Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Oct, 2017 | 09:00

By Eric Turner

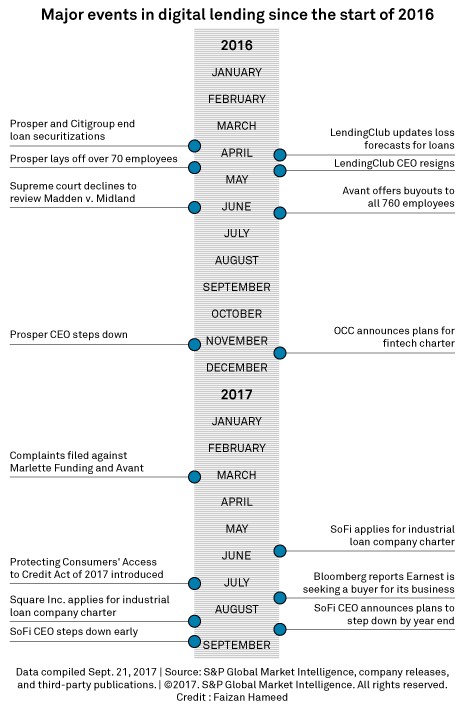

The recent exit of Social Finance Inc. CEO Mike Cagney represents the third departure of a big-name digital lending CEO since the start of 2016. Social Finance, more commonly known as SoFi, was long considered a bright spot in the digital lending industry after making it through a rough 2016 unscathed. A combination of internal factors and regulatory uncertainty tested the resolve of many lenders during that time.

Looking back at industry troubles since 2016, while it is clear that SoFi is not alone in facing high-profile issues, digital lenders that made it through troubling times have emerged stronger, and regulatory catalysts have set the stage for a stronger future.

Everything unravels

Heading into 2016, investors started to notice higher-than-expected defaults on loans from large marketplace platforms, especially in lower-graded loans. In order to compensate for these higher losses, some lenders increased interest rates to keep investors on their platforms. For institutions that had been purchasing loans and packaging them into asset-backed securities, the underperformance of loans in previous securitizations became a concern. By April, Citigroup Inc. was having trouble marketing a new securitization of loans from personal-focused lender Prosper Marketplace Inc., leading the two firms to end their partnership. Without this important source of capital, Prosper saw originations fall 55.5% during the second quarter of 2016.

At perhaps the worst possible time, troubles emerged from personal-focused lender LendingClub Corp., one of the few publicly traded digital lenders and the largest in terms of loan originations. During a board investigation into altered loans that were sold to an institutional investor, it emerged that founder and CEO Renaud Laplanche had an undisclosed stake in a fund that had been purchasing LendingClub loans. The eventual resignation of Laplanche in May 2016 grabbed headlines and raised concerns around corporate governance in the industry.

The damage from earlier in the year spilled over to the rest of the digital lending sector. Platforms buckled down and attempted to streamline operations, leading to layoffs and buyouts of hundreds of employees at Prosper and personal-focused lender Avant. By the end of 2016, Prosper would also see its CEO step down as the company attempted to rebuild its business.

The two large publicly traded lenders — small and medium enterprise-focused On Deck Capital Inc. and LendingClub — each saw their share prices fall more than 50% in 2016. In order to restore shareholder confidence, both companies embarked on aggressive cost-cutting in the fourth quarter of 2016 and first quarter of 2017, leading On Deck to cut its headcount by 27% during the first half of the year.

Regulation adds to the pain

Compounding these issues at larger companies, an unclear regulatory landscape was pressuring digital lenders, many of whose platforms have relied on federally chartered banks to originate loans on their behalf. This arrangement came into question as an unrelated court decision in the Madden v. Midland Funding LLC case was increasingly applied to digital lenders. The Madden case, which relates to credit card debt, brought into question the long-standing principle of “valid when made.” For lenders, "valid when made" is the idea that a loan and its corresponding attributes such as interest rate do not change when it is sold. This is a core concept for lenders that rely on chartered banks to originate loans that are later purchased by a platform.

Madden, which was argued in the United States Court of Appeals for the Second Circuit located in New York, led some digital lending platforms to exit the state due to uncertainty, causing origination volumes to fall. In March 2017, the attorney general for the state of Colorado filed amended complaints against Avant and Marlette Funding LLC, operator of the Best Egg platform, stating that the firms are circumventing state usury limits. The complaint largely focuses on the Madden case and the "valid when made" concept.

Past problems lead to a brighter future

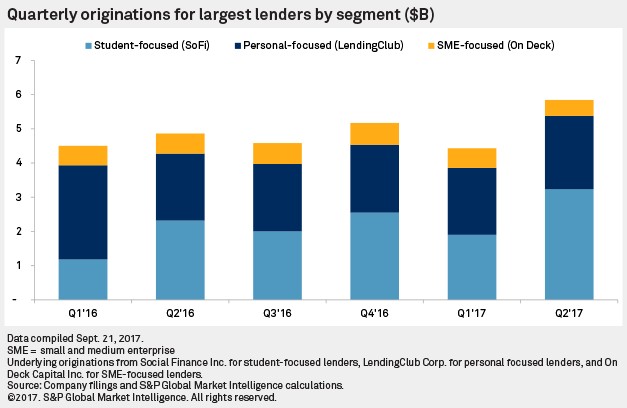

Digital lenders entered 2017 with a renewed focus on operational efficiency and loan quality. For some, these measures are starting to pay off. LendingClub and On Deck both reached targeted profitability measures in the second quarter of the year. Prosper has reignited loan growth thanks to a $5 billion commitment to fund new loans, and the company reported positive adjusted EBITDA for the second quarter. Ex-LendingClub CEO Renaud Laplanche has launched a new personal-focused lender called Upgrade. Student-focused lender Earnest has taken a different approach and according to Bloomberg is seeking a buyer for its business. Originations have started to rebound as large lenders in the industry regain confidence in their models and continue to ramp up volumes.

On the regulatory front, much-needed relief appears to be around the corner. Congress has introduced a bill titled the Protecting Consumers’ Access to Credit Act of 2017, aiming to reaffirm "valid when made," which could supersede the application of Madden v. Midland. The Office of the Comptroller of the Currency has introduced a path for fintech companies, including digital lenders, to receive special-purpose bank charters. SoFi and Square Inc., which operates the small and medium enterprise-focused platform Square Capital, have applied for industrial loan company charters that, if successfully received, could open up a new path to regulatory certainty.

With internal issues seemingly fixed at most lenders and a more promising regulatory landscape on the horizon, it is unlikely that the problems at SoFi will impact the digital lending sector like those at LendingClub did last year. In fact, the outlook for many lenders in the industry is considerably brighter.