Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 22, 2023

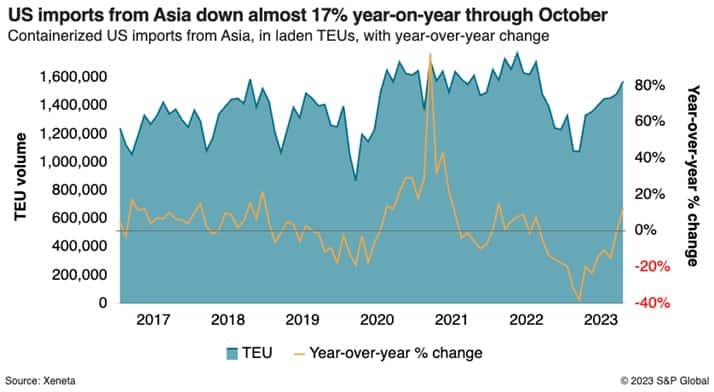

A shortage of containers in the nation's interior amid a double-digit percentage drop in containerized imports this year is beginning to compromise the ability of US agricultural exporters to ship their commodities to markets in Asia and Europe now that the harvest season is in full swing.

Agricultural interests blame the equipment shortage on the almost 17% decline in US imports from Asia through the first 10 months of the year. Containerized imports that move inland to population centers such as Chicago, Dallas and Kansas City provide the boxes that are unloaded and repositioned to export facilities in those regions to be refilled with agricultural commodities.

Bruce Abbe, a consultant to agricultural interests in the upper Midwest, said the equipment shortages have emerged over the past two weeks and will probably worsen now that the fall harvest is underway.

"With the peak ag export shipping now kicking into high gear for the next few months, yes, there is a bit of angst and worry that container issues may crop up again," Abbe told the Journal of Commerce. A spike in blank sailings from Asia to the US West and East coasts is exacerbating the equipment shortage by disrupting shipping schedules.

When trans-Pacific carriers increased their blank sailings in August to prevent spot rates from collapsing, it was apparent that container shortages would develop in the interior as the volume of import containers continued to decline, said Hayden Swofford, independent administrator of the Pacific Northwest Asia Shippers Association.

"It was predictable," he said. "Imports predicate everything."

Chicago is the area of greatest concern, said April Zobel, profit center manager at the agribusiness company The Andersons, although the container shortages there are just beginning to emerge.

"Chicago is the market that is most affected, although we can still execute there. The Ohio Valley is OK," Zobel said.

Western US railroads BNSF Railway and Union Pacific are not dedicating as much capacity from the ports to interior rail hubs as they did when import volumes were much stronger through much of last year, but the railroads say they are filling all the orders they receive from the ocean carriers.

"We are directing the capacity where the ocean carriers are directing us," a BNSF spokesperson told the Journal of Commerce.

"Union Pacific has not experienced a meaningful reduction in container flow to major population centers on our network," a UP spokesperson said. "We are also still transporting empty containers back from the inland points to the West Coast."

In fact, some West Coast terminal operators are seeing a surplus of empties building up at their facilities. Yusen Terminals has so many empty containers that it is storing some of them at near-dock temporary storage yards until they can be loaded onto vessels headed back to Asia, said Alan McCorkle, president of Yusen Terminals in Los Angeles.

Swofford said he does not see the equipment shortages in the interior being resolved until US imports increase sufficiently enough to incentivize the railroads to deploy more capacity to inland population hubs. Indications are that import volumes will not increase significantly until the pre-Lunar New Year rush in January, he said.

"The railroads will not run empty trains," he added.

Carriers, likewise, will not expand their inland point intermodal (IPI) bookings until import volumes from Asia pick up, said Peter Friedmann, executive director of the Agriculture Transportation Coalition.

"We're the backhaul. We know that," Friedmann said. "We depend on imports to incentivize carriers for the backhaul."

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?