Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Aug 04, 2021

Research Signals - July 2021

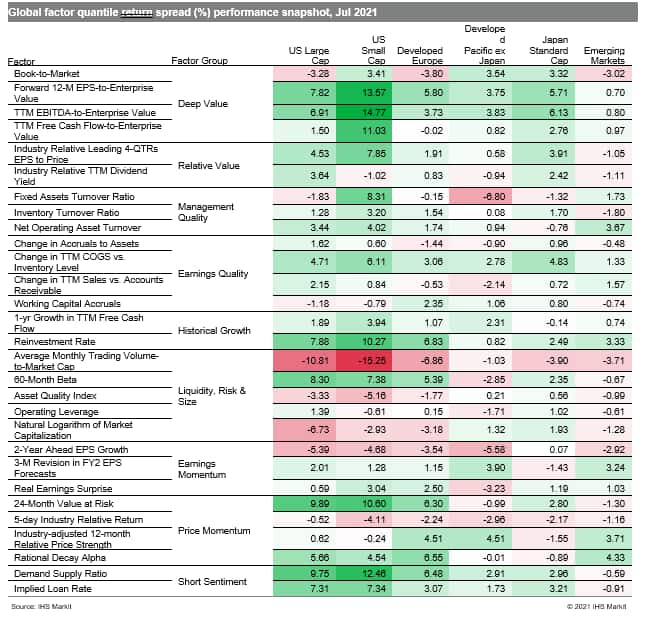

In a month of exciting and record-breaking competition during the Tokyo Olympics, several chart-topping events affected global markets and a broad representation of factors competed for the monthly performance lead across regions (Table 1). US and European equity markets continued to post all-time highs, though stocks struggled in Asia as rising coronavirus cases, including daily counts in the Japanese capital which topped earlier records, fueled concerns on the strength of the global economic recovery. While the J.P.Morgan Global Manufacturing PMI maintained a solid pace of expansion, with gold, silver and bronze medals awarded to the Netherlands, Germany and Austria and the US just shy of making the podium, record supply chain constraints drove up input prices and hindered growth.

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.