current supply. For example, at Escondida, where strike action was aimed at a BHP Billiton Group, rather than the government, and concerned wages rather than labor laws. BHP stated in its fiscal 2017 Operational Review that the 44-day strike at Escondida in the March quarter was responsible for 214,000 tonnes of lost copper output and a resulting posttax loss of US$367 million.

This equated to a 22% drop in Escondida's fiscal 2017 output. Without the March strike, the impact of fatality related suspensions (-21,000 tonnes), and severe weather impact (-12,000 tonnes), output at Escondida would have risen by 4% to a total 1.02 million tonnes. Put into a different context, losses related to this one strike represented approximately 4% of Chilean annual output and 1% of global mined copper output. Chile's socialist government has been proceeding in an opposite direction to Peru, strengthening trade union rights and giving the strikers more impact. It remains to be seen whether extended periods of strike action will occur as wage contracts, such as at Collahuasi, Mantos Blancos, and Radomiro Tomic, come up for renegotiation.

Request a demo to gain strategic insight into worldwide mine production trends.