Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — May 28, 2025

By Marc Rayos

Total Scope 1 and 2 emissions from primary copper mines declined in 2024, reversing an upward trend since 2021.

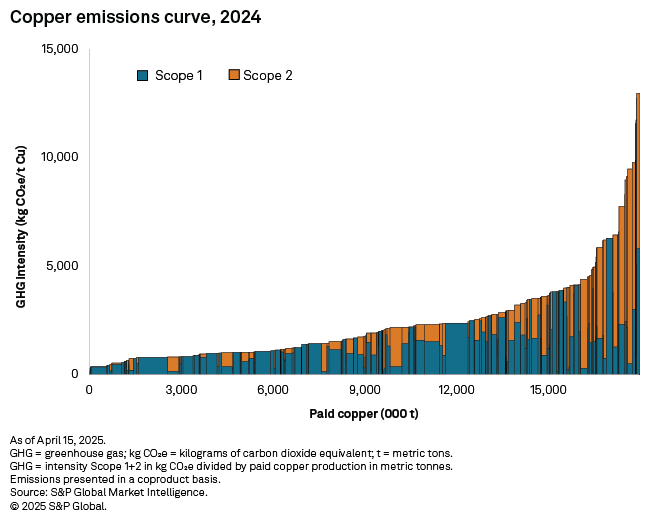

Primary copper mines emitted an estimated 53.64 million metric tons of CO2 equivalent in 2024, decreasing 1.17 MMt year over year. Scope 2 emissions accounted for two-thirds of the total reduction, with an improved renewable mix steadily decreasing indirect greenhouse gas emissions. Decreasing emissions associated with electricity generation — purchased or self-generated — has been the initial pathway for abatement initiatives for most mines, mainly by securing purchase agreements or switching to lower-emission fuel sources.

Emissions intensity figures are anticipated to drop further in 2025 amid an increase in copper production. Paid copper production is forecast to increase 630,000 metric tons year over year in 2025 to just over 18 MMt.

A major factor in the 2024 emissions decline was the shutdown of First Quantum Minerals Ltd.'s Cobre Panama in late 2023 over contract and environmental concerns. The Panamanian mine was the second-largest emitter and mostly sourced its energy requirements from fossil fuels such as coal and diesel. Had it operated at capacity with the same energy sources, total emissions would be about 1 MMt CO2e higher year over year.

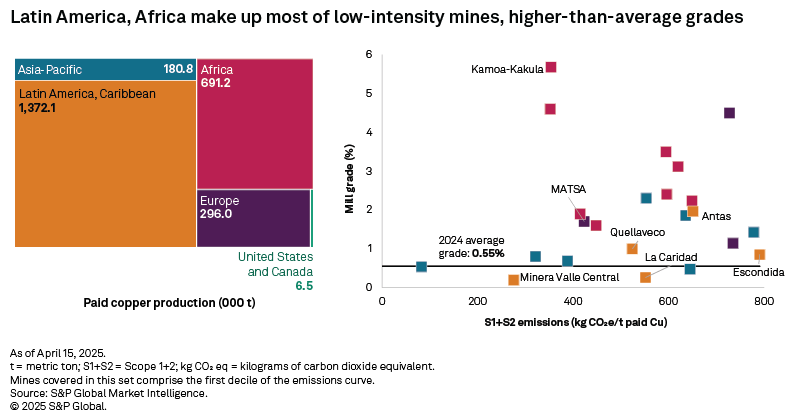

Mines in the first decile of the 2024 emissions curve emitted less than 800 kg CO2e per metric ton of copper. More than half of these mines are in Africa and Latin America, connected to grids with large shares of renewable sources. In top producer Chile, wind and solar power provided close to one-third of the total electricity generated in 2024. Of the mines in the first decile, 80% have head grades above the 2024 average of 0.55%, which also provides a positive lever for lowering intensities.

Minera Valle Central, a tailings retreatment mine operated by Amerigo Resources Ltd. in Chile, has one of the lowest emission intensities of 275 kg CO2e/t of paid copper, despite extracting material of a lower grade. Its hydraulic mining operations are remotely operated, with some ore only needing to undergo grinding before being fed into the flotation circuit. The mine is directly tied to the national grid and has a power supply contract in place, ensuring that close to 100% of its power is sourced from renewables.

Major copper producer Kamoa-Kakula in the Democratic Republic of Congo, jointly owned by Ivanhoe Mines Ltd. and Zijin Mining Group Company Ltd., also boasts low emission intensity, due in large part to its chart-topping, greater-than-5% head grade. The underground mine uses drift-and-fill methods, and the ore is transported by a system of conveyor belts toward its processing plant. The mine sources all its power from hydropower plants in the DRC.

Outside Latin America and Africa, Sandfire Resources Ltd.'s MATSA operation in Spain is composed of three underground mines hosting volcanogenic massive sulfide orebodies. These mines have mill grades averaging 1.70% and employ long-hole stoping methods. Higher productivity and selectivity mean less consumables are needed, and renewable sources provide all the operation's electricity.

With mining operations reliant on energy to move, crush and grind ores for mineral processing, the initial pathway for miners to lower their emissions has been to optimize operations and decarbonize their power generation supply. As such, we project the share of Scope 2 emission intensities to shrink from 49% in 2021 to 42% in 2025 as more mines secure or build renewable energy facilities for their operations.

Among major copper companies, Anglo American PLC and Antofagasta PLC were front-runners in securing energy contracts for their assets in Chile, allowing the companies to wind down their Scope 2 footprints in 2022 and 2023, respectively. Others followed suit using the same methods, or by installing renewable generation facilities to curb some of their emissions.

The declining trend in copper emissions intensity is not expected to translate into an overall reduction in total emissions, which are forecast to inch up 1.2% in 2025. Similar to what gold mines are facing, decarbonizing mobile sources (Scope 1) has been a challenge. As 87% of the copper ore mined in 2024 in our dataset comes from open-pit operations, the amount of Scope 1 emissions is determined by changes in material movement and increasing strip ratios.

The effect is more pronounced among assets producing more than 100,000 metric tons of copper, as their ore and waste movements are forecast to rise 4.7% to 7 billion metric tons in 2025. Over a period from 2021 to 2024, Southern Copper Corp.'s Buenavista mine in Mexico saw its emission rise 11% with the expansion and commissioning of works surrounding its zinc plant. Emissions at Freeport-McMoRan Inc.'s Cerro Verde mine in Peru grew 30% over the same period as it completed the expansion of its mill capacity to up to 420,000 tons per day in 2023.

Among 10 major copper producers included in this coverage, only Freeport moderated its Scope 1 emissions intensity. Its sole Indonesian copper-gold operating mine, Grasberg, saw its emission intensities fall 32% over from 2022 to 2024. While the mine's total emissions were still up, it saw a 20% increase in copper production over the same period.

An autonomous electric train system is used at Grasberg to transport ore through underground tunnels, moving about 130,000 metric tons per day. The system reduces ventilation requirements and cuts around 80,000 metric tons CO2e per year. The mine has also curtailed its Scope 1 emissions by using a dual-fuel source power plant, offsetting some coal usage with biodiesel. A planned natural gas powerplant at the mine is projected to remove an additional 1.1 MMt CO2e from its Scope 1 figure.

Rio Tinto Group's Bingham Canyon copper mine in Utah shifted to renewable diesel composed of soybean, animal and used cooking oil to power the machinery and mining fleet used in each stage of its copper operations. In 2023, the company commissioned a 5-MW solar plant near its copper concentrator, with an additional 25 MW planned to come online later in 2025.

Truck trolley assist systems have also been employed in various mines, resulting in modest emission reductions. At First Quantum's three copper mines in Panama and Zambia, the company saved diesel used to drive trucks up ramps, effectively offsetting around 30,000 metric tons CO2e. Mining fleet electrification is in various stages of testing at different copper mines. It remains to be seen if widespread adoption will occur and substantially curb Scope 1 emissions, or what solutions will allow various mining operations to remain cost-competitive against a conventional diesel mining fleet.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.