Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Feb 5, 2025

By Malav Parekh

In 2024, IT spending showed a consistent positive trajectory, marking a significant rebound from the previous year's challenges. This optimism is reflected in Tech Demand Indicator scores of above 50 for the first three quarters in 2024, and a projected year-topping demand score of 53.38 in the fourth quarter, indicating not just steady demand for technology products and services in 2024, but also positive momentum heading into 2025. As organizations continue to navigate economic pressures, the strategic prioritization of technology investments, particularly in generative AI, will likely be pivotal in shaping the IT landscape in the coming year.

Momentum in IT spending is poised to continue, driven by strategic investments in AI, information security (infosec) and cloud infrastructure. Despite the economic pressures that have prompted many organizations to reassess their IT budgets, AI remains at the forefront of spending priorities. Enterprises are increasingly recognizing the value of AI as a tool for operational efficiency and a strategic asset for future growth. The high adoption rates of infosec and cloud services underscore their critical roles in maintaining business continuity and compliance. Enthusiasm for AI, particularly GenAI, is notable, with a significant portion of planned expenditures coming from first-time adopters. This suggests growing confidence in AI's potential to transform business processes and enhance customer experiences. Moreover, the integration of customer experience solutions with AI and data analytics is becoming a strategic focus, reflecting a broader trend of convergence in technology investments. The primary drivers of IT spending will likely continue to be employee collaboration and productivity improvements, alongside cost-reduction strategies, as companies strive to do more with less.

AI, infosec to drive strategic IT spending in 2025

While current difficult economic conditions put pressure on businesses to cut IT spending, they are driving some strategic spending into certain IT products and services. More than two in three (67%) small and medium-sized enterprises (SMEs) we surveyed report implementing changes to their IT budgets and strategies in response to current economic conditions. In comparison, 86% of large enterprises report changes in their IT budgets and strategies due to economic conditions.

These strategic actions primarily focus on improving efficiencies using IT, such as automation to reduce manual processes, upskilling existing staff to do more with fewer people, investing in new business applications for efficiencies and shifting spending to cloud services.

SMEs are most likely to look to reduce their need for labor/manual processes or do more with fewer people through automation and streamlining of processes (23%) and upskilling existing staff to fill IT requirements/IT adjacent roles (23%). The propensity to take such actions among large enterprises is even higher, at 35% each. Negotiating prices/payment terms with existing service providers when considering contract renewals (20%) is the third-most-common strategy among SMEs, indicating that vendors may find it even more challenging to increase prices for SME customers.

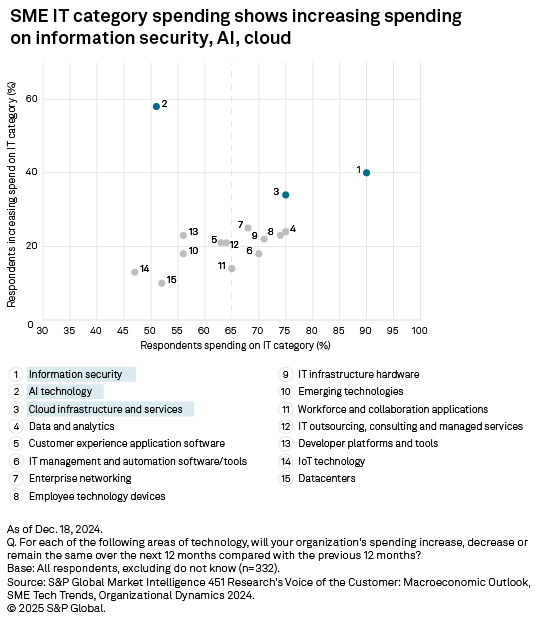

Infosec remains the top spending priority for SMEs going into 2025, with 90% planning investments in this area over the next 12 months. Cloud infrastructure and services, along with data and analytics, tie for second place at 75%, closely followed by employee technology devices at 74%.

While artificial intelligence spending intent among SMEs (51%) currently lags the cross-category average of 65%, the growth dynamics tell a different story. Of those SMEs planning AI investments, a remarkable 60% indicate they will increase their spending — significantly more than spending increase plans for information security (40%) and cloud services (34%).

AI driving new IT adoption wave

Additionally, unlike information security and cloud infrastructure, where spending increases typically represent expansions of existing investments, many of the planned AI expenditures come from first-time adopters. Although the absolute spending levels on AI remain below those of security and cloud infrastructure, the strong interest in AI — particularly generative AI — is prompting organizations to develop strategic initiatives around its potential capabilities.

Large enterprises demonstrate a markedly higher AI adoption rate than SMEs, with 85% already allocating budget to AI initiatives, and 57% of these enterprises planning to increase their AI investments over the next 12 months. However, when viewed in the broader context of enterprise IT spending, the current 85% AI adoption rate still falls below the average adoption rate across all IT categories (92%). Only a few categories show lower adoption rates than AI, including internet of things (77%), IT outsourcing, consulting and managed services (79%) and emerging technologies (83%).

These figures serve as a reminder that we are still in the early stages of AI adoption, especially generative AI, as most businesses are still figuring out their strategy for using the technology.

Beyond information security, cloud infrastructure and data analytics, large enterprises are also showing above-average desire to spend on technologies such as customer experience solutions (36%) and IT management and automation software/tools (34%).

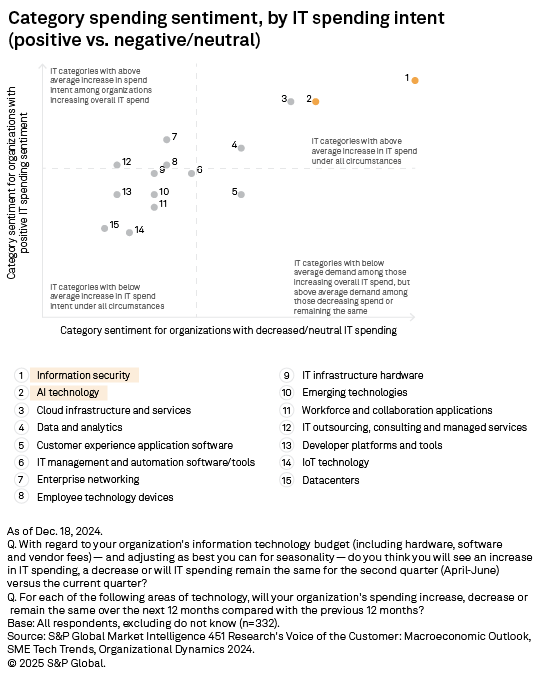

Infosec, cloud, AI likely to see high demand in 2025 regardless of organizations' IT spending intent

There is also evidence that AI, along with infosec and cloud, is driving much of the growth, with organizations ramping up their focus on spending on essential technologies. Technologies such as infosec, cloud and AI are likely to see high demand going into 2025 as organizations are showing outsized interest in them regardless of plans to increase or decrease spending.

Among organizations not increasing overall IT spending (either reducing it or keeping it the same), we are seeing above-average interest in increasing spending on data and analytics and customer experience application software, in addition to infosec, cloud and AI.

Interestingly, the customer experience application software category is seeing above-average interest from organizations not increasing their IT spending, but a below-average sentiment from those increasing IT spending. This is largely due to customer experience increasingly fusing into several other tech categories, particularly infosec, AI, and data and analytics.

The primary drivers of IT spending are employee collaboration and productivity improvements, while lowering cost is emerging as a key driver for spending increases in AI technology and customer experience applications and software.

Employee collaboration and productivity improvements (57%), security/regulatory compliance (56%) and business continuity (49%) are the top drivers of increased spending among SMEs on one or more IT categories. Customer experience enhancement (46%) is also a major driver for spending increases in some categories as businesses focus on achieving a better return on investment.

An increase in spending on automation (55%) is likely driven by the need to enhance collaboration and productivity, as well as lower operational costs. Lowering costs is also a primary driver of increased spending on cloud infrastructure and services.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is a technology research group within S&P Global Market Intelligence. For more about the group, please refer to the 451 Research overview and contact page.

Location

Products & Offerings

Segment